Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturer of glass bottles has been affected by competition from plastic bottles and is currently operating at between 65 and 70 per cent

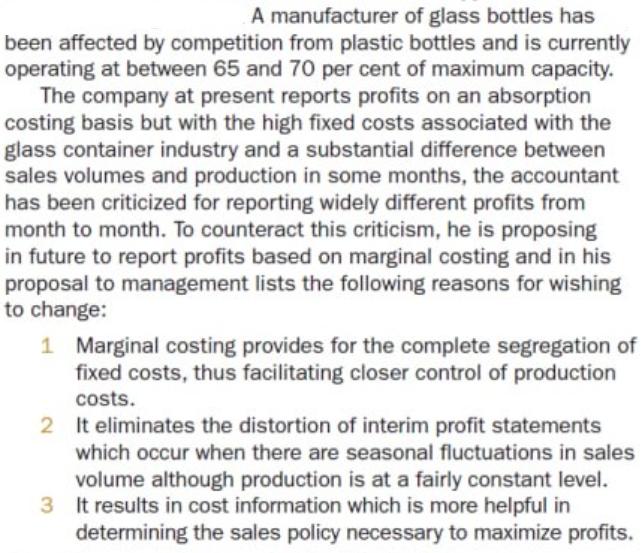

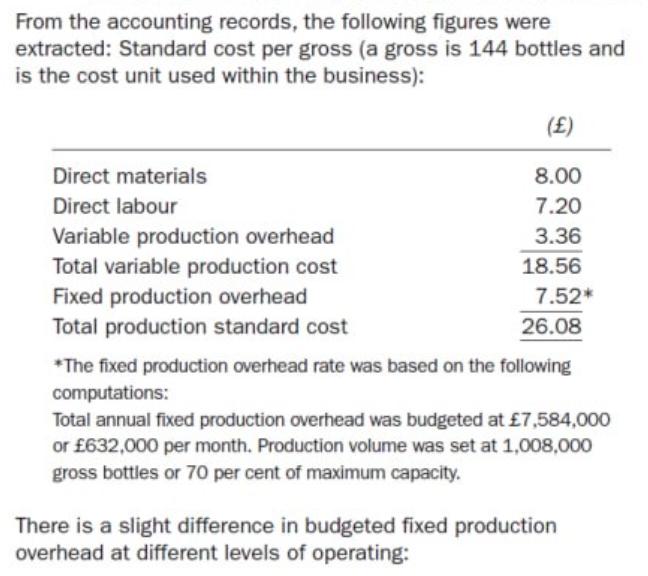

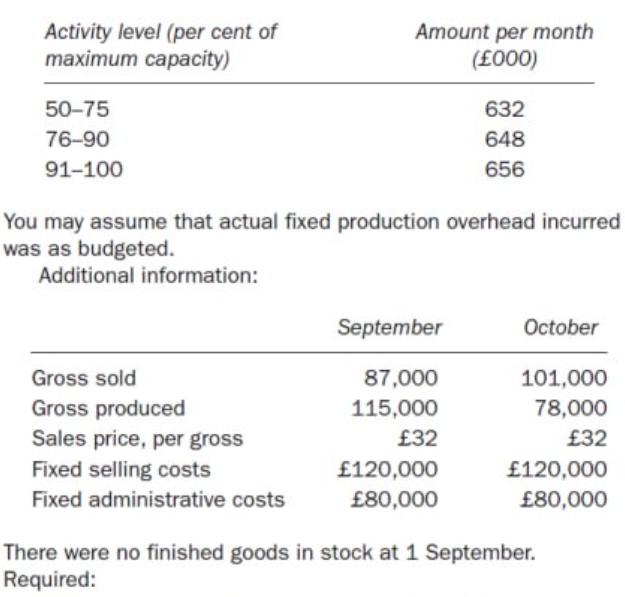

A manufacturer of glass bottles has been affected by competition from plastic bottles and is currently operating at between 65 and 70 per cent of maximum capacity. The company at present reports profits on an absorption costing basis but with the high fixed costs associated with the glass container industry and a substantial difference between sales volumes and production in some months, the accountant has been criticized for reporting widely different profits from month to month. To counteract this criticism, he is proposing in future to report profits based on marginal costing and in his proposal to management lists the following reasons for wishing to change: 1 Marginal costing provides for the complete segregation of fixed costs, thus facilitating closer control of production costs. 2 It eliminates the distortion of interim profit statements which occur when there are seasonal fluctuations in sales volume although production is at a fairly constant level. 3 It results in cost information which is more helpful in determining the sales policy necessary to maximize profits. From the accounting records, the following figures were extracted: Standard cost per gross (a gross is 144 bottles and is the cost unit used within the business): Direct materials Direct labour Variable production overhead Total variable production cost Fixed production overhead Total production standard cost () 8.00 7.20 3.36 18.56 7.52* 26.08 *The fixed production overhead rate was based on the following computations: Total annual fixed production overhead was budgeted at 7,584,000 or 632,000 per month. Production volume was set at 1,008,000 gross bottles or 70 per cent of maximum capacity. There is a slight difference in budgeted fixed production overhead at different levels of operating: Activity level (per cent of maximum capacity) 50-75 76-90 91-100 Amount per month (000) 632 648 656 You may assume that actual fixed production overhead incurred was as budgeted. Additional information: Gross sold Gross produced Sales price, per gross Fixed selling costs September October 87,000 101,000 115,000 78,000 32 32 120,000 120,000 80,000 80,000 Fixed administrative costs There were no finished goods in stock at 1 September. Required: (a) Prepare monthly profit statements for September and October using (i) absorption costing; and (ii) marginal costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started