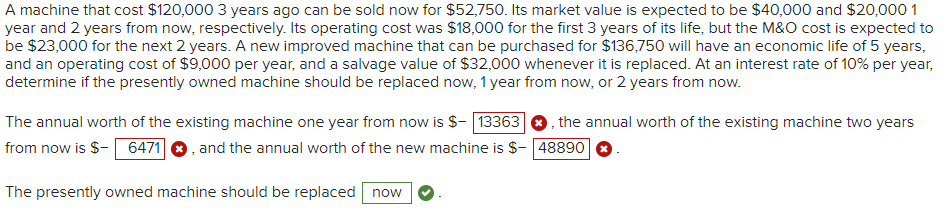

Question: A machine that cost $ 1 2 0 , 0 0 0 3 years ago can be sold now for $ 5 2 , 7

A machine that cost $ years ago can be sold now for $ Its market value is expected to be $ and $

year and years from now, respectively. Its operating cost was $ for the first years of its life, but the M&O cost is expected to

be $ for the next years. A new improved machine that can be purchased for $ will have an economic life of years,

and an operating cost of $ per year, and a salvage value of $ whenever it is replaced. At an interest rate of per year,

determine if the presently owned machine should be replaced now, year from now, or years from now.

The annual worth of the existing machine one year from now is $

the annual worth of the existing machine two years

from now is $

and the annual worth of the new machine is $

The presently owned machine should be replaced

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock