Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Michael bought shares of Apple Inc. on NASDAQ in the US one year ago for USD 90. Today, the share price is USD

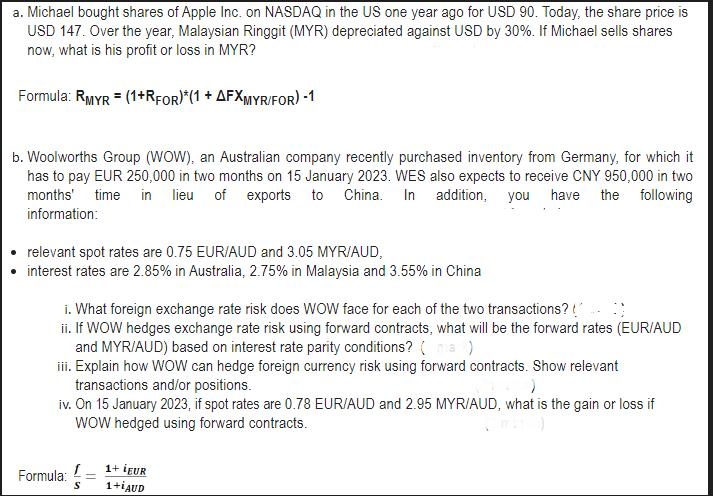

a. Michael bought shares of Apple Inc. on NASDAQ in the US one year ago for USD 90. Today, the share price is USD 147. Over the year, Malaysian Ringgit (MYR) depreciated against USD by 30%. If Michael sells shares now, what is his profit or loss in MYR? Formula: RMYR = (1+RFOR)*(1 + AFXMYR/FOR) -1 b. Woolworths Group (WOW), an Australian company recently purchased inventory from Germany, for which it has to pay EUR 250,000 in two months on 15 January 2023. WES also expects to receive CNY 950,000 in two months' time in lieu of exports to China. In addition, you have the following information: relevant spot rates are 0.75 EUR/AUD and 3.05 MYR/AUD, interest rates are 2.85% in Australia, 2.75% in Malaysia and 3.55% in China i. What foreign exchange rate risk does WOW face for each of the two transactions? ii. If WOW hedges exchange rate risk using forward contracts, what will be the forward rates (EUR/AUD and MYR/AUD) based on interest rate parity conditions? (ma) iii. Explain how WOW can hedge foreign currency risk using forward contracts. Show relevant transactions and/or positions. iv. On 15 January 2023, if spot rates are 0.78 EUR/AUD and 2.95 MYR/AUD, what is the gain or loss if WOW hedged using forward contracts. Formula: S 1+ IEUR 1+LAUD

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Michael bought Apple shares 1 year ago for USD 90 Current share price is USD 147 MYR depreciated a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started