Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company made long term agreements with large automotive industry partner, which generate large-fixed revenue for a long time. However, the company still

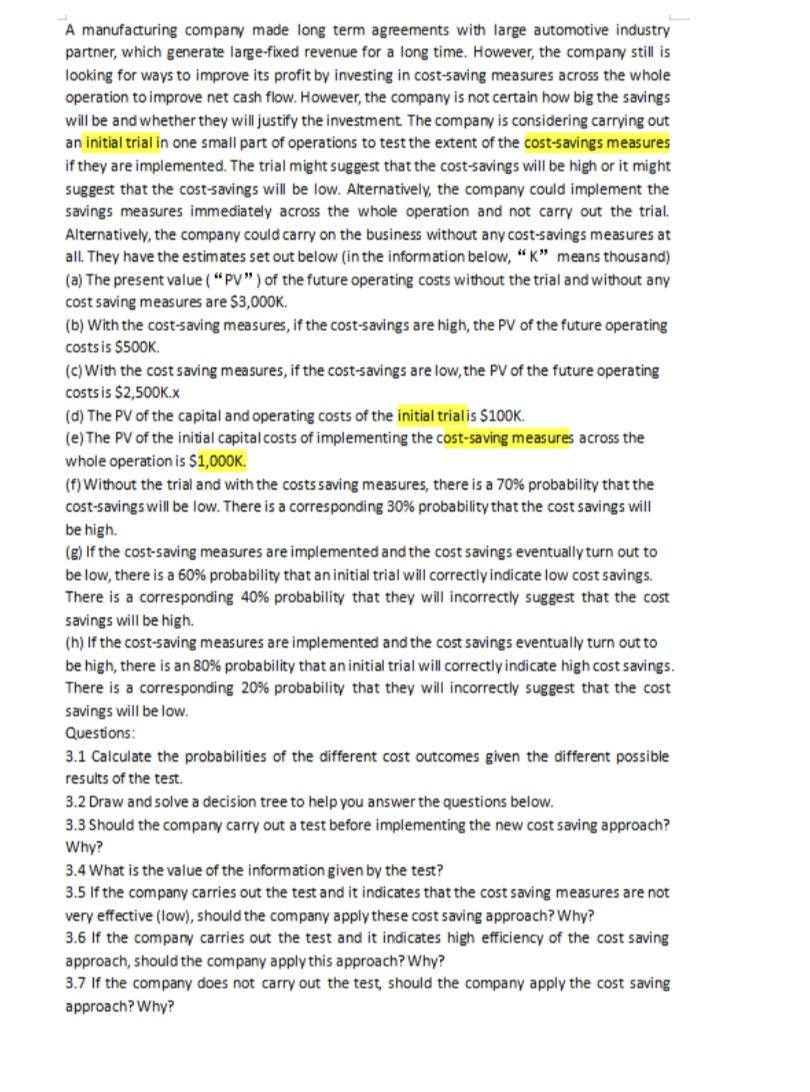

A manufacturing company made long term agreements with large automotive industry partner, which generate large-fixed revenue for a long time. However, the company still is looking for ways to improve its profit by investing in cost-saving measures across the whole operation to improve net cash flow. However, the company is not certain how big the savings will be and whether they will justify the investment. The company is considering carrying out an initial trial in one small part of operations to test the extent of the cost-savings measures if they are implemented. The trial might suggest that the cost-savings will be high or it might suggest that the cost-savings will be low. Alternatively, the company could implement the savings measures immediately across the whole operation and not carry out the trial. Alternatively, the company could carry on the business without any cost-savings measures at all. They have the estimates set out below (in the information below, "K" means thousand) (a) The present value ("PV") of the future operating costs without the trial and without any cost saving measures are $3,000K. (b) With the cost-saving measures, if the cost-savings are high, the PV of the future operating costs is $500K. (c) With the cost saving measures, if the cost-savings are low, the PV of the future operating costs is $2,500K.X (d) The PV of the capital and operating costs of the initial trial is $100K. (e) The PV of the initial capital costs of implementing the cost-saving measures across the whole operation is $1,000K. (f) Without the trial and with the costs saving measures, there is a 70 % probability that the cost-savings will be low. There is a corresponding 30% probability that the cost savings will be high. (g) If the cost-saving measures are implemented and the cost savings eventually turn out to be low, there is a 60% probability that an initial trial will correctly indicate low cost savings. There is a corresponding 40% probability that they will incorrectly suggest that the cost savings will be high. (h) If the cost-saving measures are implemented and the cost savings eventually turn out to be high, there is an 80% probability that an initial trial will correctly indicate high cost savings. There is a corresponding 20% probability that they will incorrectly suggest that the cost savings will be low. Questions: 3.1 Calculate the probabilities of the different cost outcomes given the different possible results of the test. 3.2 Draw and solve a decision tree to help you answer the questions below. 3.3 Should the company carry out a test before implementing the new cost saving approach? Why? 3.4 What is the value of the information given by the test? 3.5 If the company carries out the test and it indicates that the cost saving measures are not very effective (low), should the company apply these cost saving approach? Why? 3.6 If the company carries out the test and it indicates high efficiency of the cost saving approach, should the company apply this approach? Why? 3.7 If the company does not carry out the test, should the company apply the cost saving approach? Why?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets break down the decisionmaking process using the information provided 31 Calculate the probabilities of the different cost outcomes given the different possible results of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started