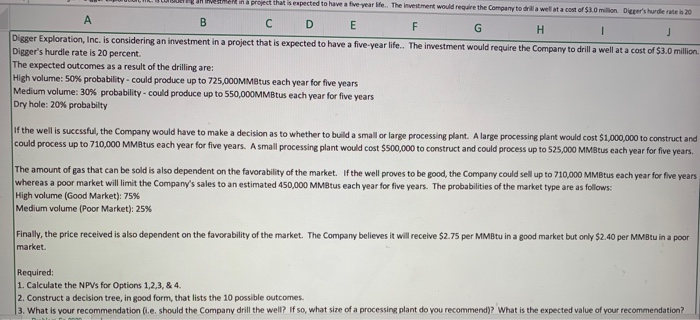

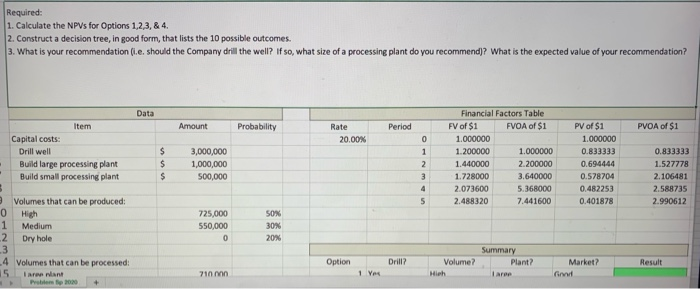

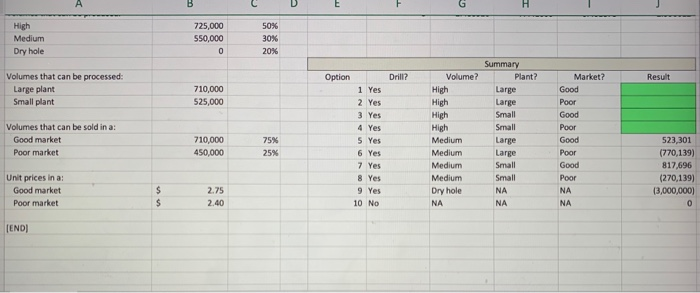

a m era project that expected to have a five-year . The investment would require the Company to drill a well at a cost of 53.0 million D er's hurdle rate is 20 A E F G H I Digger Exploration, Inc. is considering an investment in a project that is expected to have a five-year life. The investment would require the Company to drill a well at a cost of $3.0 million Digger's hurdle rate is 20 percent The expected outcomes as a result of the drilling are: High volume: 50% probability could produce up to 725,000MMBtus each year for five years Medium volume: 30% probability could produce up to 550,000MMBtus each year for five years Dry hole: 20% probabilty If the well is sucessful, the Company would have to make a decision as to whether to build a small or large processing plant. A large processing plant would cost $1,000,000 to construct and could process up to 710,000 MMBtus each year for five years. A small processing plant would cost $500,000 to construct and could process up to 525,000 MMBtus each year for five years. The amount of gas that can be sold is also dependent on the favorability of the market. If the well proves to be good, the Company could sell up to 710,000 MMBtus each year for five years whereas a poor market will limit the Company's sales to an estimated 450,000 MMBtus each year for five years. The probabilities of the market type are as follows: High volume (Good Market): 75% Medium volume (Poor Market): 25% Finally, the price received is also dependent on the favorability of the market. The Company believes it will receive $2.75 per MM tu in a good market but only $2.40 per MMBtu in a poor market. Required: 1. Calculate the NPVs for Options 1.2.3.& 4. 2. Construct a decision tree, in good form, that lists the 10 possible outcomes. 3. What is your recommendation le should the Company drill the well? If so, what size of a processing plant do you recommend)? What is the expected value of your recommendation? Required: 1. Calculate the NPVs for Options 1,2,3, & 4. 2. Construct a decision tree, in good form, that lists the 10 possible outcomes. 3. What is your recommendation (i.e. should the Company drill the well? If so, what size of a processing plant do you recommend? What is the expected value of your recommendation? Amount Probability Rate Period PVOA of $1 20.00% item Capital costs: Drill well Build large processing plant Build small processing plant 3,000,000 1,000,000 500,000 Financial Factors Table FV of $ 1 FVOA of $1 1.000000 1.200000 1.000000 1.440000 2.200000 1.728000 3.640000 2.073600 5.368000 2.488320 7.441600 PV of $1 1.000000 0.833333 0.694444 0.578704 0.482253 0.401878 0.833333 1.527778 2.106481 2.588735 2.990612 Volumes that can be produced: 0 High 50% 725,000 550,000 Medium Dry hole 20% Summary Plant? Option Drill? Result 4 5 Volumes that can be processed: renant Volume? Hleh Market? Goud 710 min ben 100 + CIE 50% High Medium Dry hole 725,000 550,000 30% 20% Option Drill? Volume? Market? Result Volumes that can be processed: Large plant Small plant High 710,000 525,000 Good Poor Good Poor Summary Plant? Large Large Small Small Large Large Small Small Volumes that can be sold in a: Good market Poor market 75% 710,000 450,000 High High High Medium Medium Medium Medium Dry hole 1 Yes 2 Yes 3 Yes 4 Yes 5 Yes 6 Yes 7 Yes 8 Yes 9 Yes 10 No Good 25% Poor 523,301 (770,139) 817,696 (270,139) (3,000,000) Good Poor NA Unit prices in a Good market Poor market 2.75 2.40 NA NA NA [END]