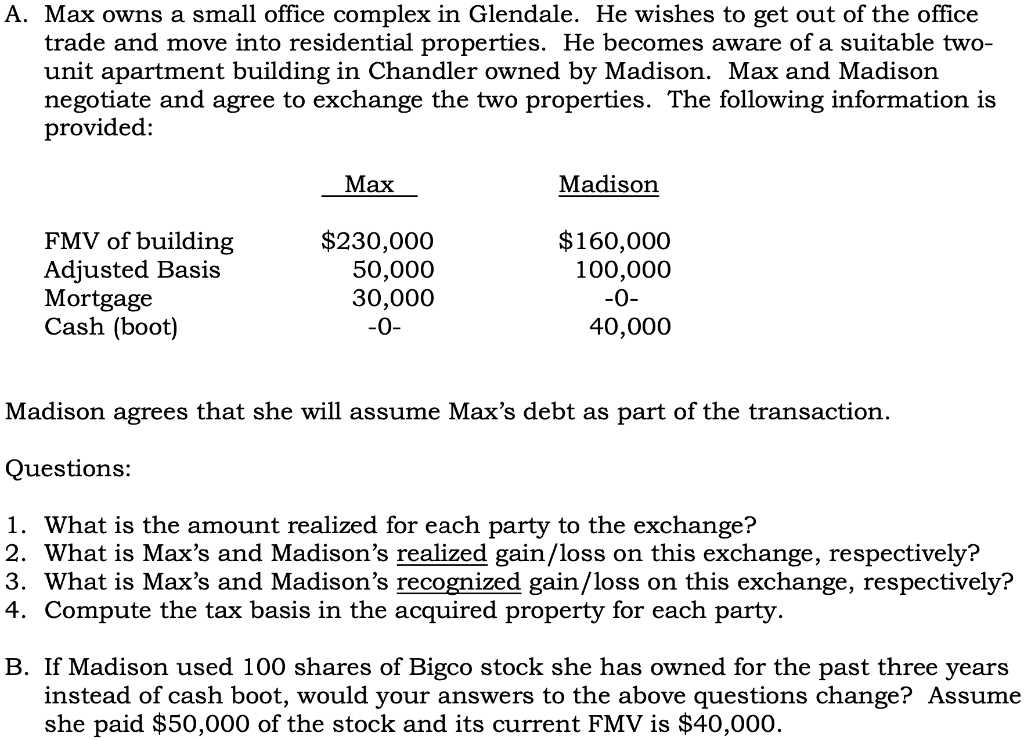

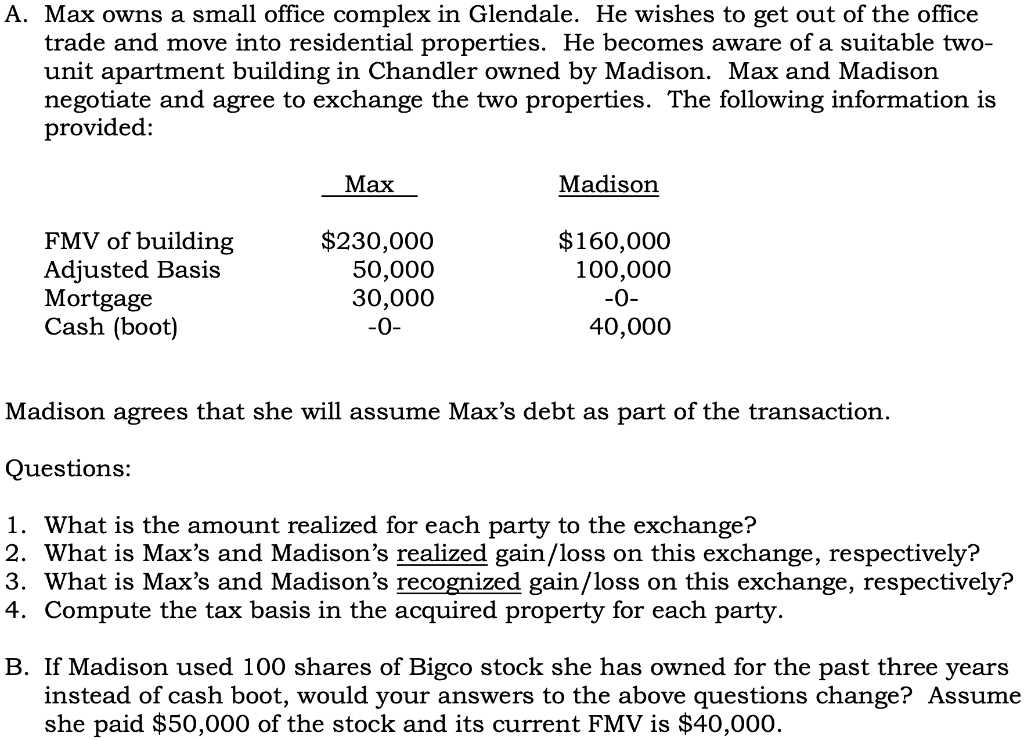

A. Max owns a small office complex in Glendale. He wishes to get out of the office trade and move into residential properties. He becomes aware of a suitable two- unit apartment building in Chandler owned by Madison. Max and Madison negotiate and agree to exchange the two properties. The following information is provided: Max Madison FMV of building Adjusted Basis Mortgage Cash (boot) $230,000 50,000 30,000 -0- $160,000 100,000 -0- 40,000 Madison agrees that she will assume Max's debt as part of the transaction. Questions: 1. What is the amount realized for each party to the exchange? 2. What is Max's and Madison's realized gain/loss on this exchange, respectively? 3. What is Max's and Madison's recognized gain/loss on this exchange, respectively? 4. Compute the tax basis in the acquired property for each party. B. If Madison used 100 shares of Bigco stock she has owned for the past three years instead of cash boot, would your answers to the above questions change? Assume she paid $50,000 of the stock and its current FMV is $40,000. A. Max owns a small office complex in Glendale. He wishes to get out of the office trade and move into residential properties. He becomes aware of a suitable two- unit apartment building in Chandler owned by Madison. Max and Madison negotiate and agree to exchange the two properties. The following information is provided: Max Madison FMV of building Adjusted Basis Mortgage Cash (boot) $230,000 50,000 30,000 -0- $160,000 100,000 -0- 40,000 Madison agrees that she will assume Max's debt as part of the transaction. Questions: 1. What is the amount realized for each party to the exchange? 2. What is Max's and Madison's realized gain/loss on this exchange, respectively? 3. What is Max's and Madison's recognized gain/loss on this exchange, respectively? 4. Compute the tax basis in the acquired property for each party. B. If Madison used 100 shares of Bigco stock she has owned for the past three years instead of cash boot, would your answers to the above questions change? Assume she paid $50,000 of the stock and its current FMV is $40,000