Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company produces and sells Product ST. The production cost of the product is made up as follows: Direct material Direct labour Variable

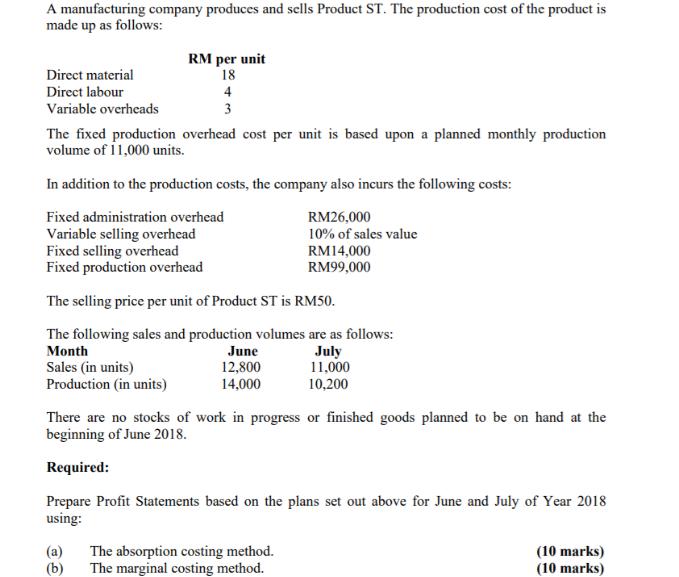

A manufacturing company produces and sells Product ST. The production cost of the product is made up as follows: Direct material Direct labour Variable overheads RM per unit 18 4 3 The fixed production overhead cost per unit is based upon a planned monthly production volume of 11,000 units. In addition to the production costs, the company also incurs the following costs: Fixed administration overhead RM26,000 10% of sales value Variable selling overhead Fixed selling overhead Fixed production overhead RM14,000 RM99,000 The selling price per unit of Product ST is RM50. The following sales and production volumes are as follows: Month July Sales (in units) 11,000 Production (in units) 10,200 June 12,800 14,000 There are no stocks of work in progress or finished goods planned to be on hand at the beginning of June 2018. Required: Prepare Profit Statements based on the plans set out above for June and July of Year 2018 using: (a) The absorption costing method. (b) The marginal costing method. (10 marks) (10 marks)

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Profit Statements based on the absorption costing method June 2018 Particulars Amount RM Sales 128...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started