Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturer wants to determine its WACC. Today, 1/1/2018, the firm issued 7,000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds

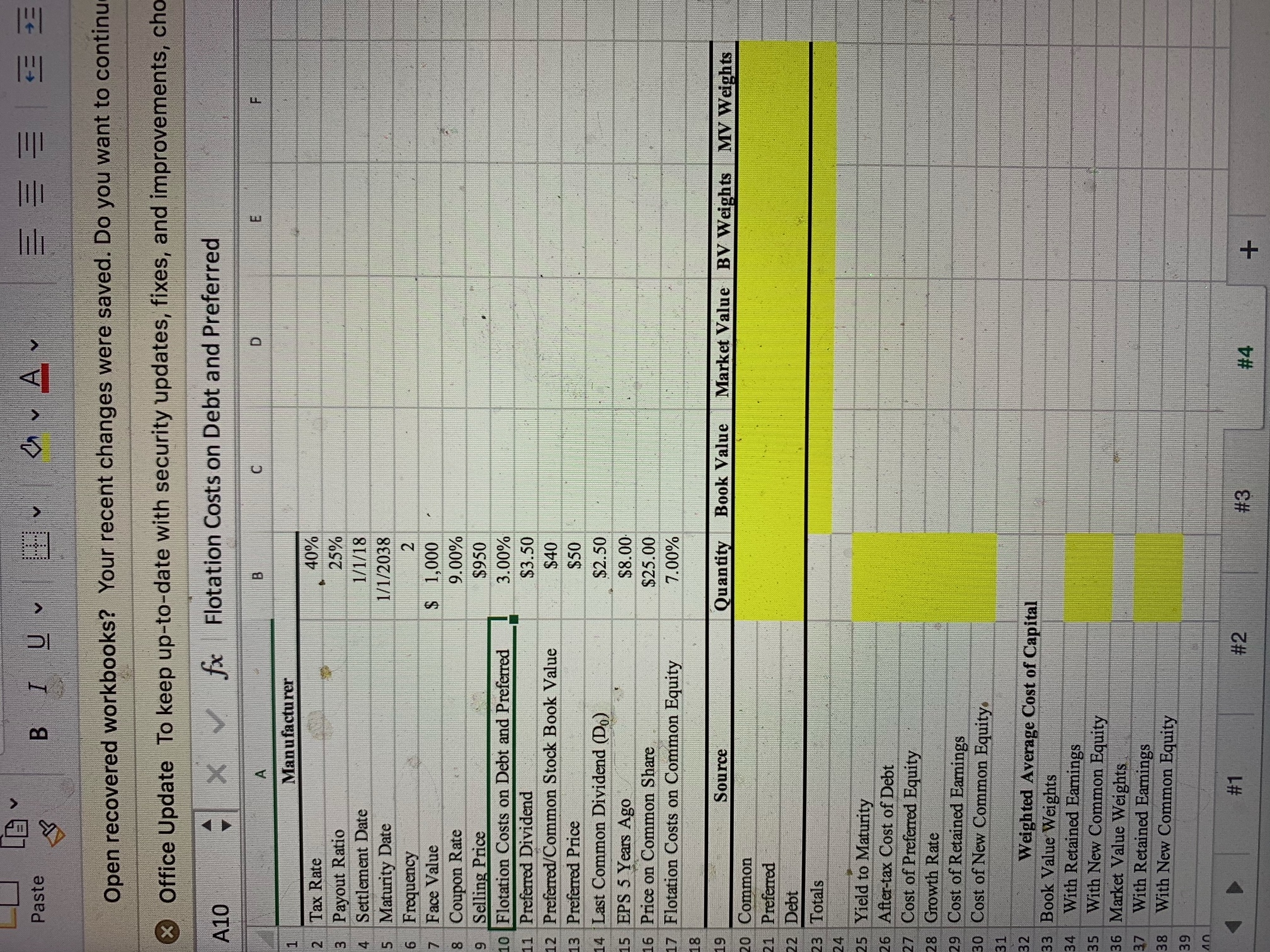

- A manufacturer wants to determine its WACC. Today, 1/1/2018, the firm issued 7,000 bonds that will mature in 1/1/2038 with $1,000 face value. These bonds will pay a 9% coupon rate semiannually and are currently selling for $950. The firm has 100,000 preferred shares of stock outstanding with a book value of $40, but currently selling for $50 per share. The most recent preferred and common dividends were $3.50 and $2.50 per share, respectively. The firms EPS five years ago was $8.00 and it expects to increase its next dividend payment by the implied 5-year earnings per share growth rate. Flotation costs on debt and preferred equity are both 3%, but 7% in the case of common stocks. The common stock is selling today for $25 and the firms tax rate and payout ratio are 40% and 25%, respectively. The firm has 200,000 shares of common stock outstanding with the same book value as that of its preferred stock.

a) Calculate the book value and market value weights for each source of capital.

b) Calculate the component costs of capital (i.e., debt, preferred equity, retained earnings, and new common equity).

- Determine the weighted average costs of capital using both the market and the book value weights

I will provide a picture of the required template below, please show calculations. *Note: This is all the information the question provides, no need to type out the whole thing, I just need the highlighted portion. I would provide a chart but Cengage says "the question is too long" if I do that so I just took a picture of it.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started