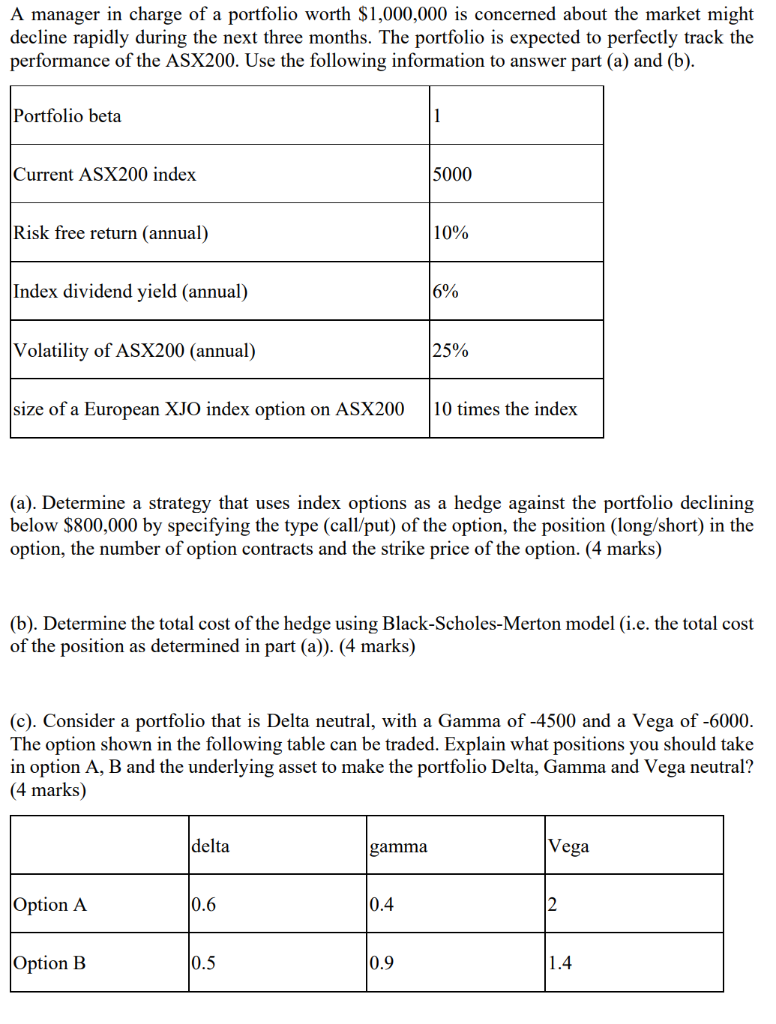

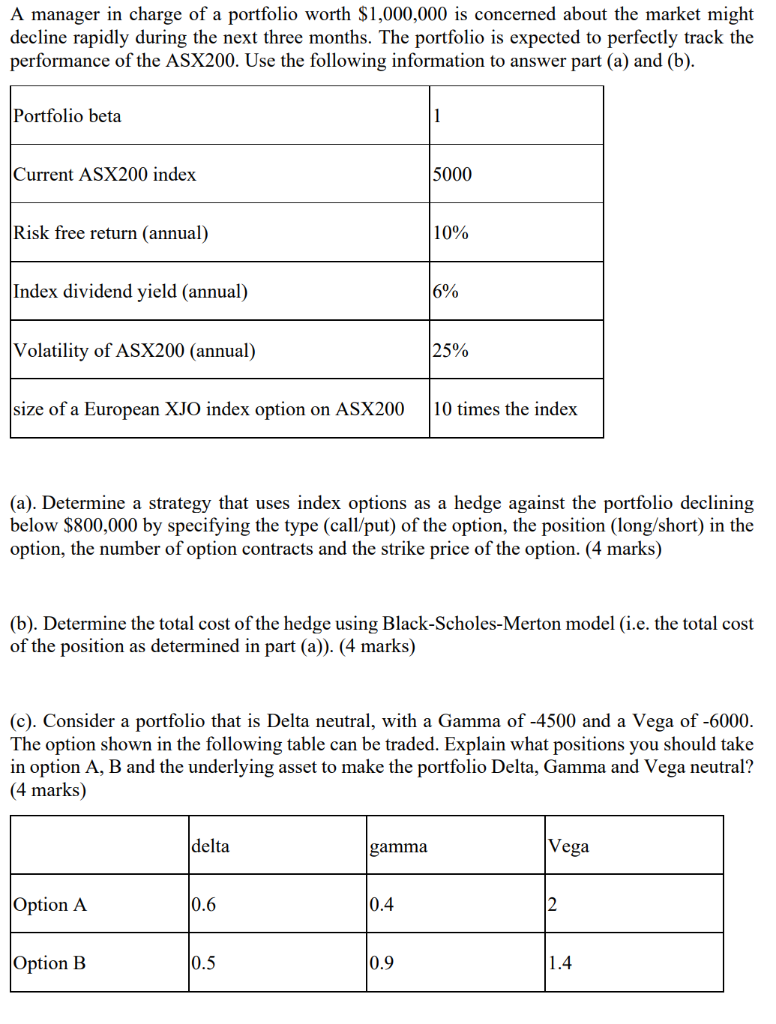

A manager in charge of a portfolio worth $1,000,000 is concerned about the market might decline rapidly during the next three months. The portfolio is expected to perfectly track the performance of the ASX200. Use the following information to answer part (a) and (b). Portfolio beta 1 Current ASX200 index 5000 Risk free return (annual) 10% Index dividend yield (annual) 16% Volatility of ASX200 (annual) 25% size of a European XJO index option on ASX200 10 times the index (a). Determine a strategy that uses index options as a hedge against the portfolio declining below $800,000 by specifying the type (call/put) of the option, the position (long/short) in the option, the number of option contracts and the strike price of the option. (4 marks) (b). Determine the total cost of the hedge using Black-Scholes-Merton model (i.e. the total cost of the position as determined in part (a)). (4 marks) (C). Consider a portfolio that is Delta neutral, with a Gamma of -4500 and a Vega of -6000. The option shown in the following table can be traded. Explain what positions you should take in option A, B and the underlying asset to make the portfolio Delta, Gamma and Vega neutral? (4 marks) delta gamma Vega Option A 10.6 0.4 2 Option B 10.5 0.9 1.4 A manager in charge of a portfolio worth $1,000,000 is concerned about the market might decline rapidly during the next three months. The portfolio is expected to perfectly track the performance of the ASX200. Use the following information to answer part (a) and (b). Portfolio beta 1 Current ASX200 index 5000 Risk free return (annual) 10% Index dividend yield (annual) 16% Volatility of ASX200 (annual) 25% size of a European XJO index option on ASX200 10 times the index (a). Determine a strategy that uses index options as a hedge against the portfolio declining below $800,000 by specifying the type (call/put) of the option, the position (long/short) in the option, the number of option contracts and the strike price of the option. (4 marks) (b). Determine the total cost of the hedge using Black-Scholes-Merton model (i.e. the total cost of the position as determined in part (a)). (4 marks) (C). Consider a portfolio that is Delta neutral, with a Gamma of -4500 and a Vega of -6000. The option shown in the following table can be traded. Explain what positions you should take in option A, B and the underlying asset to make the portfolio Delta, Gamma and Vega neutral? (4 marks) delta gamma Vega Option A 10.6 0.4 2 Option B 10.5 0.9 1.4