Answered step by step

Verified Expert Solution

Question

1 Approved Answer

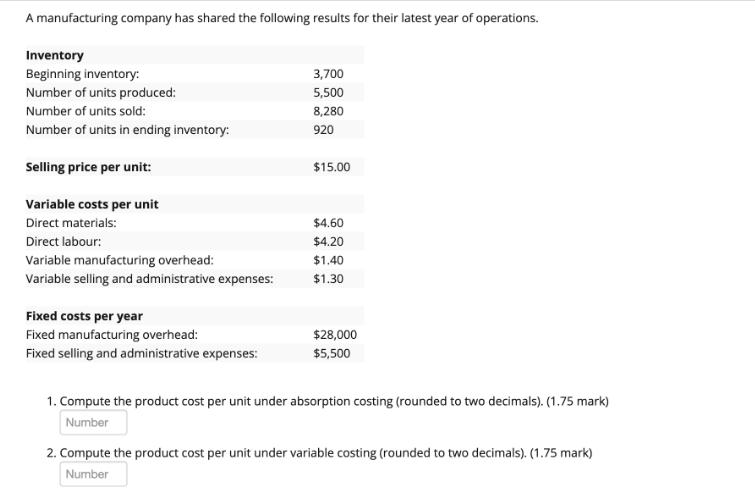

A manufacturing company has shared the following results for their latest year of operations. Inventory Beginning inventory: Number of units produced: Number of units

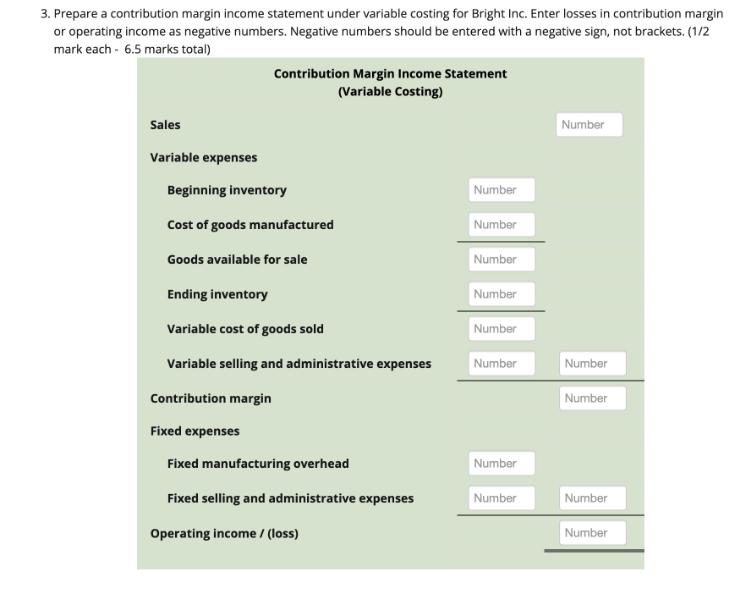

A manufacturing company has shared the following results for their latest year of operations. Inventory Beginning inventory: Number of units produced: Number of units sold: Number of units in ending inventory: Selling price per unit: Variable costs per unit Direct materials: Direct labour: Variable manufacturing overhead: Variable selling and administrative expenses: Fixed costs per year Fixed manufacturing overhead: Fixed selling and administrative expenses: 3,700 5,500 8,280 920 $15.00 $4.60 $4.20 $1,40 $1.30 $28,000 $5,500 1. Compute the product cost per unit under absorption costing (rounded to two decimals). (1.75 mark) Number 2. Compute the product cost per unit under variable costing (rounded to two decimals). (1.75 mark) Number 3. Prepare a contribution margin income statement under variable costing for Bright Inc. Enter losses in contribution margin or operating income as negative numbers. Negative numbers should be entered with a negative sign, not brackets. (1/2 mark each 6.5 marks total) Sales Variable expenses Contribution Margin Income Statement (Variable Costing) Beginning inventory Cost of goods manufactured Goods available for sale Ending inventory Variable cost of goods sold Variable selling and administrative expenses Contribution margin Fixed expenses Fixed manufacturing overhead Fixed selling and administrative expenses Operating income / (loss) Number Number Number Number Number Number Number Number Number Number Number Number Number

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations and the contribution margin income statement under variable costing for Br...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started