Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A man purchased land in 1963 and began residing on it with his second wife in 1988. They deeded the property to her daughter

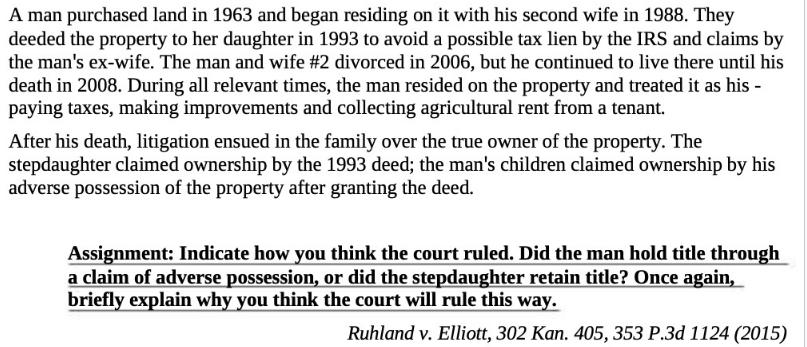

A man purchased land in 1963 and began residing on it with his second wife in 1988. They deeded the property to her daughter in 1993 to avoid a possible tax lien by the IRS and claims by the man's ex-wife. The man and wife #2 divorced in 2006, but he continued to live there until his death in 2008. During all relevant times, the man resided on the property and treated it as his - paying taxes, making improvements and collecting agricultural rent from a tenant. After his death, litigation ensued in the family over the true owner of the property. The stepdaughter claimed ownership by the 1993 deed; the man's children claimed ownership by his adverse possession of the property after granting the deed. Assignment: Indicate how you think the court ruled. Did the man hold title through a claim of adverse possession, or did the stepdaughter retain title? Once again, briefly explain why you think the court will rule this way. Ruhland v. Elliott, 302 Kan. 405, 353 P.3d 1124 (2015)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The court ruled that the man did not hold title through a claim of adverse possession The stepdaught...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started