Question

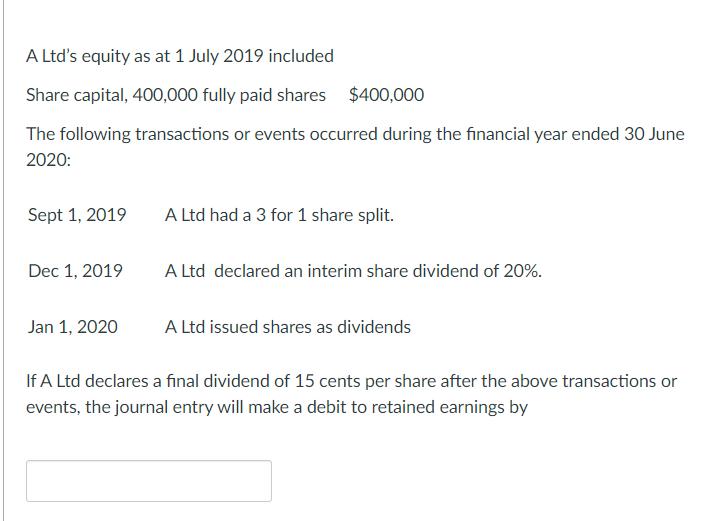

A Ltd's equity as at 1 July 2019 included Share capital, 400,000 fully paid shares $400,000 The following transactions or events occurred during the

A Ltd's equity as at 1 July 2019 included Share capital, 400,000 fully paid shares $400,000 The following transactions or events occurred during the financial year ended 30 June 2020: Sept 1, 2019 Dec 1, 2019 Jan 1, 2020 A Ltd had a 3 for 1 share split. A Ltd declared an interim share dividend of 20%. A Ltd issued shares as dividends If A Ltd declares a final dividend of 15 cents per share after the above transactions or events, the journal entry will make a debit to retained earnings by

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the journal entry for the final dividend declaration of 15 cents per share we need to consider the impact of the previous transa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Financial Reporting

Authors: Alan Melville

7th Edition

1292293128, 9781292293127

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App