Answered step by step

Verified Expert Solution

Question

1 Approved Answer

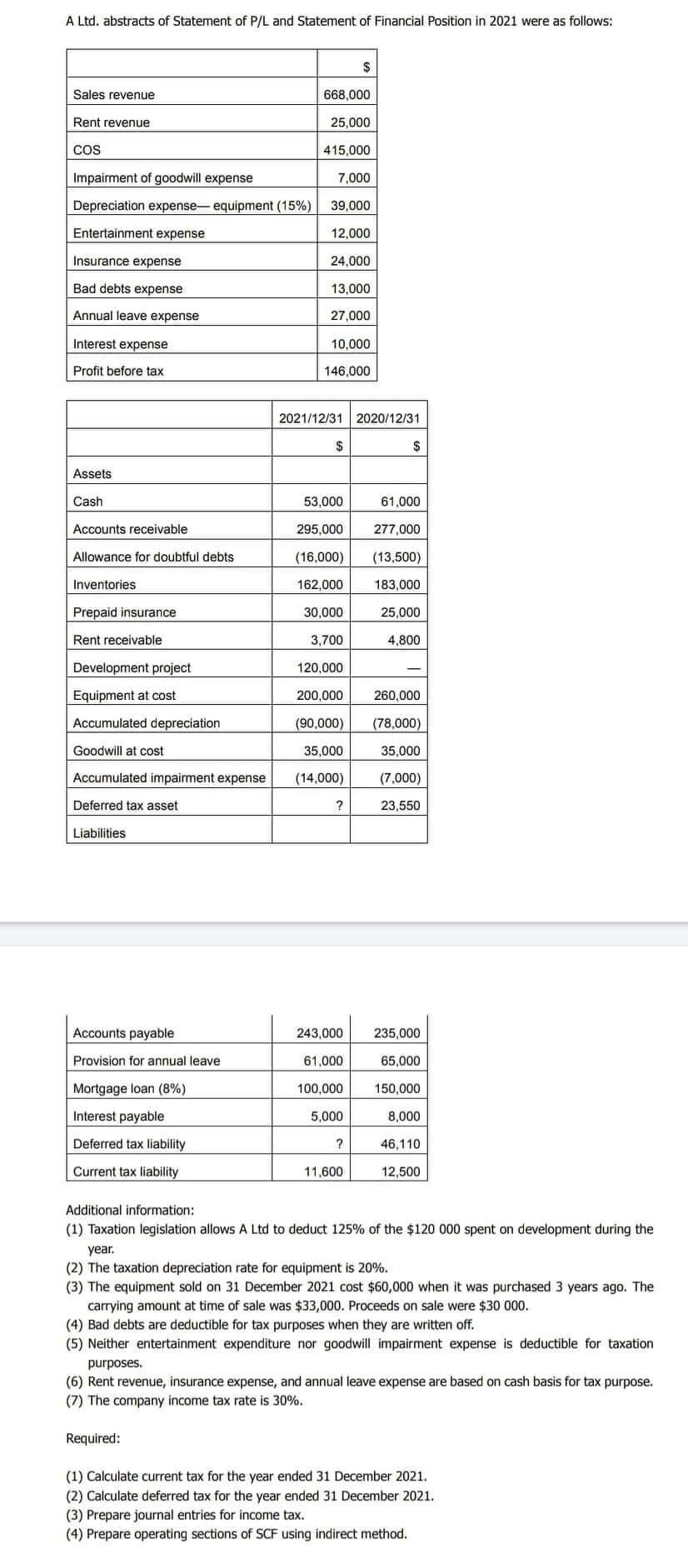

A Ltd. abstracts of Statement of P/L and Statement of Financial Position in 2021 were as follows: Sales revenue Rent revenue COS Impairment of

A Ltd. abstracts of Statement of P/L and Statement of Financial Position in 2021 were as follows: Sales revenue Rent revenue COS Impairment of goodwill expense Depreciation expense- equipment (15%) Entertainment expense Insurance expense Bad debts expense Annual leave expense Interest expense Profit before tax Assets Cash Accounts receivable Allowance for doubtful debts Inventories Prepaid insurance Rent receivable Development project Equipment at cost Accumulated depreciation Goodwill at cost Accumulated impairment expense Deferred tax asset Liabilities Accounts payable Provision for annual leave Mortgage loan (8%) Interest payable Deferred tax liability Current tax liability 668,000 25,000 415,000 7,000 Required: 39,000 12,000 24,000 13,000. 27,000 10,000 146,000 2021/12/31 2020/12/31 $ 53,000 295,000 (16,000) 162,000 30,000 3,700 120,000 200,000 (90,000) 35,000 (14,000) ? ? $ 11,600 61,000 277,000 (13,500) 183,000 25,000 4,800 243,000 235,000 61,000 65,000 100,000 5,000 260,000 (78,000) 35,000 (7,000) 23,550 150,000 8,000 46,110 12,500 Additional information: (1) Taxation legislation allows A Ltd to deduct 125% of the $120 000 spent on development during the year. (2) The taxation depreciation rate for equipment is 20%. (3) The equipment sold on 31 December 2021 cost $60,000 when it was purchased 3 years ago. The carrying amount at time of sale was $33,000. Proceeds on sale were $30 000. (4) Bad debts are deductible for tax purposes when they are written off. (5) Neither entertainment expenditure nor goodwill impairment expense is deductible for taxation purposes. (6) Rent revenue, insurance expense, and annual leave expense are based on cash basis for tax purpose. (7) The company income tax rate is 30%. (1) Calculate current tax for the year ended 31 December 2021. (2) Calculate deferred tax for the year ended 31 December 2021. (3) Prepare journal entries for income tax. (4) Prepare operating sections of SCF using indirect method.

Step by Step Solution

★★★★★

3.32 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate current tax for the year ended 31 December 2021 Ans As per table tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started