Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing plant buys a tool machine for 120,000 monetary units. Annual operating costs are equal to 4,000 monetary units. Gross income decreases by

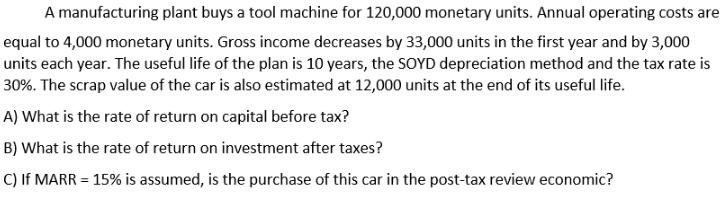

A manufacturing plant buys a tool machine for 120,000 monetary units. Annual operating costs are equal to 4,000 monetary units. Gross income decreases by 33,000 units in the first year and by 3,000 units each year. The useful life of the plan is 10 years, the SOYD depreciation method and the tax rate is 30%. The scrap value of the car is also estimated at 12,000 units at the end of its useful life. A) What is the rate of return on capital before tax? B) What is the rate of return on investment after taxes? C) If MARR = 15% is assumed, is the purchase of this car in the post-tax review economic?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the information and calculate the rate of return on capital before tax A the rate of return on investment after taxes B and evaluate w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started