Question

A Ltd. is considering investing in new project with the following details: Initial capital cost *100 Crores Annual unit sales 1.25 Crores Selling price

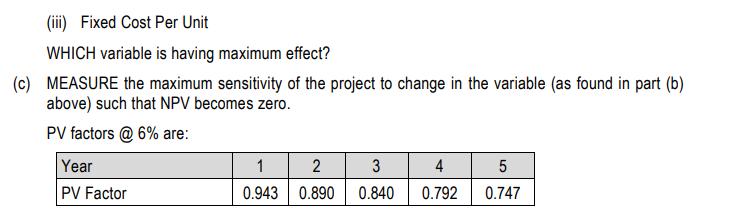

A Ltd. is considering investing in new project with the following details: Initial capital cost *100 Crores Annual unit sales 1.25 Crores Selling price *100 per unit Variable cost *50 per unit Fixed cost 12.50 Crores per year Discounting Rate 6% Considering life of the project as 3 years, you are required to: (a) CALCULATE the NPV of the project. (b) COMPUTE the impact on the project's NPV considering a 5% adverse variance in following variables: (i) Selling Price per Unit (ii) Variable Cost Per Unit (iii) Fixed Cost Per Unit WHICH variable is having maximum effect? (c) MEASURE the maximum sensitivity of the project to change in the variable (as found in part (b) above) such that NPV becomes zero. PV factors @ 6% are: Year PV Factor 1 2 0.943 0.890 3 0.840 4 0.792 5 0.747

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

10th edition

1473748873, 9781473748910 , 1473748917, 978-1473748873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App