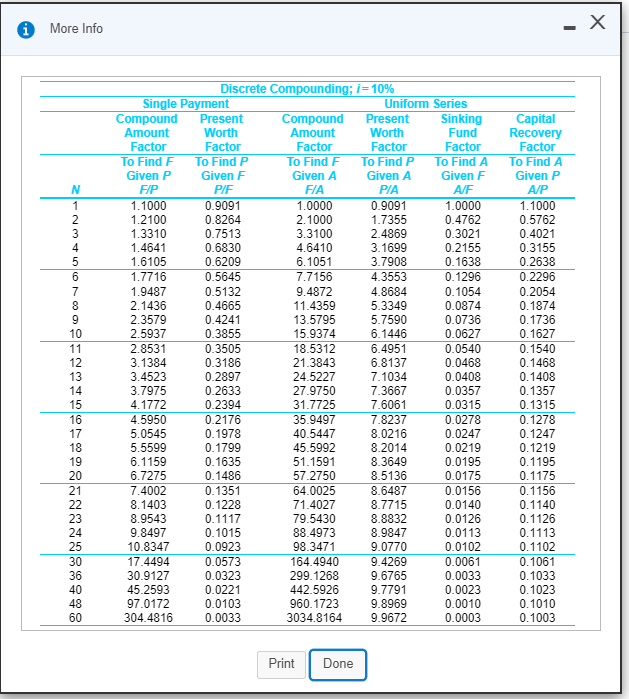

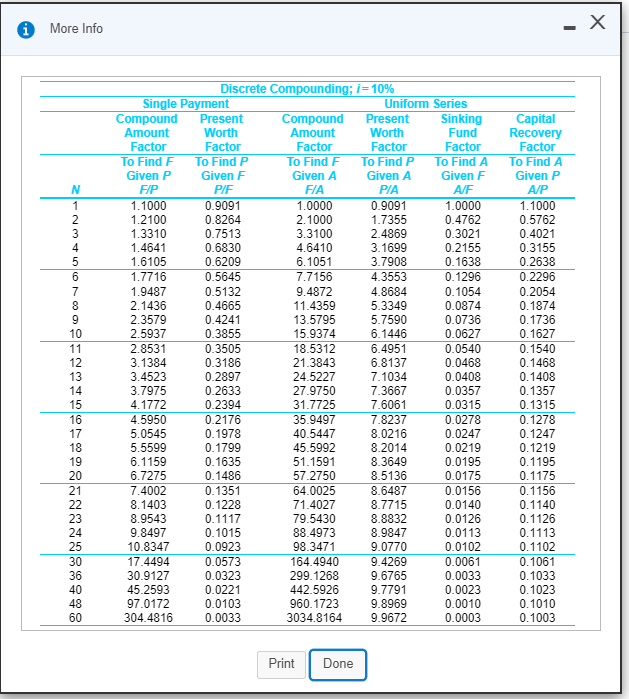

A mining investment is more likely to generate revenues of $600,000 per year for the next 10 years of service life. However, the investors think that there is a possibility that the revenues could be as high as $840,000 per year or as low $240,000 per year. The investors' MARR is 10% per year. Answer the following two questions: Click the icon to view the interest and annuity table for discrete compounding when i = 10% per month. 1 Calculate the PW based on the pessimistic estimate of the net annual revenues. O A. $3.56 Million O B. $3.44 Million OC. $1.47 Million O D. $3.69 Million O E. $5. 16 Million 2. Calculate the PW based on the expected net annual revenues calculated using the three-point estimation technique. O A. $5. 16 Million O B. $1.47 Million O C. $3.44 Million OD. $3.69 Million O E. $3.56 Million i More Info Discrete Compounding; 1= 10% Single Payment Uniform Series Compound Present Compound Present Sinking Amount Worth Amount Worth Fund Factor Factor Factor Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F F/P P/F FIA PIA A/F 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 5.5599 0.1799 45.5992 8.2014 0.0219 6.1159 0.1635 51.1591 8.3649 0.0195 6.7275 0.1486 57 2750 8.5136 0.0175 7.4002 0.1351 64.0025 8.6487 0.0156 8.1403 0.1228 71.4027 8.7715 0.0140 8.9543 0.1117 79.5430 8.8832 0.0126 9.8497 0.1015 88.4973 8.9847 0.0113 10.8347 0.0923 98.3471 9.0770 0.0102 17.4494 0.0573 164.4940 9.4269 0.0061 30.9127 0.0323 299.1268 9.6765 0.0033 45.2593 0.0221 442.5926 9.7791 0.0023 97.0172 0.0103 960.1723 9.8969 0.0010 304.4816 0.0033 3034.8164 9.9672 0.0003 Capital Recovery Factor To Find A Given P A/P 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.1156 0.1140 0.1126 0.1113 0.1102 0.1061 0.1033 0.1023 0.1010 0.1003 Print Done