Question

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The

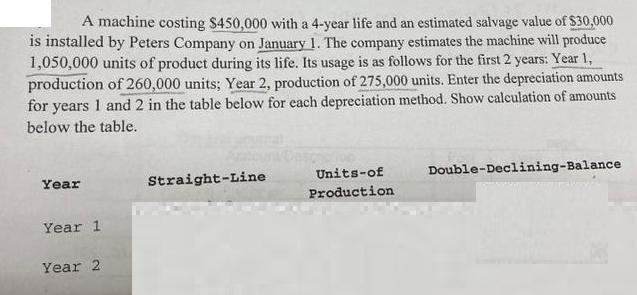

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. Its usage is as follows for the first 2 years: Year 1, production of 260,000 units; Year 2, production of 275,000 units. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table. Year Year 1 Year 2 Straight-Line Units-of Production Double-Declining-Balance

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer Depreciation Expense Straightline Method Machine cost Salvage Value Useful Life Particul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting with IFRS Fold Out Primer

Authors: John Wild

5th edition

978-0077408770, 77408772, 978-0077413804

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App