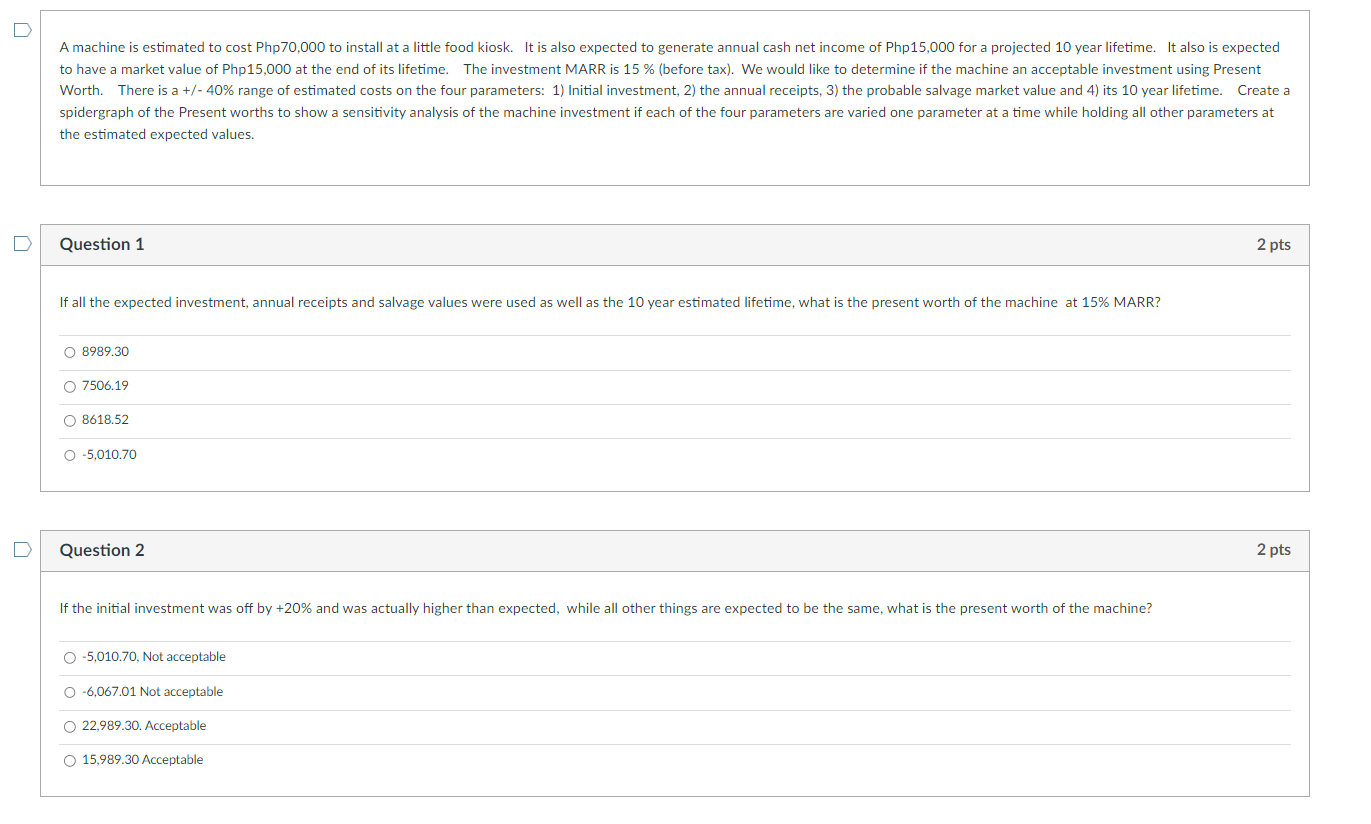

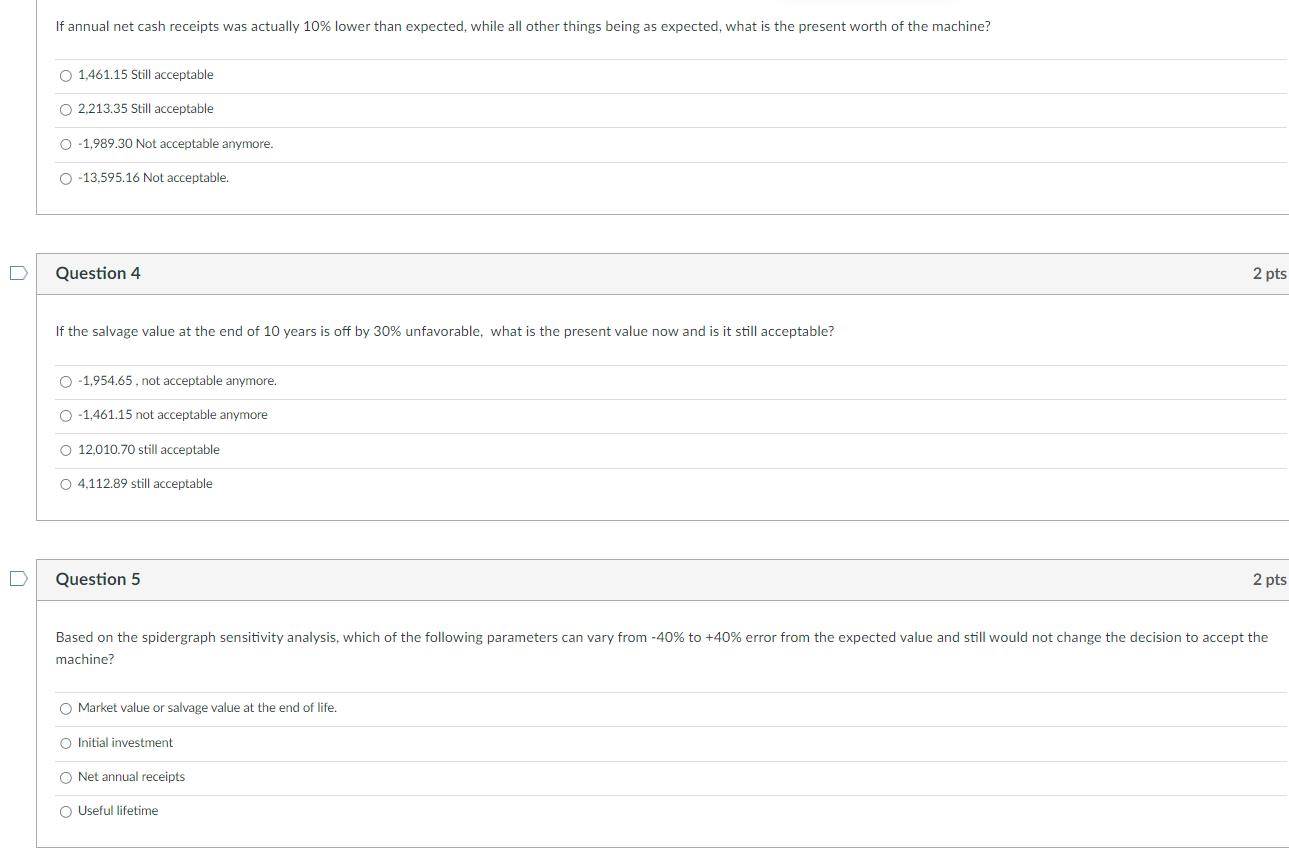

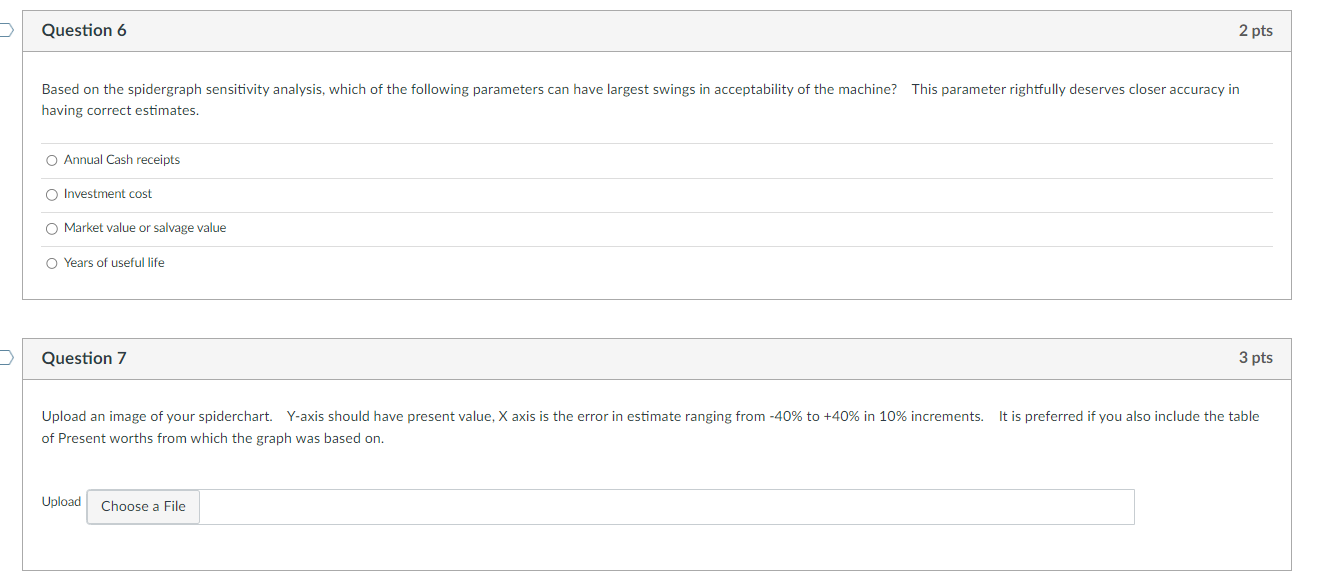

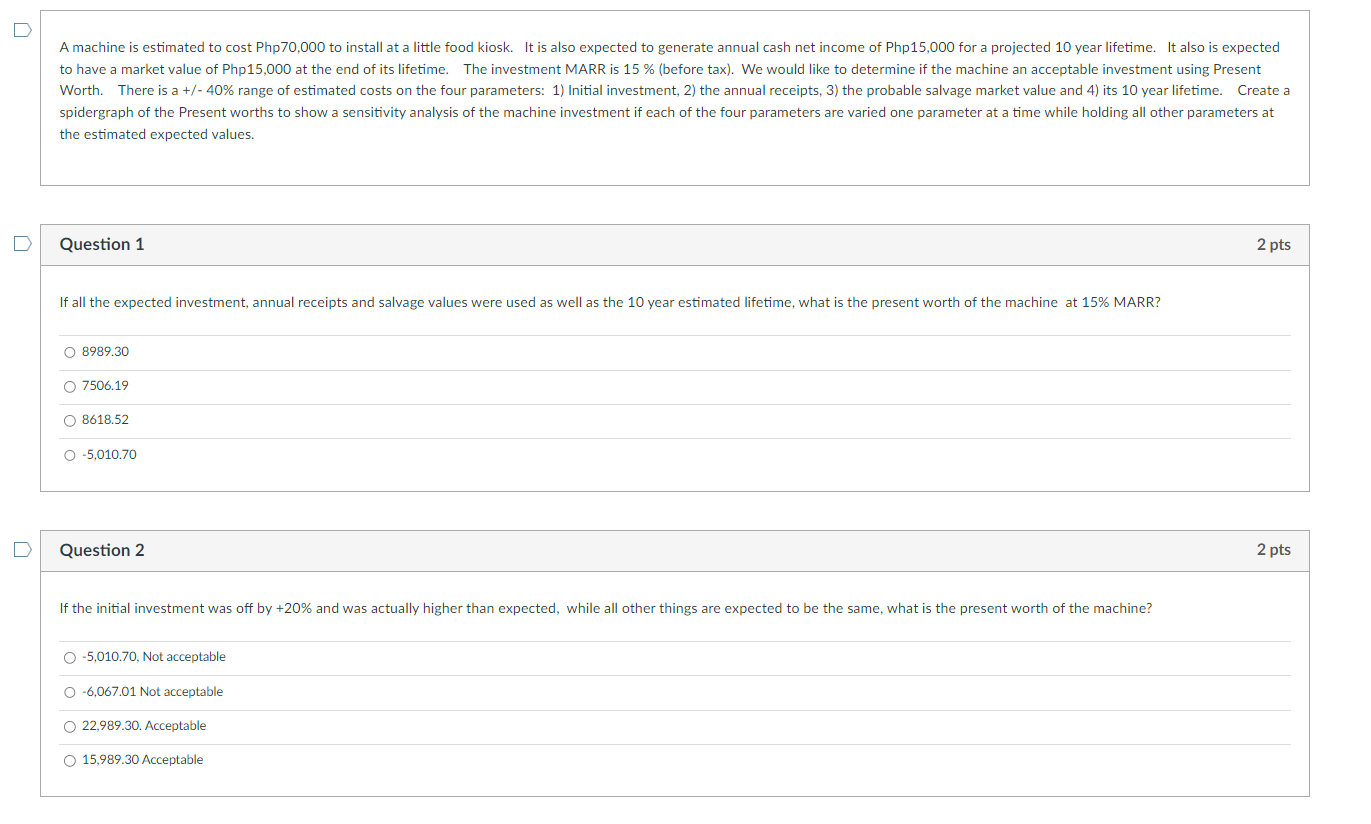

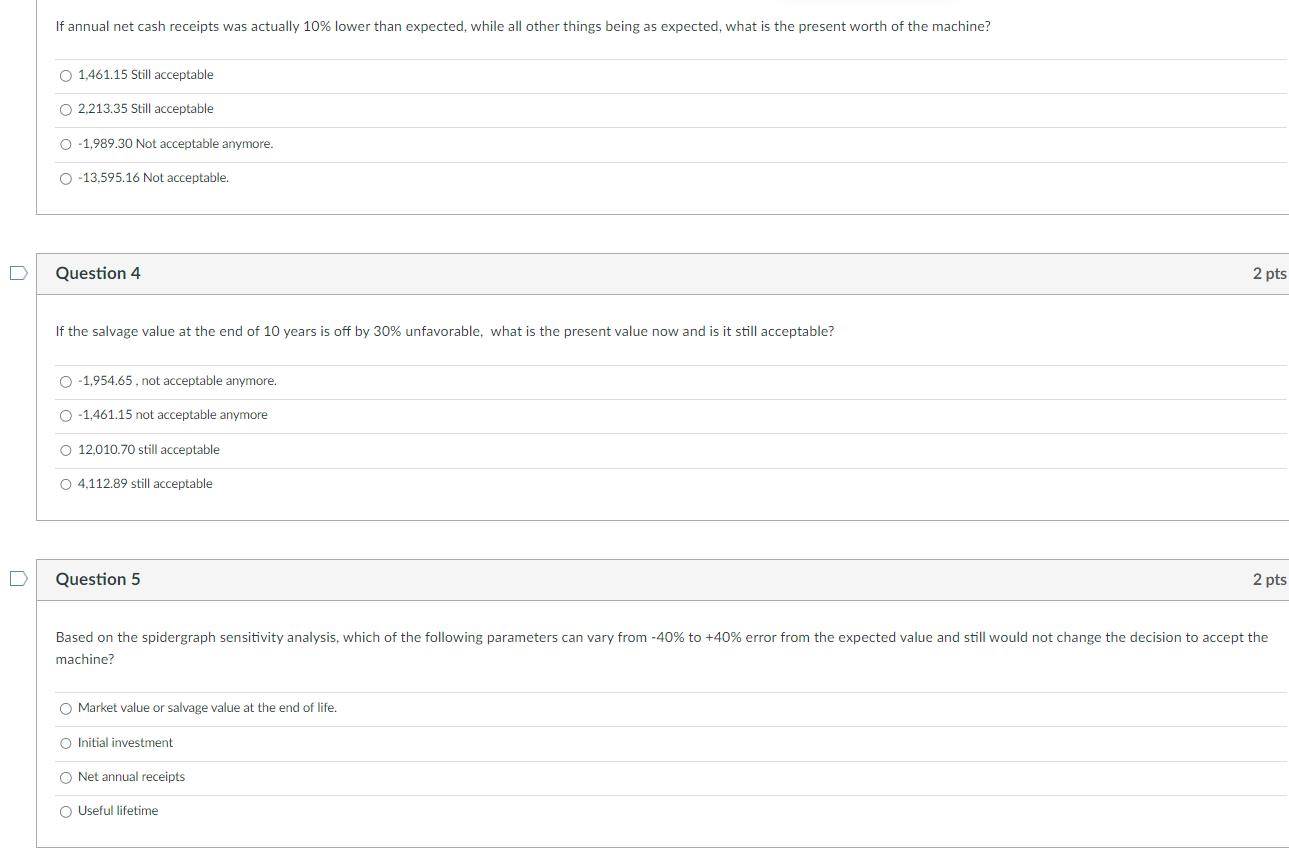

A machine is estimated to cost Php70,000 to install at a little food kiosk. It is also expected to generate annual cash net income of Php15,000 for a projected 10 year lifetime. It also is expected to have a market value of Php 15,000 at the end of its lifetime. The investment MARR is 15% (before tax). We would like to determine if the machine an acceptable investment using Present Worth. There is a +/40% range of estimated costs on the four parameters: 1) Initial investment, 2) the annual receipts, 3) the probable salvage market value and 4) its 10 year lifetime. Create a spidergraph of the Present worths to show a sensitivity analysis of the machine investment if each of the four parameters are varied one parameter at a time while holding all other parameters at the estimated expected values. Question 1 If all the expected investment, annual receipts and salvage values were used as well as the 10 year estimated lifetime, what is the present worth of the machine at 15% MARR? 8989.307506.198618.525,010.70 Question 2 If the initial investment was off by +20% and was actually higher than expected, while all other things are expected to be the same, what is the present worth of the machine? 5,010.70, Not acceptable -6,067.01 Not acceptable 22,989.30. Acceptable 15,989.30 Acceptable If annual net cash receipts was actually 10% lower than expected, while all other things being as expected, what is the present worth of the machine? 1,461.15 Still acceptable 2,213.35 Still acceptable 1,989.30 Not acceptable anymore. 13,595.16 Not acceptable. Question 4 If the salvage value at the end of 10 years is off by 30% unfavorable, what is the present value now and is it still acceptable? 1,954.65, not acceptable anymore. 1,461.15 not acceptable anymore 12,010.70 still acceptable 4,112.89 still acceptable Question 5 machine? Market value or salvage value at the end of life. Initial investment Net annual receipts Useful lifetime Based on the spidergraph sensitivity analysis, which of the following parameters can have largest swings in acceptability of the machine? This parameter rightfully deserves closer accuracy in having correct estimates. Annual Cash receipts Investment cost Market value or salvage value Years of useful life Question 7 Upload an image of your spiderchart. Y-axis should have present value, X axis is the error in estimate ranging from 40% to +40% in 10% increments. It is preferred if you also include the table of Present worths from which the graph was based on. Upload