Answered step by step

Verified Expert Solution

Question

1 Approved Answer

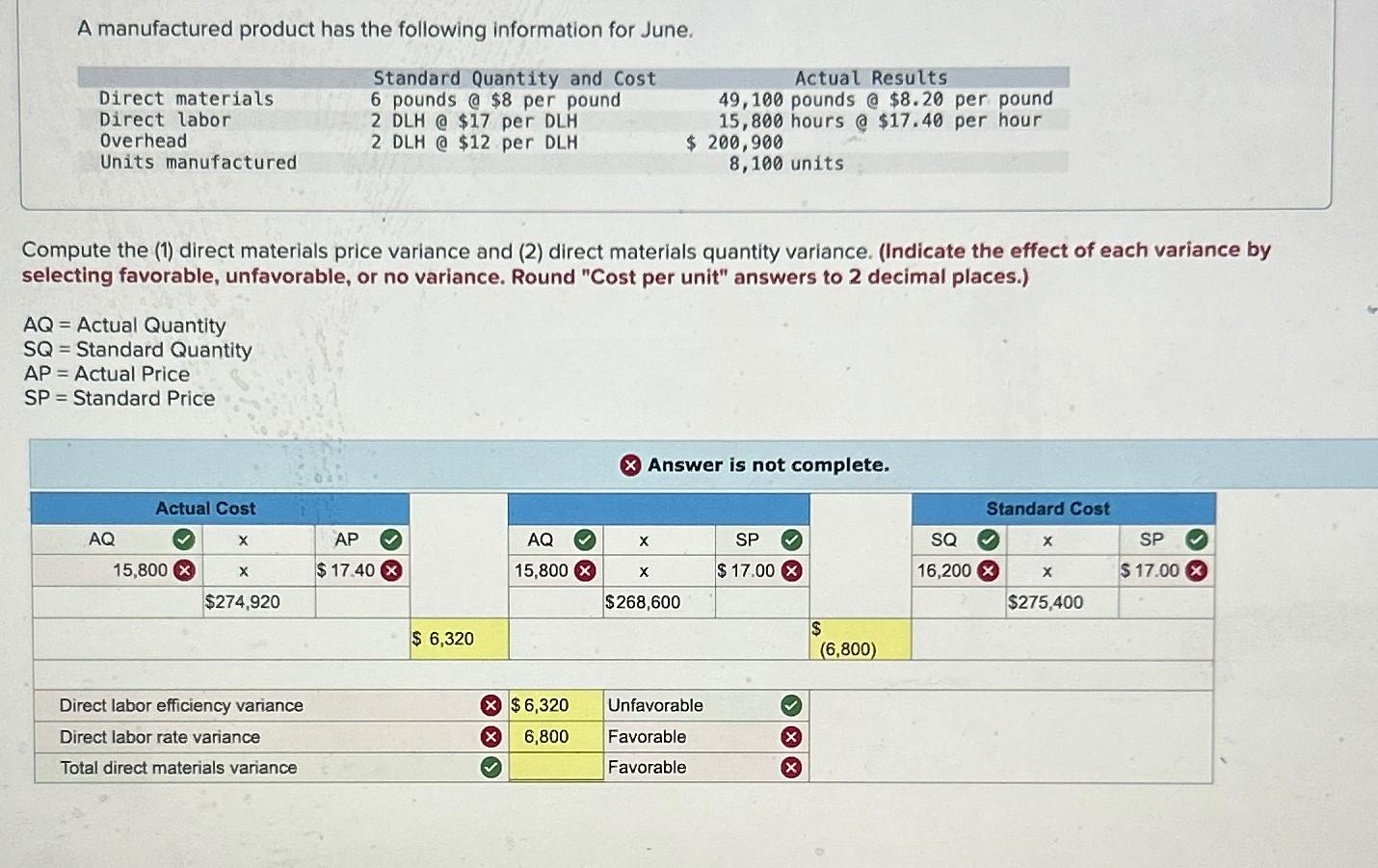

A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 6 pounds $8 per

A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard Quantity and Cost 6 pounds $8 per pound 2 DLH @$17 per DLH 2 DLH @ $12 per DLH Actual Results $ 200,900 49,100 pounds @ $8.20 per pound 15,800 hours @ $17.40 per hour 8,100 units Compute the (1) direct materials price variance and (2) direct materials quantity variance. (Indicate the effect of each variance by selecting favorable, unfavorable, or no variance. Round "Cost per unit" answers to 2 decimal places.) AQ Actual Quantity SQ Standard Quantity AP Actual Price = SP Standard Price Answer is not complete. Actual Cost Standard Cost AQ X AP AQ X SP SQ X SP 15,800 x $17.40 x 15,800 x X $17.00 x 16,200x X $17.00 x $274,920 $268,600 $275,400 Direct labor efficiency variance Direct labor rate variance Total direct materials variance $ 6,320 x $6,320 Unfavorable 6,800 Favorable Favorable $ (6,800)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the direct materials price variance we need to calculate the differenc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e074f08395_960534.pdf

180 KBs PDF File

663e074f08395_960534.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started