Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A machine has a cost of N$3 500. The annual maintenance costs of the machine are forecast to be N5900 in the first year,

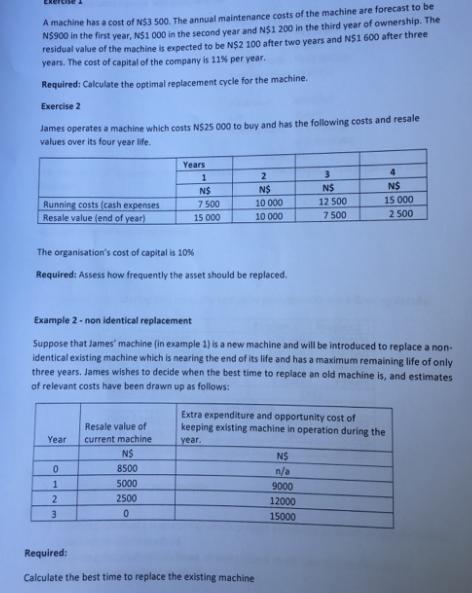

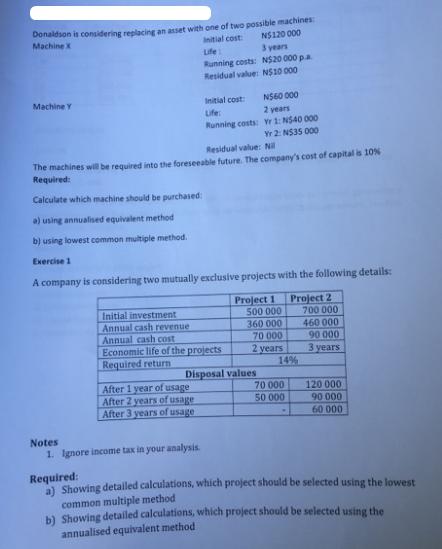

A machine has a cost of N$3 500. The annual maintenance costs of the machine are forecast to be N5900 in the first year, NS1 000 in the second year and N$1 200 in the third year of ownership. The residual value of the machine is expected to be N$2 100 after two years and NS1 600 after three years. The cost of capital of the company is 11% per year. Required: Calculate the optimal replacement cycle for the machine. Exercise 2 James operates a machine which costs NS25 000 to buy and has the following costs and resale values over its four year life. Running costs (cash expenses Resale value (end of year) The organisation's cost of capital is 10% Required: Assess how frequently the asset should be replaced. Year 0 1 2 3 Years 1 NS 7500 15 000 Resale value of current machine 2 N$ 10 000 10 000 Example 2- non identical replacement Suppose that James' machine (in example 1) is a new machine and will be introduced to replace a non- identical existing machine which is nearing the end of its life and has a maximum remaining life of only three years. James wishes to decide when the best time to replace an old machine is, and estimates of relevant costs have been drawn up as follows: NS 8500 5000 2500 0 Required: Calculate the best time to replace the existing machine 3 NS 12 500 7 500 Extra expenditure and opportunity cost of keeping existing machine in operation during the year. NS n/a 9000 12000 15000 4 NS 15 000 2 500 Donaldson is considering replacing an asset with one of two possible machines Machine X Initial cost N$120 000 Life 3 years N$20 000 pa N$10 000 Machine Y Notes Residual value: Nil The machines will be required into the foreseeable future. The company's cost of capital is 10% Required: Calculate which machine should be purchased: a) using annualised equivalent method b) using lowest common multiple method. Initial investment Annual cash revenue Annual cash cost Running costs: Residual value: Exercise 1 A company is considering two mutually exclusive projects with the following details: Project 2 Initial cost Life: Running costs: Economic life of the projects Required return After 1 year of usage After 2 years of usage After 3 years of usage 1. Ignore income tax in your analysis. N560 000 2 years Yr 1: NS40 000 Yr 2: N535 000 Project 1 Disposal values 500 000 360 000 70 000 2 years 14% 70 000 50 000 700 000 460 000 90 000 3 years 120 000 90 000 60 000 Required: a) Showing detailed calculations, which project should be selected using the lowest common multiple method b) Showing detailed calculations, which project should be selected using the annualised equivalent method

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Exercise 1 a To determine which project should be selected using the lowest common multiple LCM method we need to calculate the LCM of the project lifetimes and compare the equivalent investments for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started