Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Mansukh Itd. has six debtors who could not pay. Debtor C and E has given a certificate from the court certifying that they

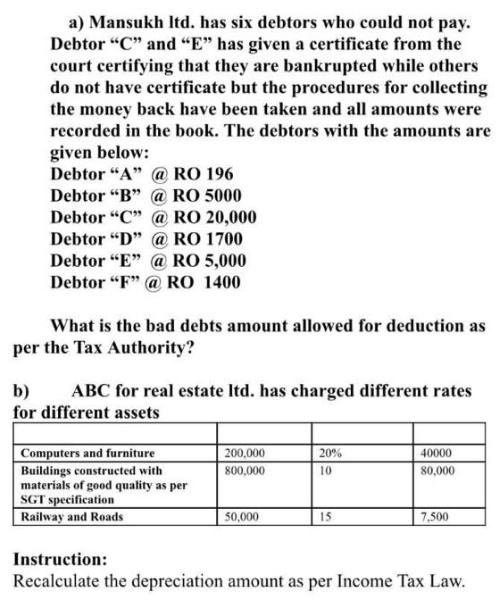

a) Mansukh Itd. has six debtors who could not pay. Debtor "C" and "E" has given a certificate from the court certifying that they are bankrupted while others do not have certificate but the procedures for collecting the money back have been taken and all amounts were recorded in the book. The debtors with the amounts are given below: Debtor "A" @ RO 196 Debtor "B" @ RO 5000 Debtor "C" @RO 20,000 Debtor "D" @ RO 1700 Debtor "E" @ RO 5,000 Debtor "F" @ RO 1400 What is the bad debts amount allowed for deduction as per the Tax Authority? b) ABC for real estate ltd. has charged different rates for different assets Computers and furniture 200,000 20% 40000 800,000 10 80,000 Buildings constructed with materials of good quality as per SGT specification Railway and Roads 50,000 15 7,500 Instruction: Recalculate the depreciation amount as per Income Tax Law.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Bad debt is a debt which is not producing money or not collectible The debtors who failed to retur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started