Answered step by step

Verified Expert Solution

Question

1 Approved Answer

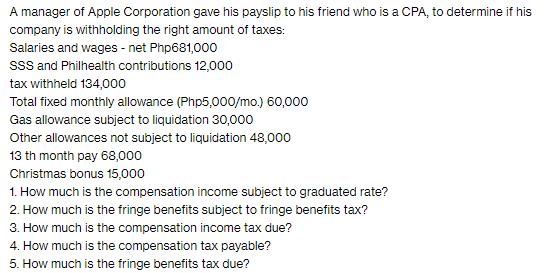

A manager of Apple Corporation gave his payslip to his friend who is a CPA, to determine if his company is withholding the right

A manager of Apple Corporation gave his payslip to his friend who is a CPA, to determine if his company is withholding the right amount of taxes: Salaries and wages - net Php681,000 SSS and Philhealth contributions 12,000 tax withheld 134,000 Total fixed monthly allowance (Php5,000/mo.) 60,000 Gas allowance subject to liquidation 30,000 Other allowances not subject to liquidation 48,000 13 th month pay 68,000 Christmas bonus 15,000 1. How much is the compensation income subject to graduated rate? 2. How much is the fringe benefits subject to fringe benefits tax? 3. How much is the compensation income tax due? 4. How much is the compensation tax payable? 5. How much is the fringe benefits tax due?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine the answers to the questions we need to calculate the various components of compensation and taxes Heres the breakdown 1 Compensation Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started