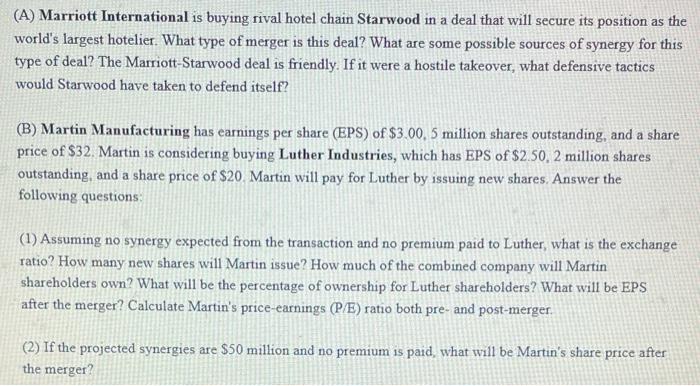

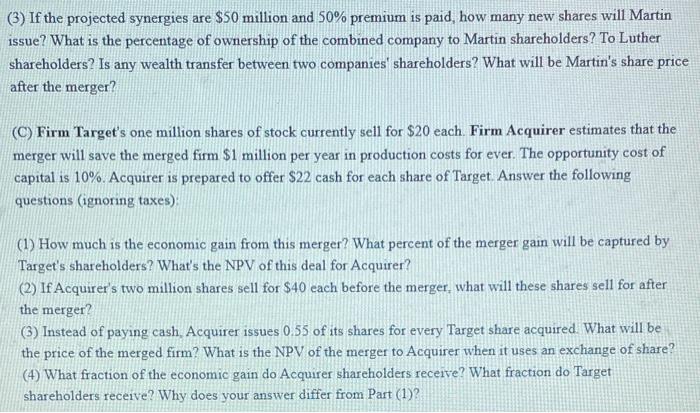

(A) Marriott International is buying rival hotel chain Starwood in a deal that will secure its position as the world's largest hotelier. What type of merger is this deal? What are some possible sources of synergy for this type of deal? The Marriott-Starwood deal is friendly. If it were a hostile takeover, what defensive tactics would Starwood have taken to defend itself? (B) Martin Manufacturing has earnings per share (EPS) of \$3.00, 5 million shares outstanding, and a share price of \$32. Martin is considering buying Luther Industries, which has EPS of $2.50.2 million shares outstanding, and a share price of $20. Martin will pay for Luther by issuing new shares. Answer the following questions: (1) Assuming no synergy expected from the transaction and no premium paid to Luther, what is the exchange ratio? How many new shares will Martin issue? How much of the combined company will Martin shareholders own? What will be the percentage of ownership for Luther shareholders? What will be EPS after the merger? Calculate Martin's price-earnings (P/E) ratio both pre- and post-merger. (2) If the projected synergies are $50 million and no premium is paid, what will be Martin's share price after the merger? (3) If the projected synergies are $50 million and 50% premium is paid, how many new shares will Martin issue? What is the percentage of ownership of the combined company to Martin shareholders? To Luther shareholders? Is any wealth transfer between two companies' shareholders? What will be Martin's share price after the merger? (C) Firm Target's one million shares of stock currently sell for $20 each. Firm Acquirer estimates that the merger will save the merged firm $1 million per year in production costs for ever. The opportunity cost of capital is 10%. Acquirer is prepared to offer $22 cash for each share of Target. Answer the following questions (ignoring taxes): (1) How much is the economic gain from this merger? What percent of the merger gain will be captured by Target's shareholders? What's the NPV of this deal for Acquirer? (2) If Acquirer's two million shares sell for $40 each before the merger, what will these shares sell for after the merger? (3) Instead of paying cash, Acquirer issues 0.55 of its shares for every Target share acquired. What will be the price of the merged firm? What is the NPV of the merger to Acquirer when it uses an exchange of share? (4) What fraction of the economic gain do Acquirer shareholders receive? What fraction do Target shareholders receive? Why does your answer differ from Part (1)