Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company has decided to purchase equipment that has an initial cost of $267,000. The equipment will be used for 17 years, at

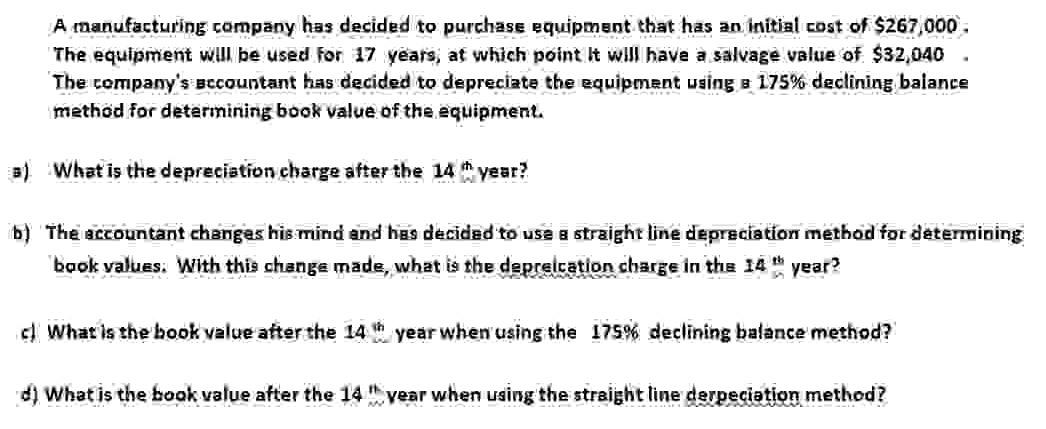

A manufacturing company has decided to purchase equipment that has an initial cost of $267,000. The equipment will be used for 17 years, at which point it will have a salvage value of $32,040 The company's Bccountant has decided to depreciate the equipment using a 175% declining balance method for determining book value of the equipment. a) What is the depreciation charge after the 14th year? b) The accountant changes his mind and has decided to use a straight line depreciation method for determining book values. With this change made, what is the deprecation charge in the 14th year? What is the book value after the 14th year when using the 175% declining balance method? d) What is the book value after the 14 year when using the straight line derpeciation method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the problem step by step a Depreciation charge after the 14th year using the 175 declining balance method First we need to find the de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

66427d08c1056_979860.pdf

180 KBs PDF File

66427d08c1056_979860.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started