Answered step by step

Verified Expert Solution

Question

1 Approved Answer

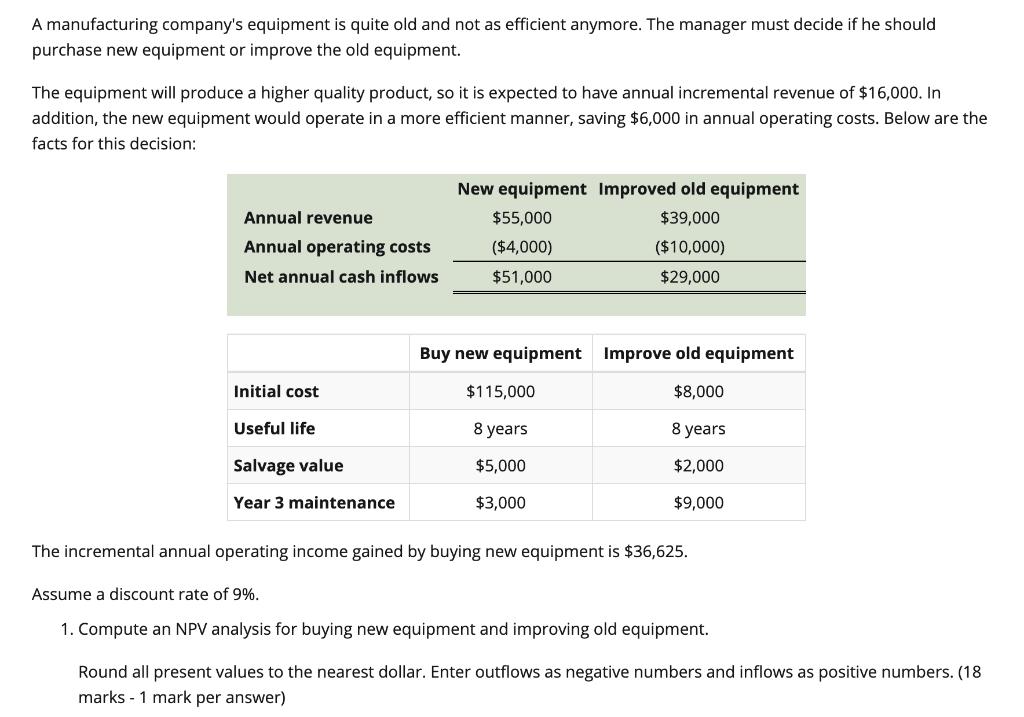

A manufacturing company's equipment is quite old and not as efficient anymore. The manager must decide if he should purchase new equipment or improve

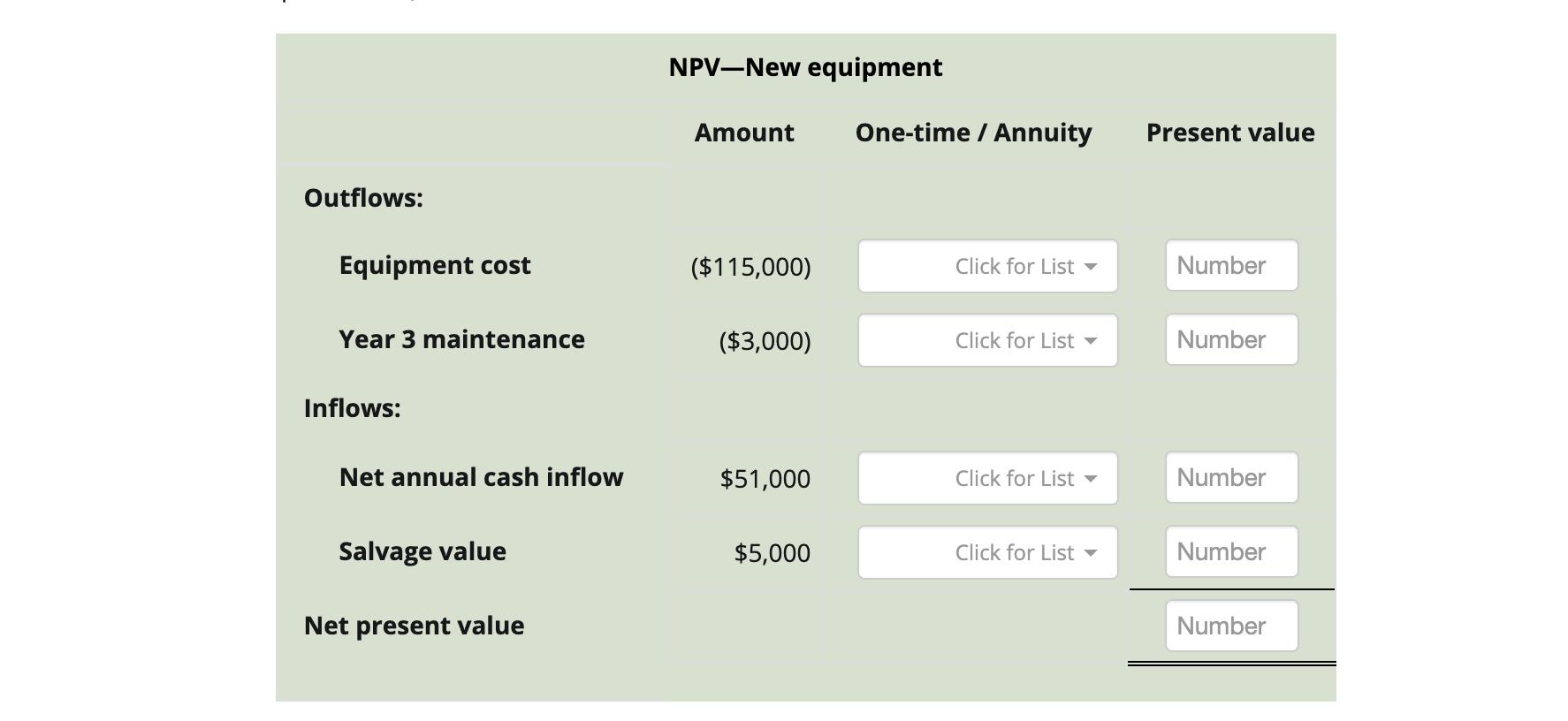

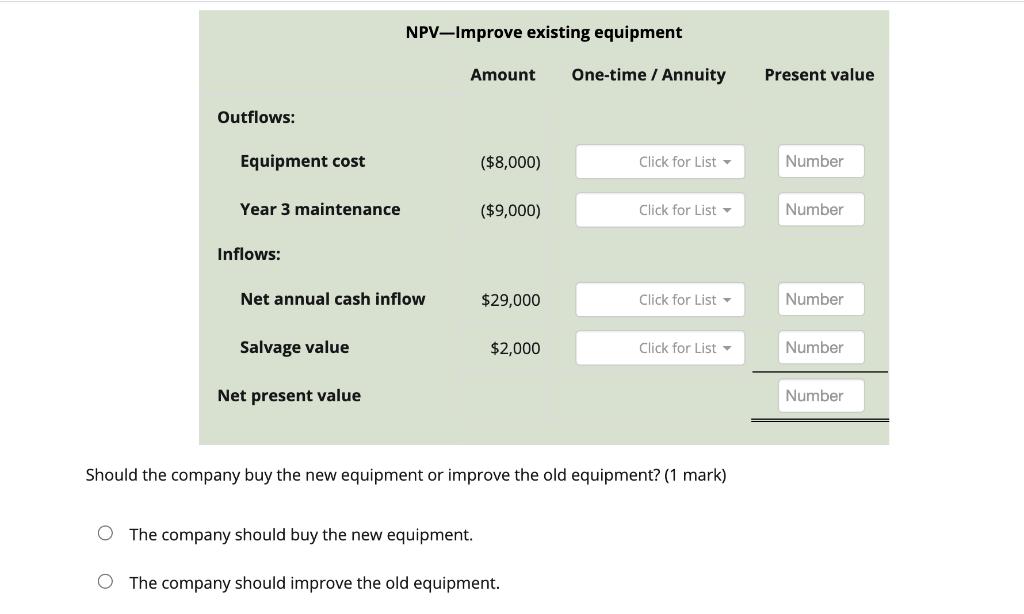

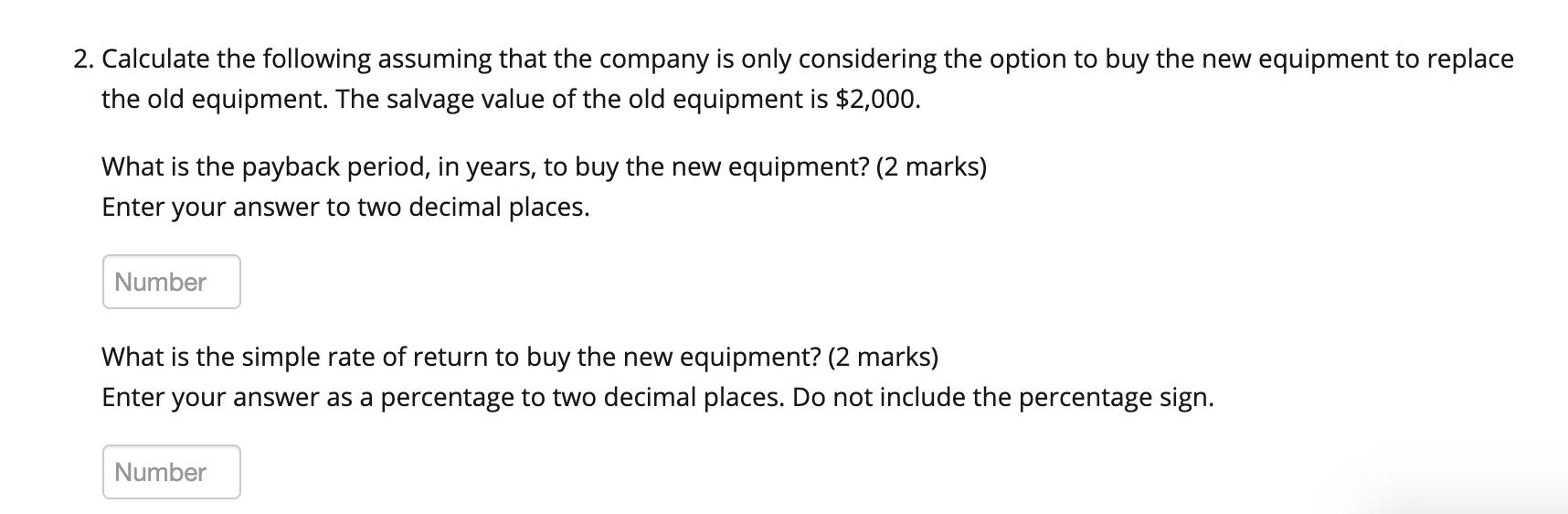

A manufacturing company's equipment is quite old and not as efficient anymore. The manager must decide if he should purchase new equipment or improve the old equipment. The equipment will produce a higher quality product, so it is expected to have annual incremental revenue of $16,000. In addition, the new equipment would operate in a more efficient manner, saving $6,000 in annual operating costs. Below are the facts for this decision: Annual revenue Annual operating costs Net annual cash inflows Initial cost Useful life Salvage value Year 3 maintenance New equipment Improved old equipment $39,000 ($10,000) $29,000 $55,000 ($4,000) $51,000 Buy new equipment $115,000 8 years $5,000 $3,000 Improve old equipment $8,000 8 years $2,000 $9,000 The incremental annual operating income gained by buying new equipment is $36,625. Assume a discount rate of 9%. 1. Compute an NPV analysis for buying new equipment and improving old equipment. Round all present values to the nearest dollar. Enter outflows as negative numbers and inflows as positive numbers. (18 marks 1 mark per answer) Outflows: Equipment cost Year 3 maintenance Inflows: Net annual cash inflow Salvage value Net present value NPV-New equipment Amount One-time / Annuity ($115,000) ($3,000) $51,000 $5,000 Click for List Click for List Click for List Click for List Present value Number Number Number Number Number Outflows: Equipment cost Year 3 maintenance Inflows: Net annual cash inflow Salvage value NPV-Improve existing equipment Net present value Amount ($8,000) ($9,000) $29,000 $2,000 One-time / Annuity The company should buy the new equipment. O The company should improve the old equipment. Click for List Click for List Click for List Click for List Should the company buy the new equipment or improve the old equipment? (1 mark) Present value Number Number Number Number Number 2. Calculate the following assuming that the company is only considering the option to buy the new equipment to replace the old equipment. The salvage value of the old equipment is $2,000. What is the payback period, in years, to buy the new equipment? (2 marks) Enter your answer to two decimal places. Number What is the simple rate of return to buy the new equipment? (2 marks) Enter your answer as a percentage to two decimal places. Do not include the percentage sign. Number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

NPV Analysis New Equipment Outflows Equipment cost 115000 Year 3 maintenance 3000 Inflows Net annual ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started