Question

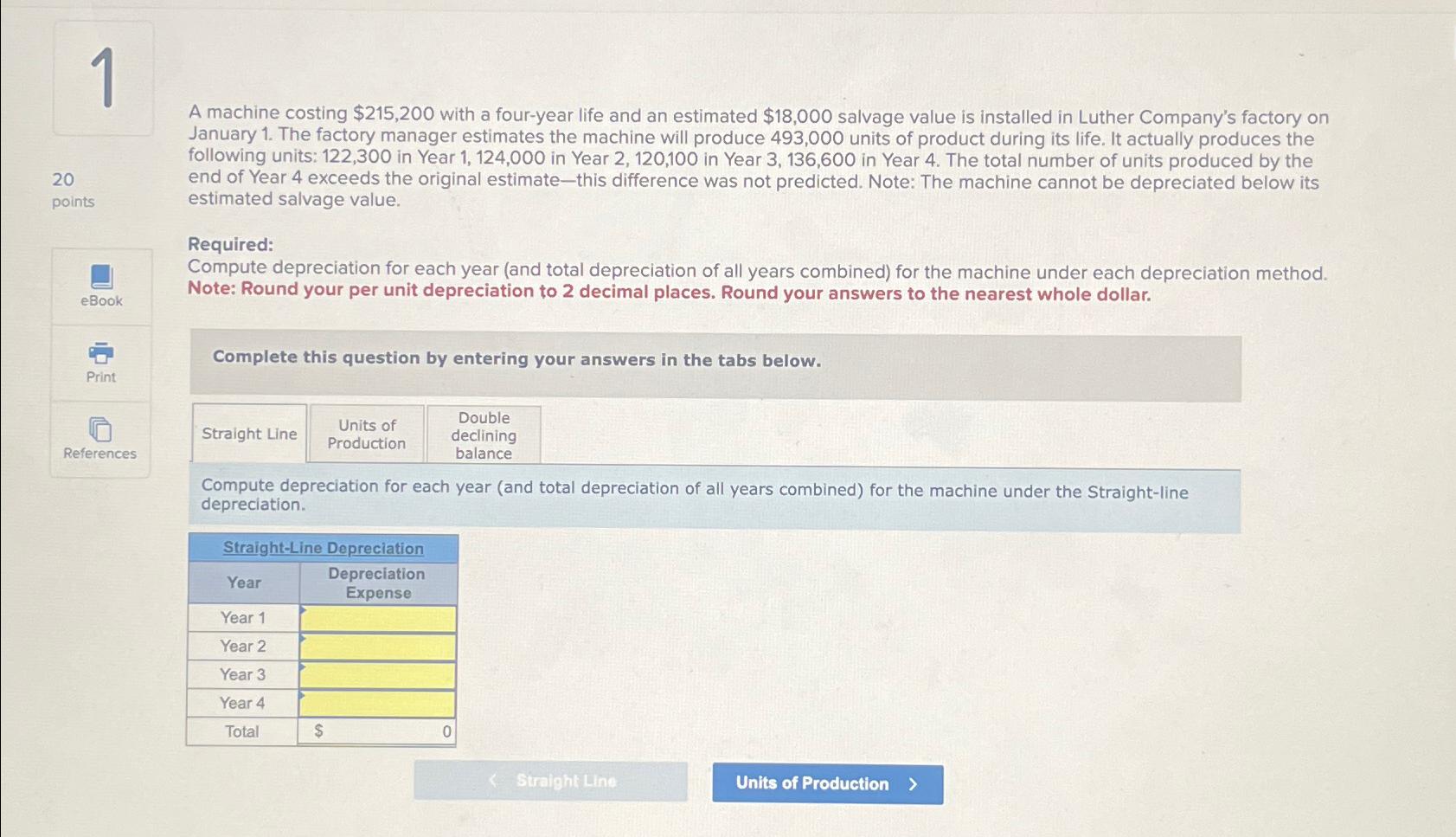

A machine costing $215,200 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company's factory on January 1

\ \ A machine costing

$215,200with a four-year life and an estimated

$18,000salvage value is installed in Luther Company's factory on January 1 . The factory manager estimates the machine will produce 493,000 units of product during its life. It actually produces the following units: 122,300 in Year 1,124,000 in Year 2, 120,100 in Year 3, 136,600 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value.\ Required:\ Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.\ Complete this question by entering your answers in the tabs below.\ \\\\table[[Straight Line,\\\\table[[Units of],[Production]],\\\\table[[Double],[declining],[balance]]]]\ Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line depreciation.\ \\\\table[[Straight-Line Depreciation],[Year,\\\\table[[Depreciation],[Expense]]],[Year 1,],[Year 2,],[Year 3,],[Year 4,],[Total,

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started