Answered step by step

Verified Expert Solution

Question

1 Approved Answer

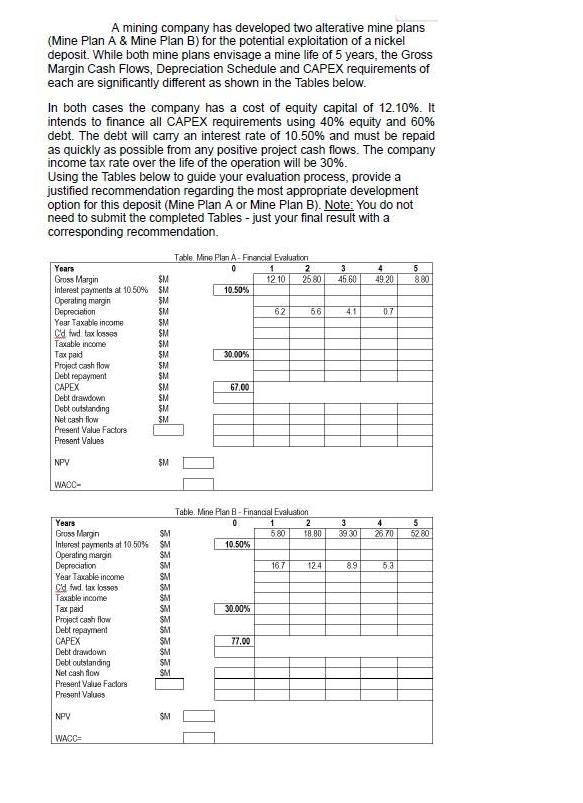

A mining company has developed two alterative mine plans (Mine Plan A & Mine Plan B) for the potential exploitation of a nickel deposit.

A mining company has developed two alterative mine plans (Mine Plan A & Mine Plan B) for the potential exploitation of a nickel deposit. While both mine plans envisage a mine life of 5 years, the Gross Margin Cash Flows, Depreciation Schedule and CAPEX requirements of each are significantly different as shown in the Tables below. In both cases the company has a cost of equity capital of 12.10%. It intends to finance all CAPEX requirements using 40% equity and 60% debt. The debt will carry an interest rate of 10.50% and must be repaid as quickly as possible from any positive project cash flows. The company income tax rate over the life of the operation will be 30%. Using the Tables below to guide your evaluation process, provide a justified recommendation regarding the most appropriate development option for this deposit (Mine Plan A or Mine Plan B). Note: You do not need to submit the completed Tables - just your final result with a corresponding recommendation. Years Gross Margin $M Interest payments at 10.50% SM Operating margin $M Depreciation Year Taxable income Cd fwd tax losse9 Taxable income Tax paid Project cash flow Debt repayment CAPEX Debt drawdown Debt outstanding Net cash flow Present Value Factors Present Values NPV WACC- SM SM $M SM $M Year Taxable income Cd fwd, tax losses Taxable income Tax paid Project cash flow Debt repayment CAPEX Debt drawdown Debt outstanding Net cash flow Present Value Factors Present Values NPV WACC= SM $M SM $M $M SM $M Years Gross Margin SM Interest payments at 10.50% $M SM Operating margin Depreciation SM SM SM SM SM SM SM SM SM SM SM SM Table Mine Plan A-Financial Evaluation 0 10.50% 30.00% 67,00 0 Table. Mine Plan B-Finanaal Evaluation 10.50% 30.00% 1 3 2 4 12.10 25.80 45.60 49.20 77.00 62 1 5.80 16.7 5.6 2 18.80 124 4.1 3 39.30 0.7 4 26 70 8.9 5.3 5 8.80 5 52 80

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

the calculati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started