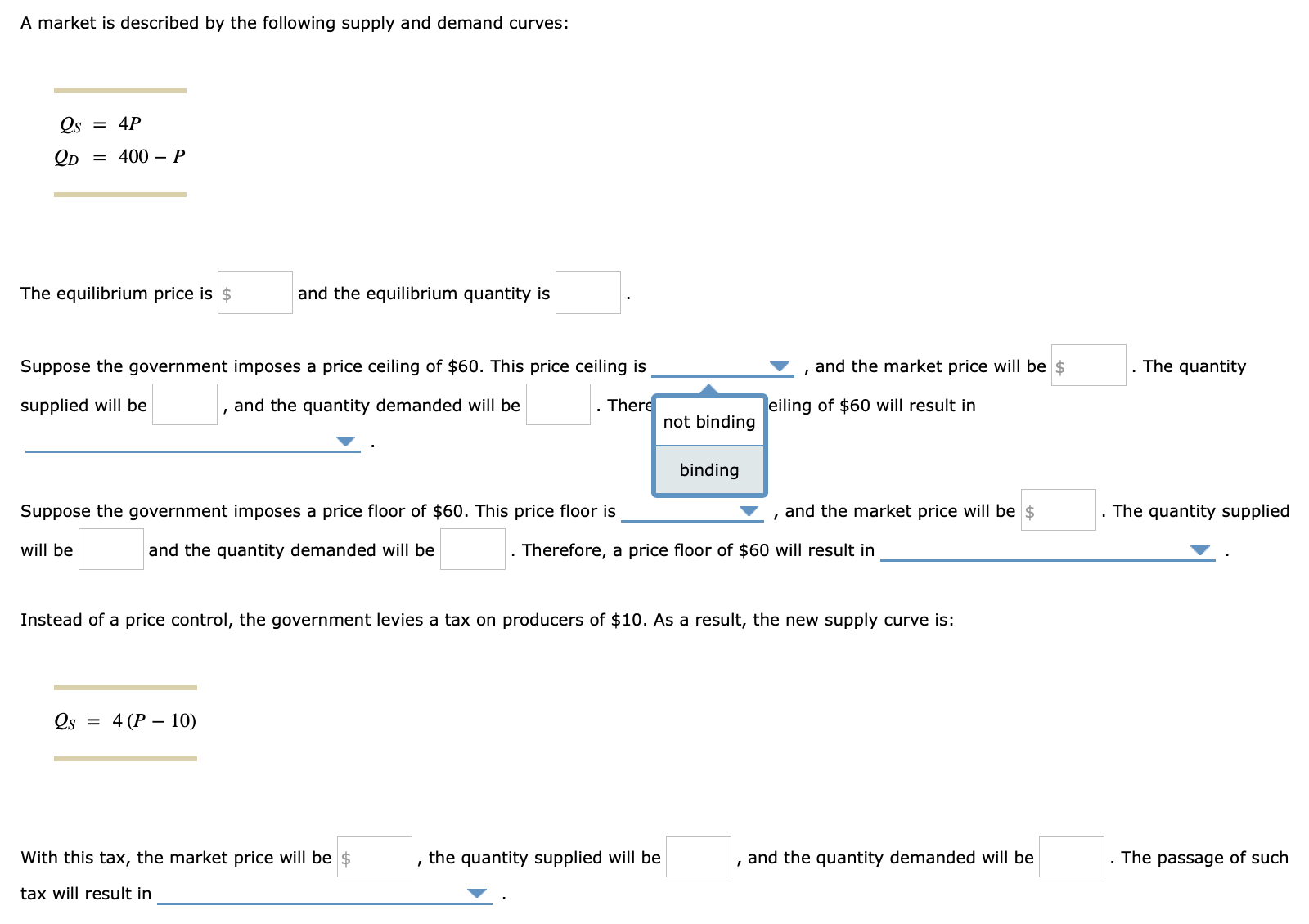

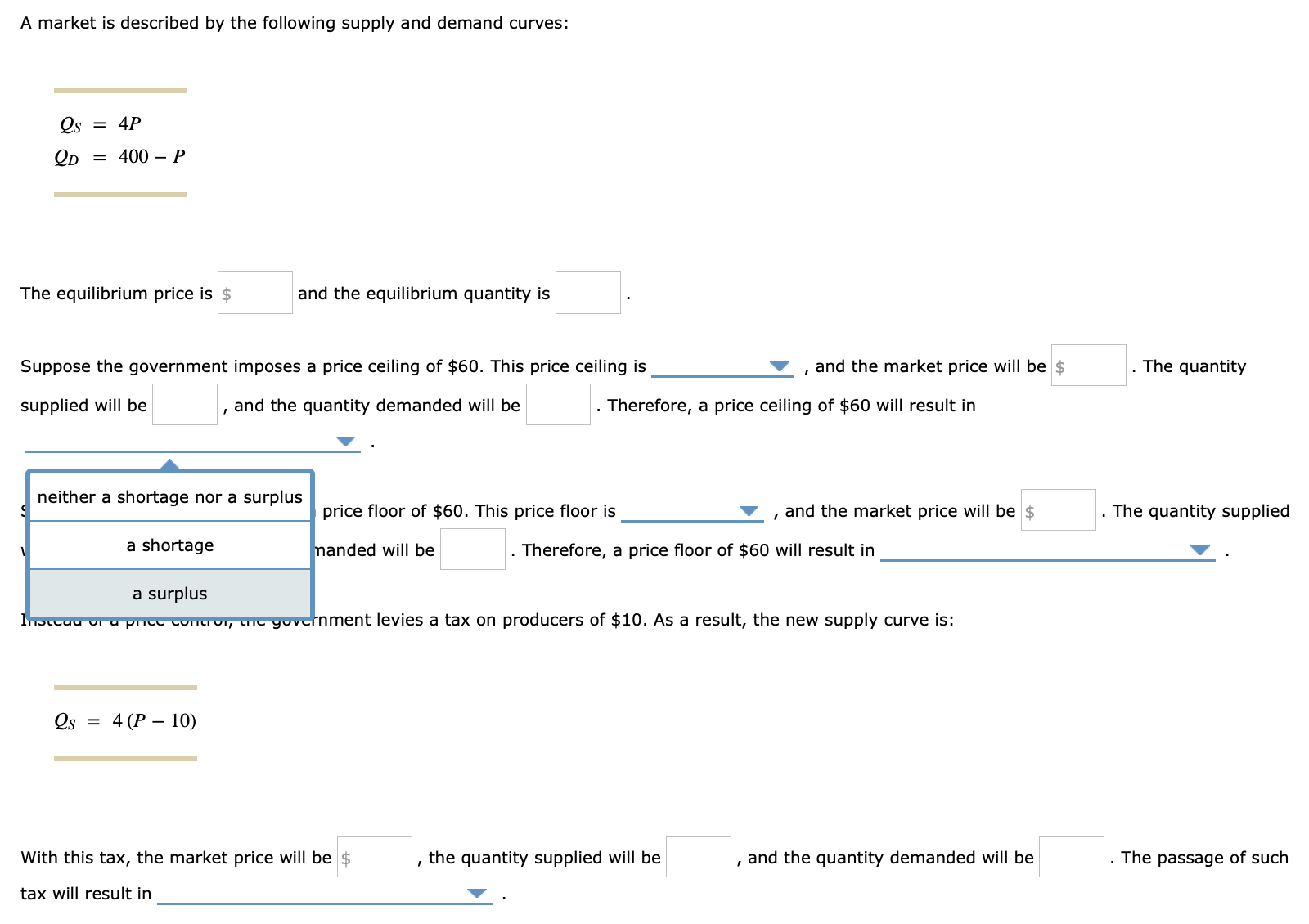

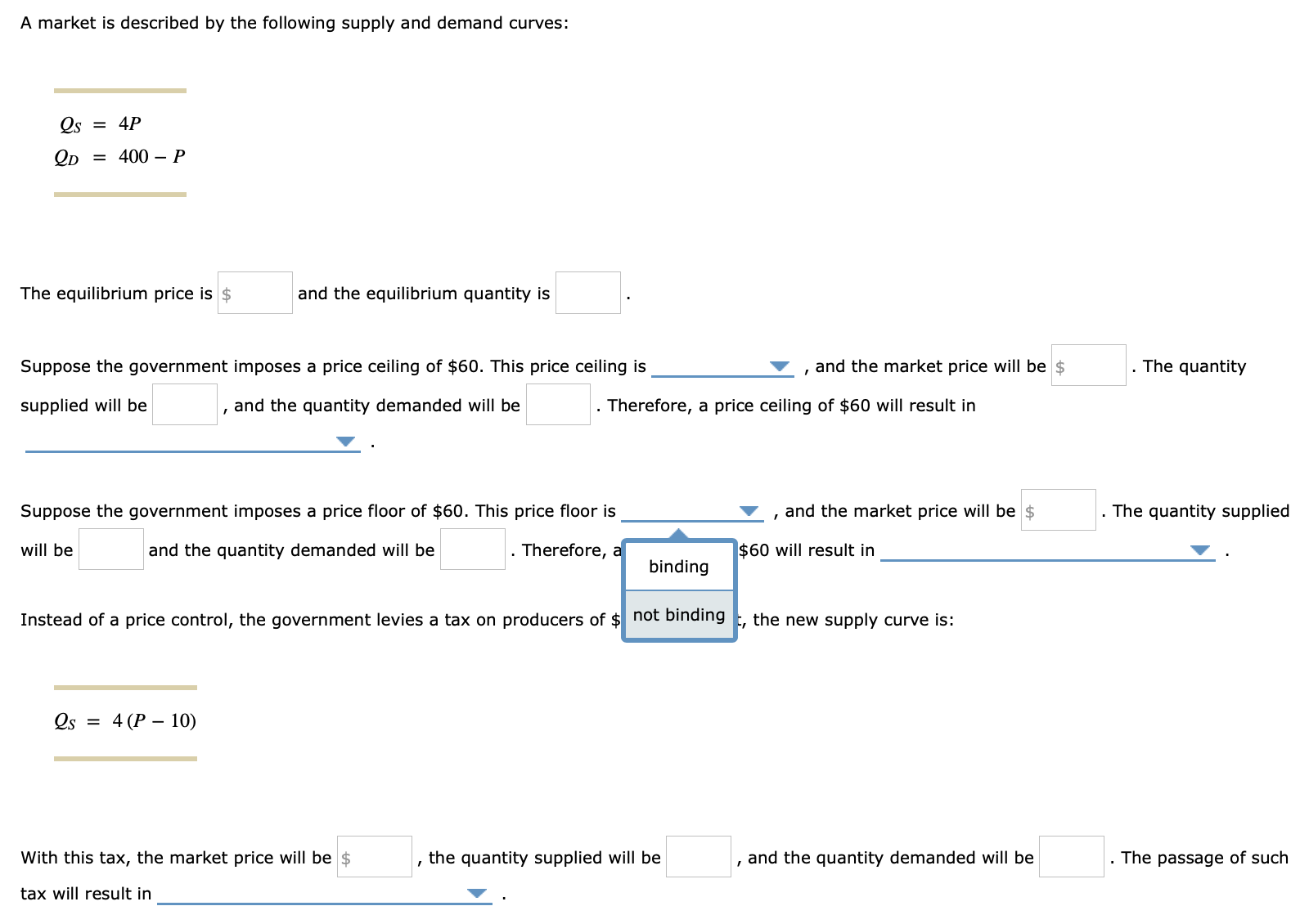

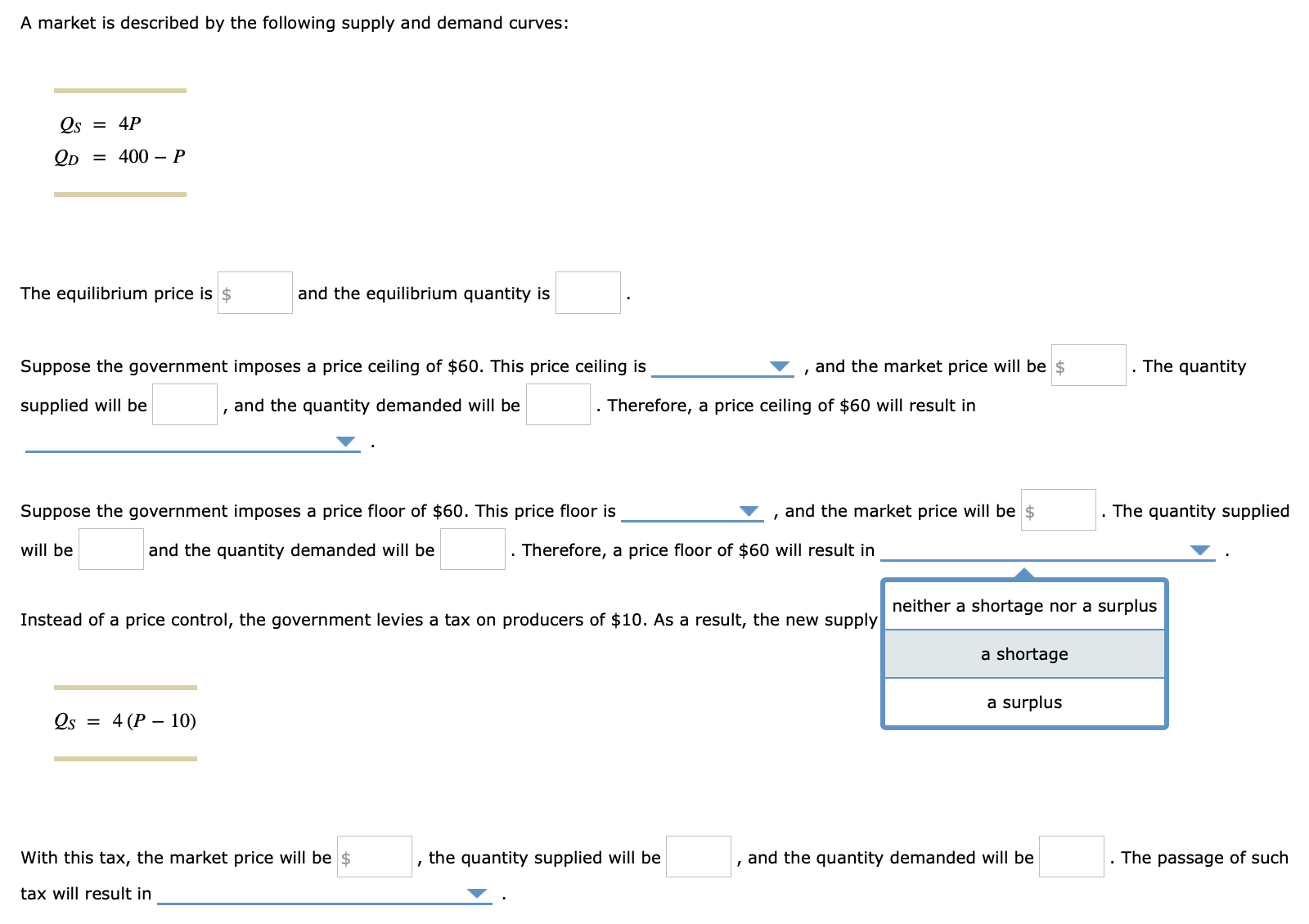

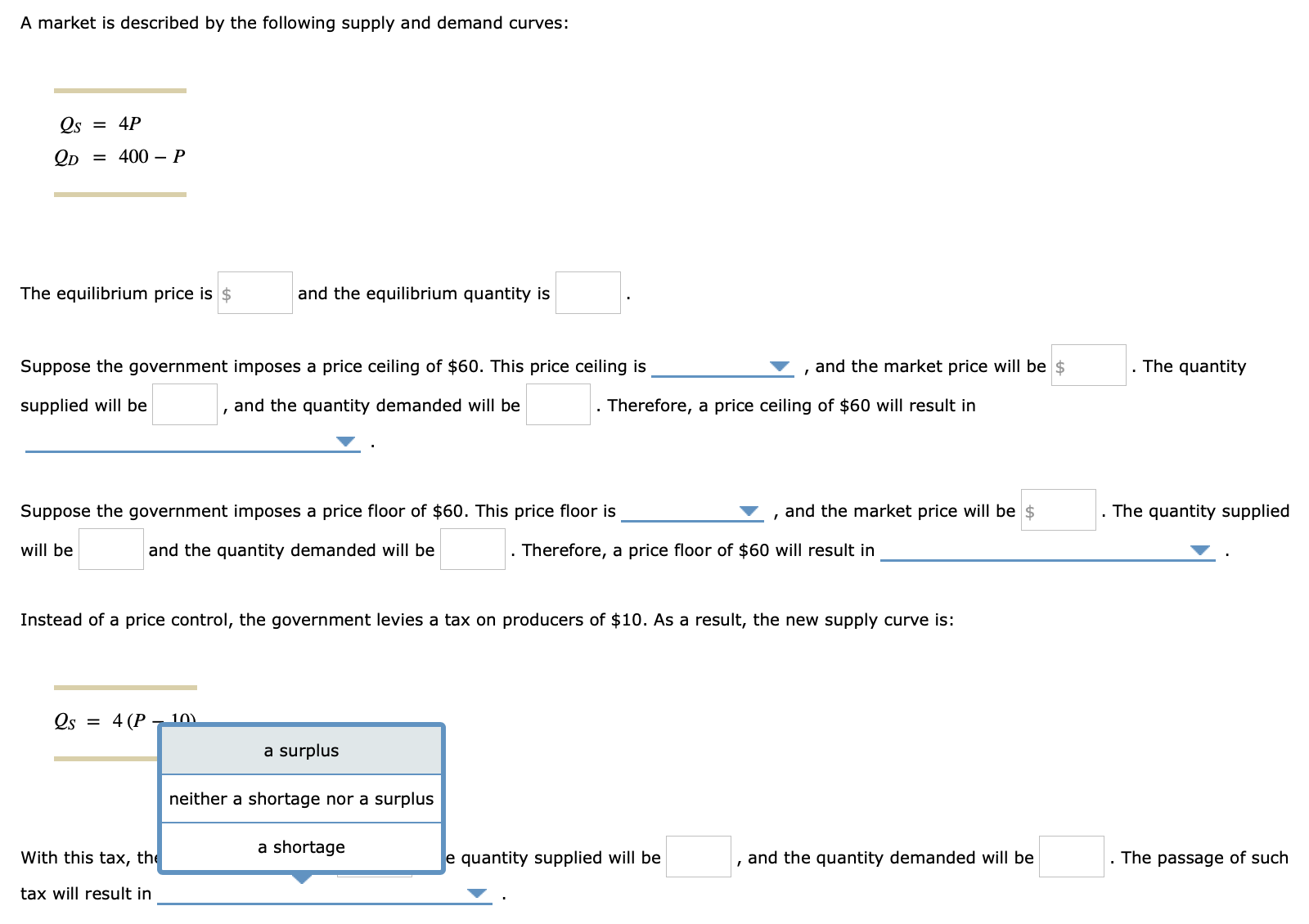

A market is described by the following supply and demand curves: 93 = 4P 9;, = 400 P The equilibrium price is $ and the equilibrium quantity is Suppose the government imposes a price ceiling of $60. This price ceiling is v , and the market price will be 51; . The quantity supplied will be , and the quantity demanded will be . The : eiling of $60 will result in not binding 7 . Suppose the government imposes a price floor of $60. This price oor is v , and the market price will be . The quantity supplied will be and the quantity demanded will be . Therefore, a price oor of $60 will result in v . Instead of a price control, the government levies a tax on producers of $10. As a result, the new supply curve is: Qs = 4(P-10J With this tax, the market price will be $ , the quantity supplied will be , and the quantity demanded will be . The passage of such tax will result in v . A market is described by the following supply and demand curves: Qs = 4P QD = 400 - P The equilibrium price is $ and the equilibrium quantity is Suppose the government imposes a price ceiling of $60. This price ceiling is , and the market price will be $ . The quantity supplied will be , and the quantity demanded will be . Therefore, a price ceiling of $60 will result in neither a shortage nor a surplus price floor of $60. This price floor is , and the market price will be $ . The quantity supplied a shortage anded will be . Therefore, a price floor of $60 will result in a surplus Inotcau or a price control, the government levies a tax on producers of $10. As a result, the new supply curve is: es = 4(P - 10) With this tax, the market price will be $ , the quantity supplied will be and the quantity demanded will be The passage of such tax will result inA market is described by the following supply and demand curves: 93 = 4P 9;, = 400 P The equilibrium price is $ and the equilibrium quantity is Suppose the government imposes a price ceiling of $60. This price ceiling is v , and the market price will be 51; . The quantity supplied will be , and the quantity demanded will be . Therefore, a price ceiling of $60 will result in v . Suppose the government imposes a price floor of $60. This price oor is v , and the market price will be . The quantity supplied will be and the quantity demanded will be . Therefore, - $60 will result in v . Instead of a price control, the government levies a tax on producers of $ "0t blndlng , the new supply curve is: Qs = 4(P-10J With this tax, the market price will be $ , the quantity supplied will be , and the quantity demanded will be . The passage of such tax will result in v . A market is described by the following supply and demand curves: Qs = 4P QD = 400 - P The equilibrium price is $ and the equilibrium quantity is Suppose the government imposes a price ceiling of $60. This price ceiling is , and the market price will be $ . The quantity supplied will be , and the quantity demanded will be . Therefore, a price ceiling of $60 will result in Suppose the government imposes a price floor of $60. This price floor is , and the market price will be $ . The quantity supplied will be and the quantity demanded will be . Therefore, a price floor of $60 will result in Instead of a price control, the government levies a tax on producers of $10. As a result, the new supply neither a shortage nor a surplus a shortage es = 4(P - 10) a surplus With this tax, the market price will be $ , the quantity supplied will be and the quantity demanded will be The passage of such tax will result inA market is described by the following supply and demand curves: 93 = 4P 9;, = 400 P The equilibrium price is $ and the equilibrium quantity is Suppose the government imposes a price ceiling of $60. This price ceiling is v , and the market price will be 51; . The quantity supplied will be , and the quantity demanded will be . Therefore, a price ceiling of $60 will result in 7 Suppose the government imposes a price floor of $60. This price oor is v , and the market price will be . The quantity supplied will be and the quantity demanded will be . Therefore, a price oor of $60 will result in v . Instead of a price control, the government levies a tax on producers of $10. As a result, the new supply curve is: Qs = 4(P a surplus neither a shortage nor a surplus a shortage With this tax, th - quantity supplied will be , and the quantity demanded will be . The passage of such tax will result in v