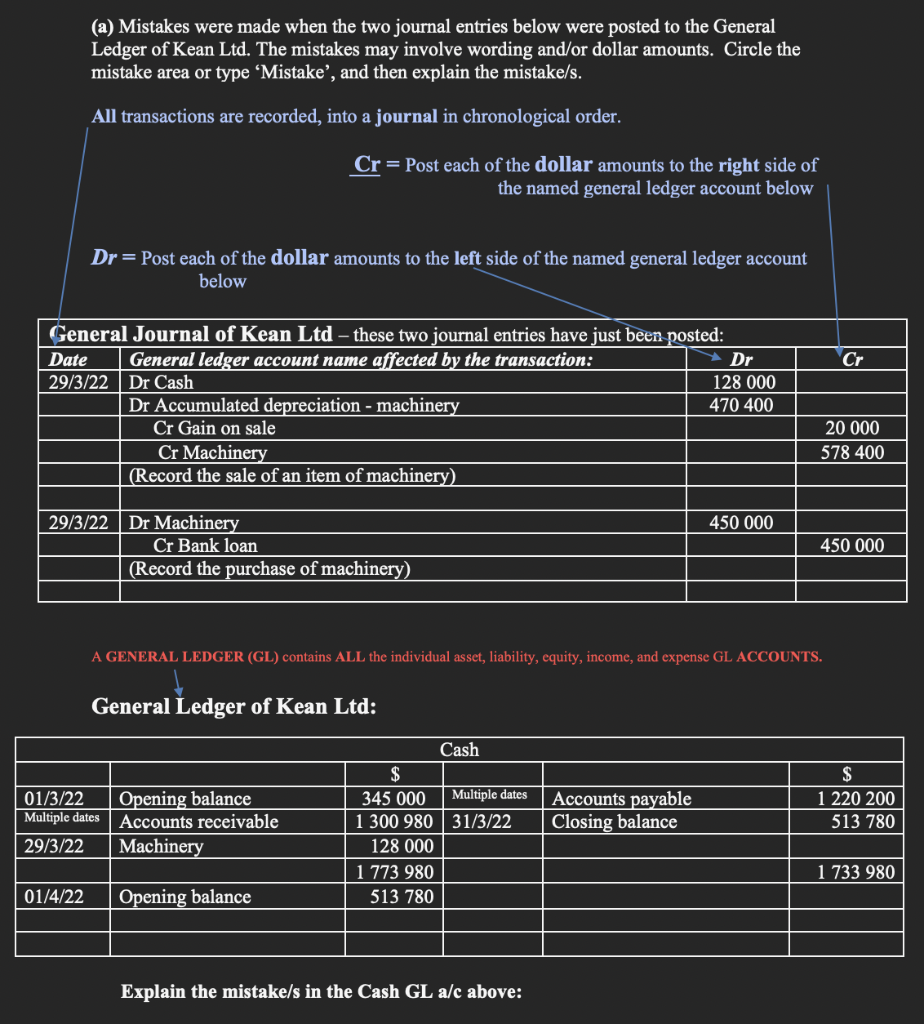

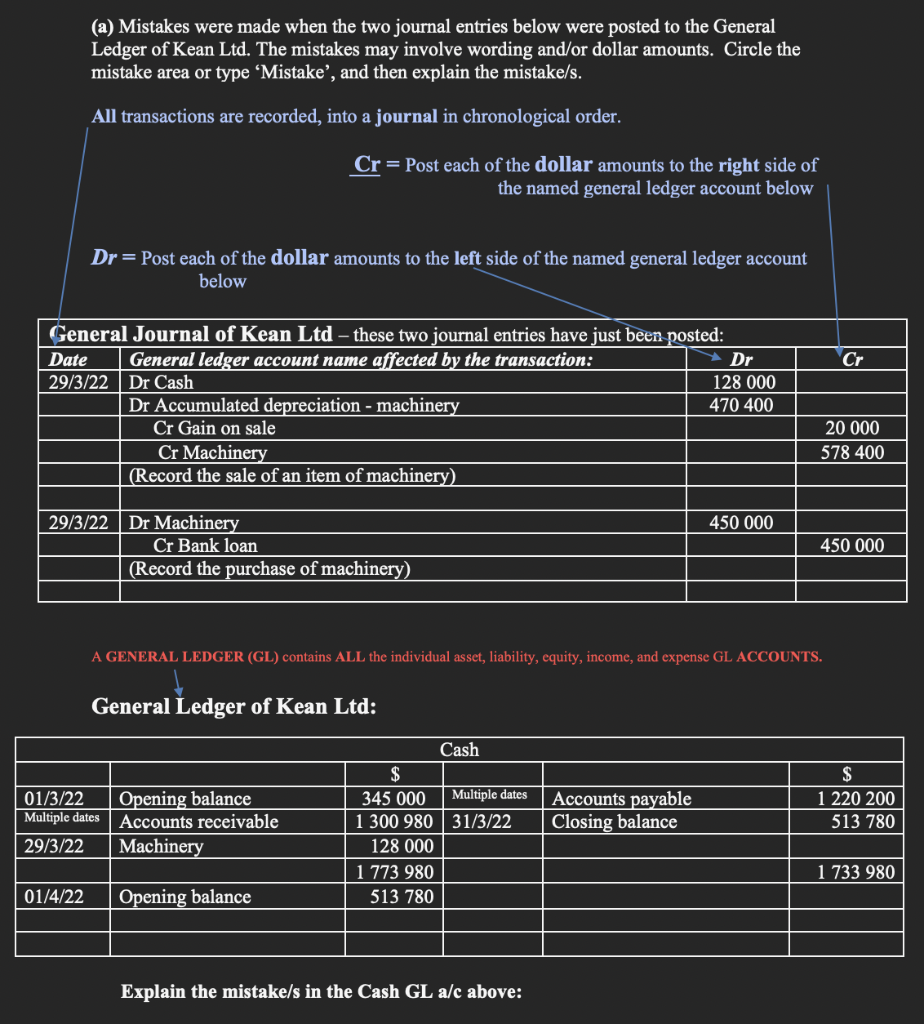

(a) Mistakes were made when the two journal entries below were posted to the General Ledger of Kean Ltd. The mistakes may involve wording and/or dollar amounts. Circle the mistake area or type Mistake, and then explain the mistake/s.

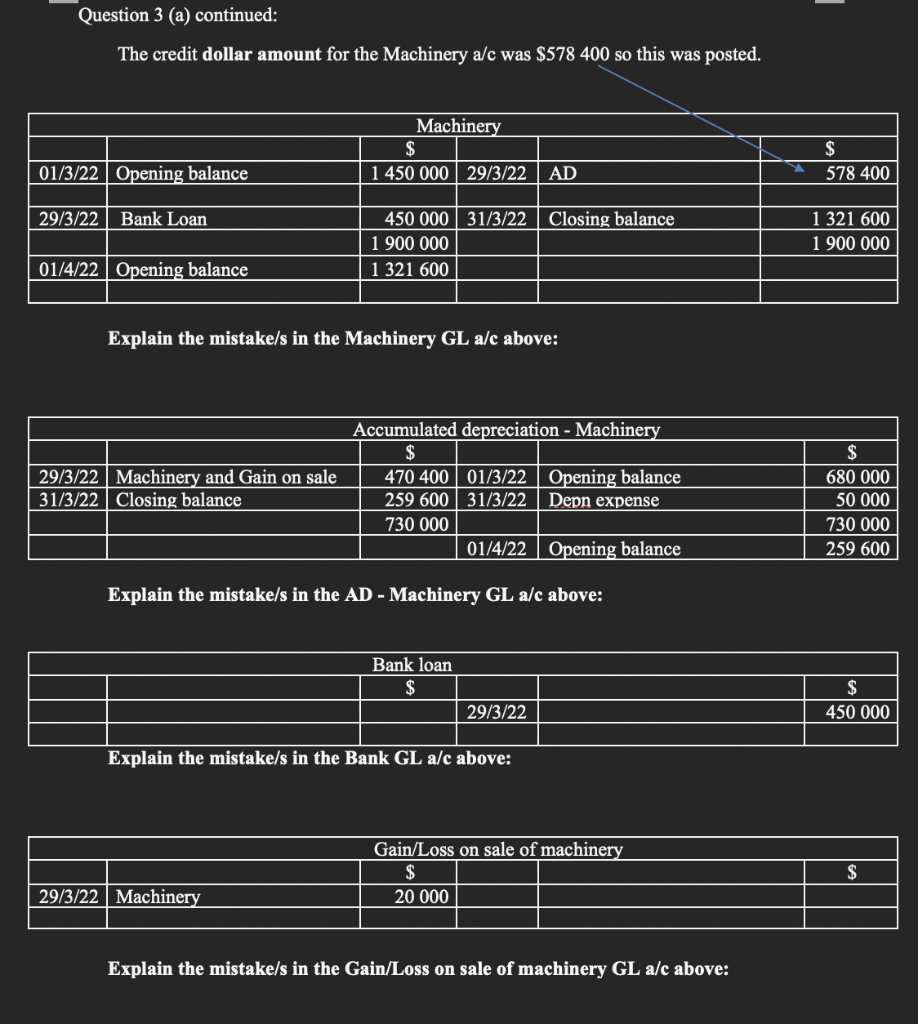

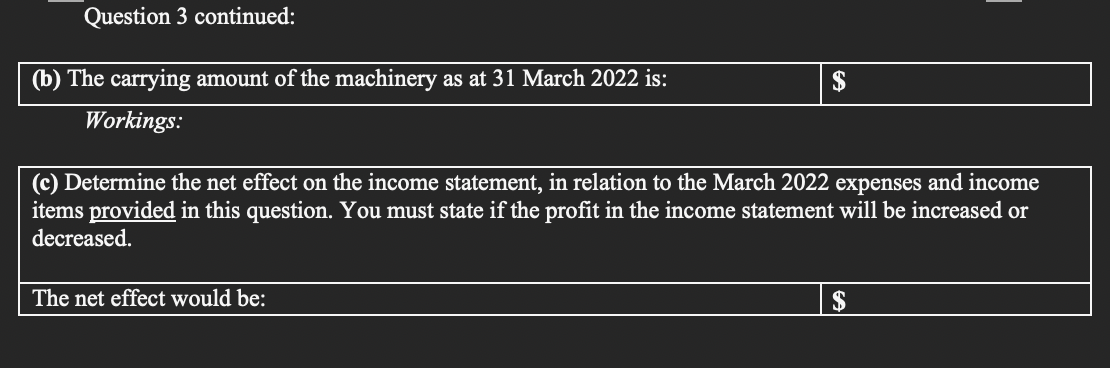

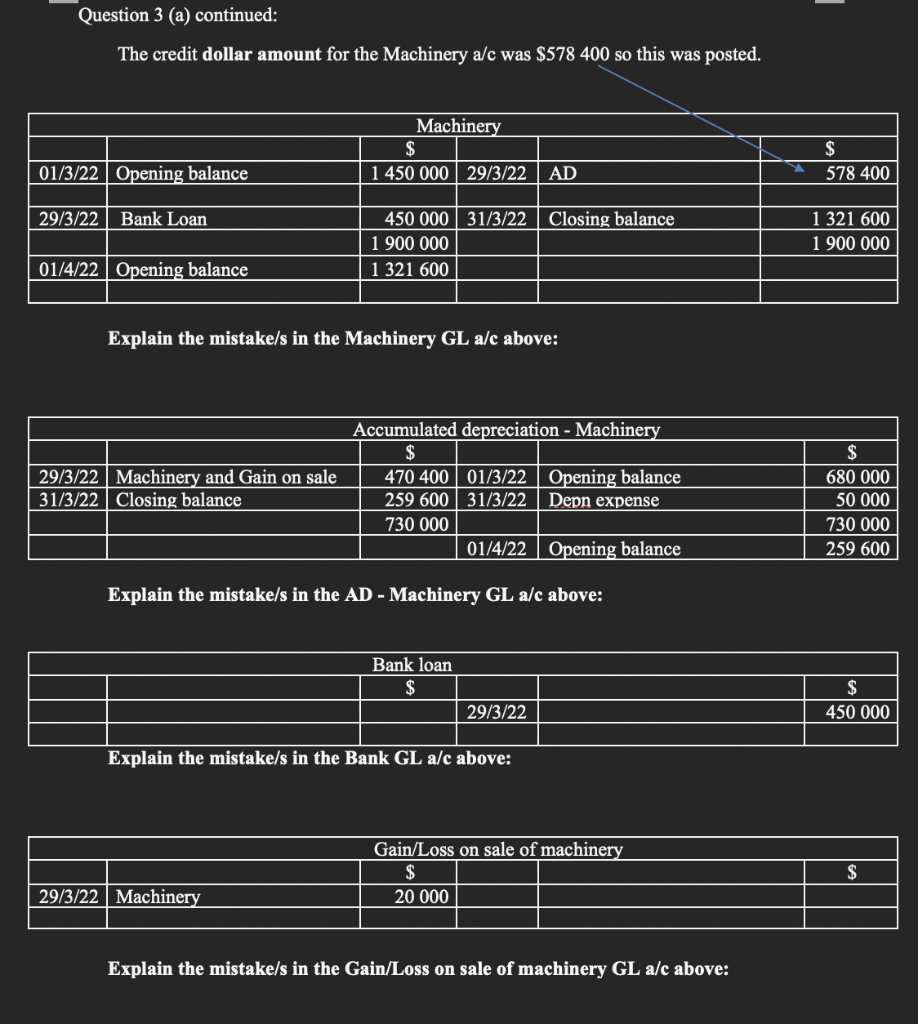

(a) Mistakes were made when the two journal entries below were posted to the General Ledger of Kean Ltd. The mistakes may involve wording and/or dollar amounts. Circle the mistake area or type Mistake', and then explain the mistake/s. All transactions are recorded, into a journal in chronological order. Cr = Post each of the dollar amounts to the right side of the named general ledger account below Dr = Post each of the dollar amounts to the left side of the named general ledger account below Dr Cr General Journal of Kean Ltd - these two journal entries have just been posted: Date General ledger account name affected by the transaction: 29/3/22 ) Dr Cash 128 000 Dr Accumulated depreciation - machinery 470 400 Cr Gain on sale Cr Machinery (Record the sale of an item of machinery) 20 000 578 400 450 000 29/3/22 Dr Machinery Cr Bank loan (Record the purchase of machinery) 450 000 A GENERAL LEDGER (GL) contains ALL the individual asset, liability, equity, income, and expense GL ACCOUNTS. General Ledger of Kean Ltd: 01/3/22 Multiple dates 29/3/22 Opening balance Accounts receivable Machinery Cash $ 345 000 Multiple dates 1 300 98031/3/22 128 000 1 773 980 513 780 Accounts payable Closing balance $ 1 220 200 513 780 1 733 980 01/4/22 Opening balance Explain the mistake/s in the Cash GL a/c above: Question 3 (a) continued: The credit dollar amount for the Machinery a/c was $578 400 so this was posted. Machinery $ 578 400 01/3/22 Opening balance 1 450 000 29/3/22 AD 29/3/22 Bank Loan 450 000 31/3/22 Closing balance 1 900 000 1 321 600 1 321 600 1 900 000 01/4/22 Opening balance Explain the mistake/s in the Machinery GL a/c above: Accumulated depreciation - Machinery 29/3/22 Machinery and Gain on sale 31/3/22 Closing balance 470 400 01/3/22 Opening balance 259 600 31/3/22 Depn expense 730 000 01/4/22 Opening balance $ 680 000 50 000 730 000 259 600 Explain the mistake/s in the AD - Machinery GL a/c above: Bank loan $ $ 450 000 29/3/22 Explain the mistake/s in the Bank GL a/c above: Gain/Loss on sale of machinery $ 20 000 $ 29/3/22 Machinery Explain the mistake/s in the Gain/Loss on sale of machinery GL a/c above: Question 3 continued: $ (b) The carrying amount of the machinery as at 31 March 2022 is: Workings: (c) Determine the net effect on the income statement, in relation to the March 2022 expenses and income items provided in this question. You must state if the profit in the income statement will be increased or decreased. The net effect would be: $