a) Make initial journal entries in the LINED JOURNAL

b) Make adjusting entries in the LINED JOURNAL

c) Make any mistake amounts and accounts into corrected ones.

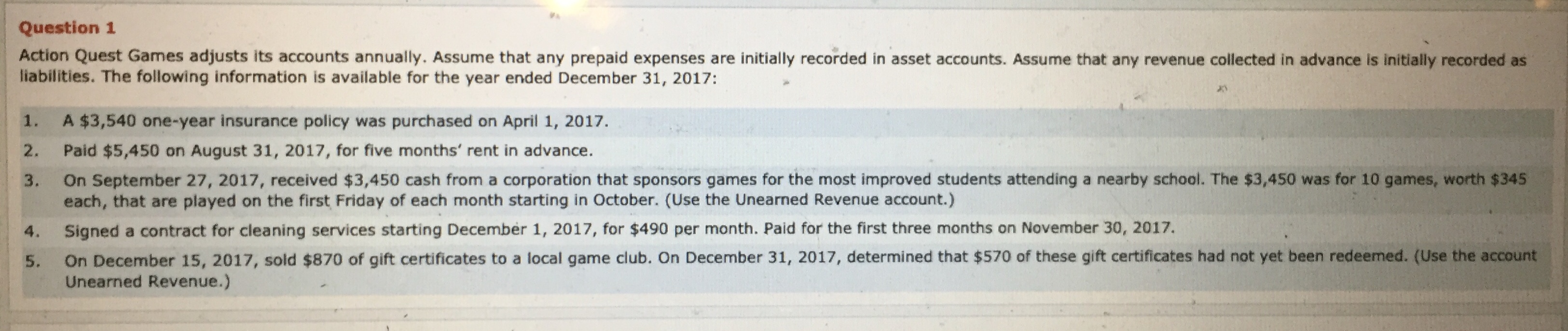

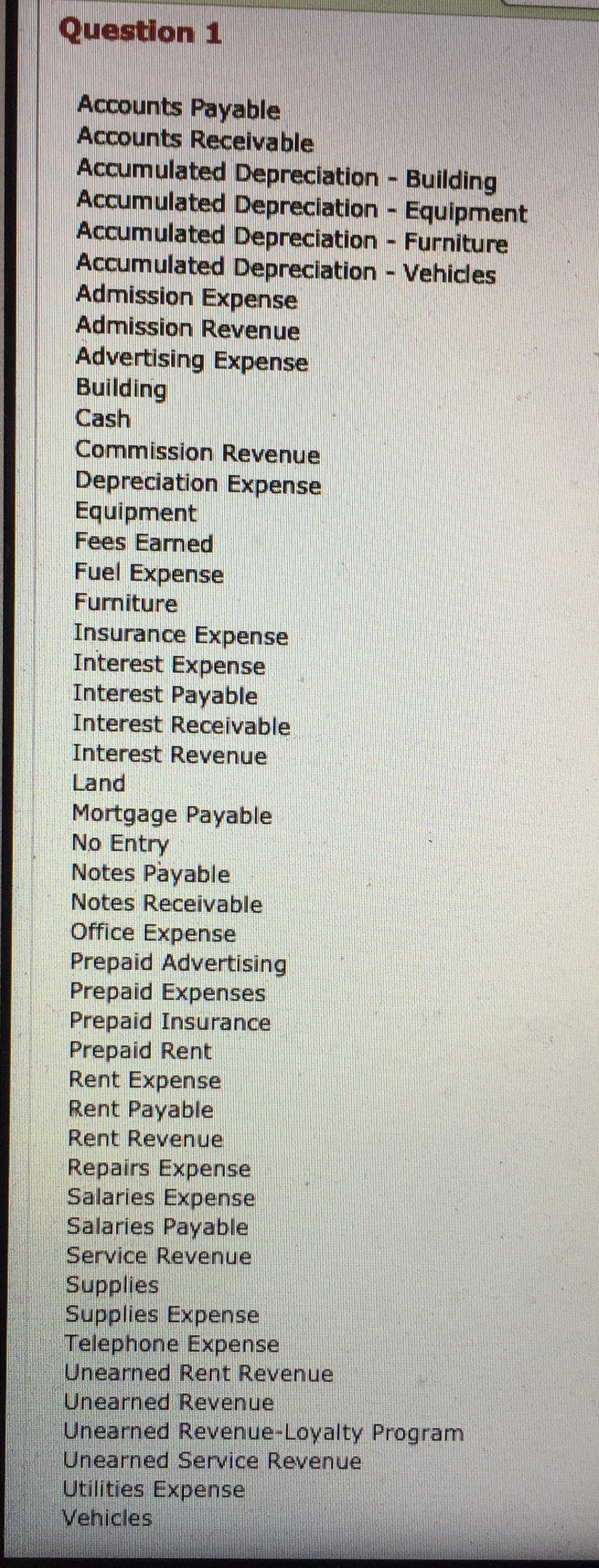

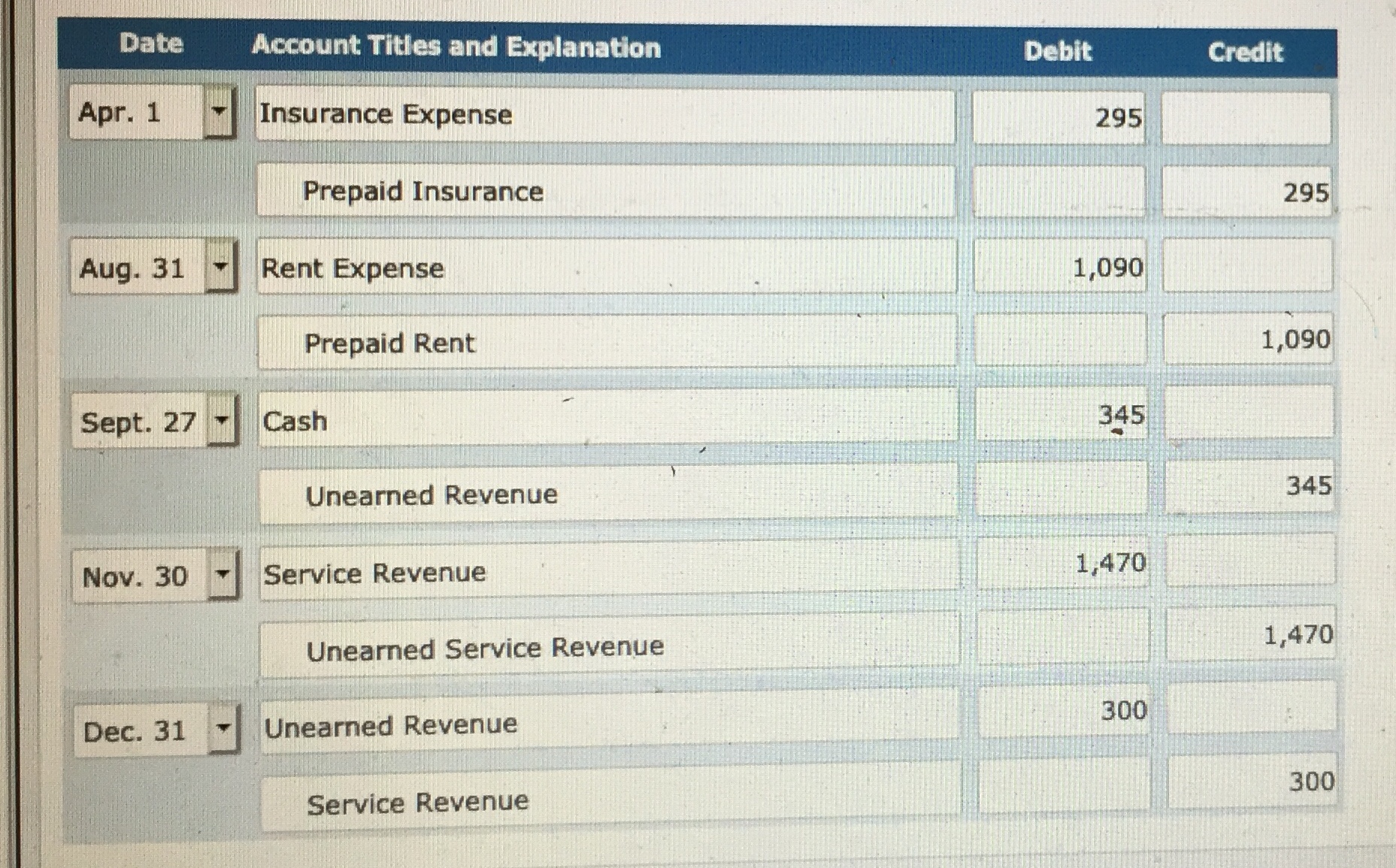

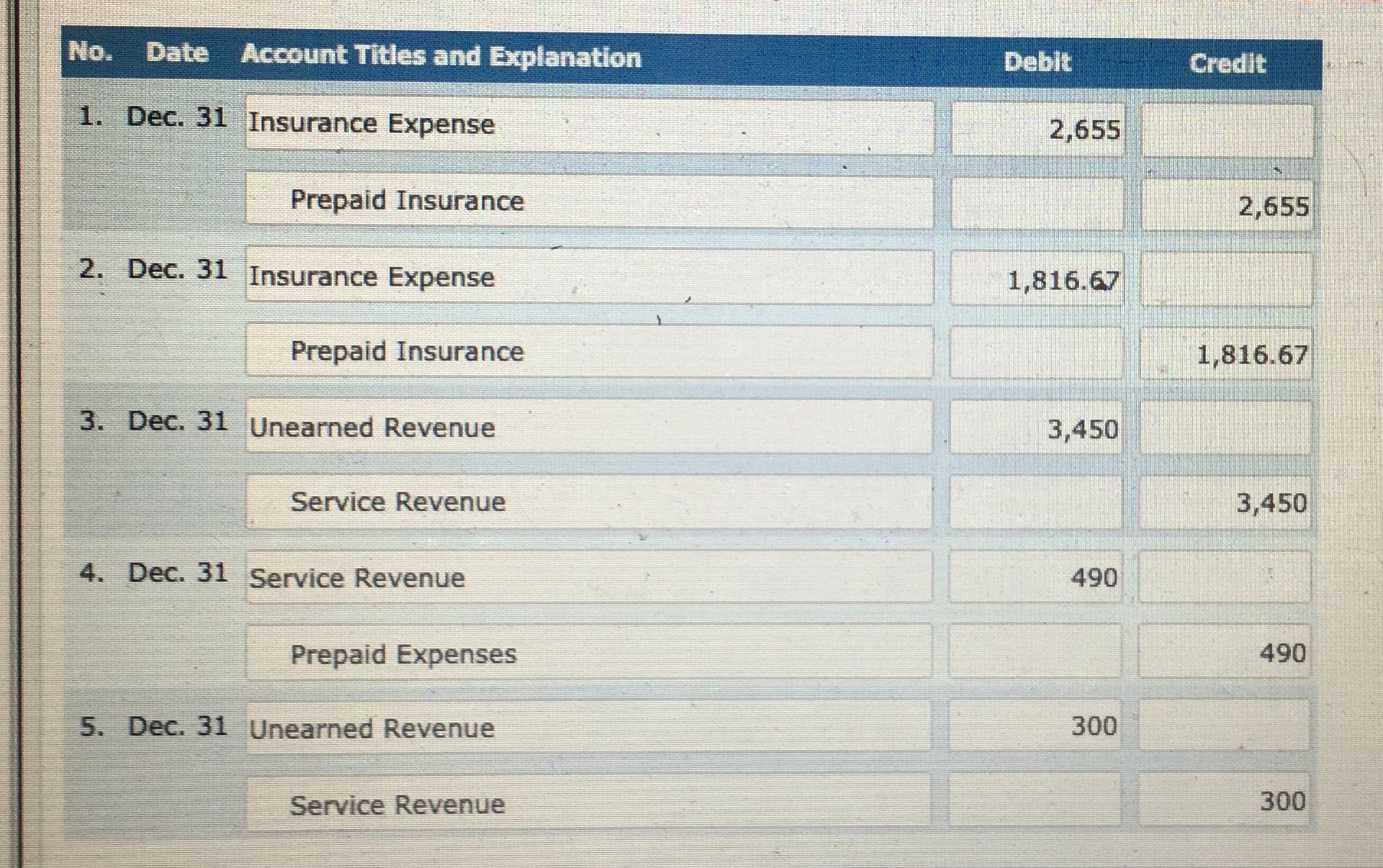

Question 1 Action Quest Games adjusts its accounts annually. Assume that any prepaid expenses are initially recorded in asset accounts. Assume that any revenue collected in advance is initially recorded as liabilities. The following information is available for the year ended December 31, 2017: 1. A $3,540 one-year insurance policy was purchased on April 1, 2017. Paid $5,450 on August 31, 2017, for five months' rent in advance. 3. On September 27, 2017, received $3,450 cash from a corporation that sponsors games for the most improved students attending a nearby school. The $3,450 was for 10 games, worth $345 each, that are played on the first Friday of each month starting in October. (Use the Unearned Revenue account.) 4. Signed a contract for cleaning services starting December 1, 2017, for $490 per month. Paid for the first three months on November 30, 2017. 5 . On December 15, 2017, sold $870 of gift certificates to a local game club. On December 31, 2017, determined that $570 of these gift certificates had not yet been redeemed. (Use the account Unearned Revenue.)Question 1 Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Accumulated Depreciation - Vehicles Admission Expense Admission Revenue Advertising Expense Building Cash Commission Revenue Depreciation Expense Equipment Fees Earned Fuel Expense Furniture Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Land Mortgage Payable No Entry Notes Payable Notes Receivable Office Expense Prepaid Advertising Prepaid Expenses Prepaid Insurance Prepaid Rent Rent Expense Rent Payable Rent Revenue Repairs Expense Salaries Expense Salaries Payable Service Revenue Supplies Supplies Expense Telephone Expense Unearned Rent Revenue Unearned Revenue Unearned Revenue-Loyalty Program Unearned Service Revenue Utilities Expense VehiclesDate Account Titles and Explanation Debit Credit Apr. 1 Insurance Expense 295 Prepaid Insurance 295 Aug. 31 Rent Expense 1,090 Prepaid Rent 1,090 Sept. 27 Cash 345 Unearned Revenue 345 Nov. 30 Service Revenue 1,470 Unearned Service Revenue 1,470 Dec. 31 Unearned Revenue 300 Service Revenue 300No. Date Account Titles and Explanation Debit Credit 1. Dec. 31 Insurance Expense 2,655 Prepaid Insurance 2,655 2. Dec. 31 Insurance Expense 1,816.67 Prepaid Insurance 1,816.67 3. Dec. 31 Unearned Revenue 3,450 Service Revenue 3,450 4. Dec. 31 Service Revenue 490 Prepaid Expenses 490 5. Dec. 31 Unearned Revenue 300 Service Revenue 300