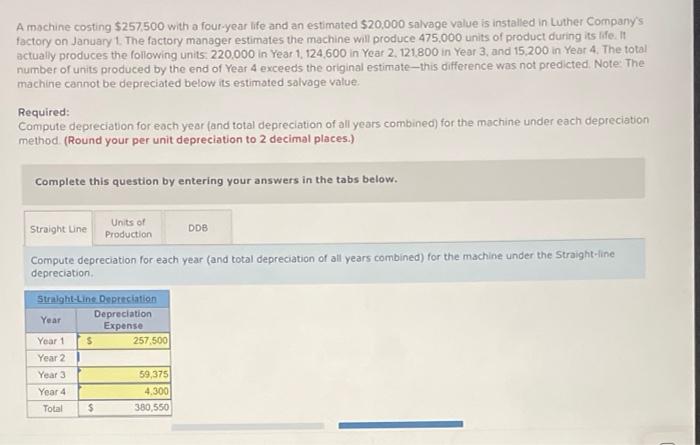

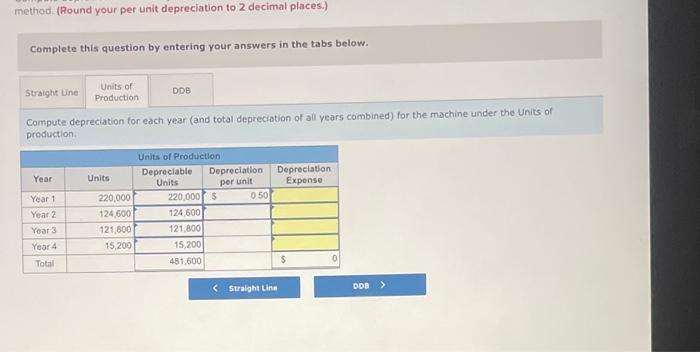

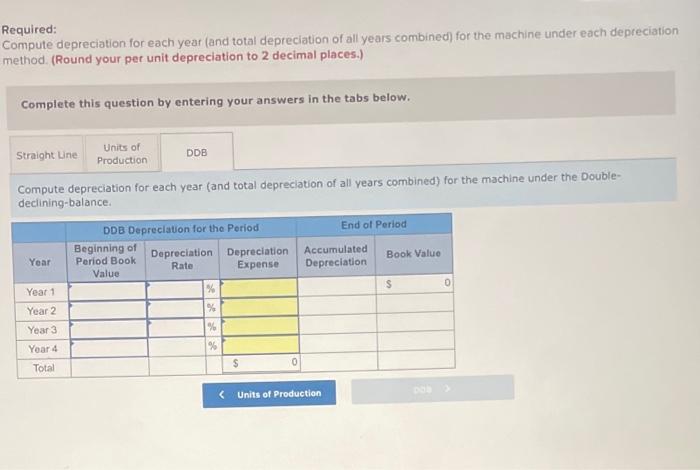

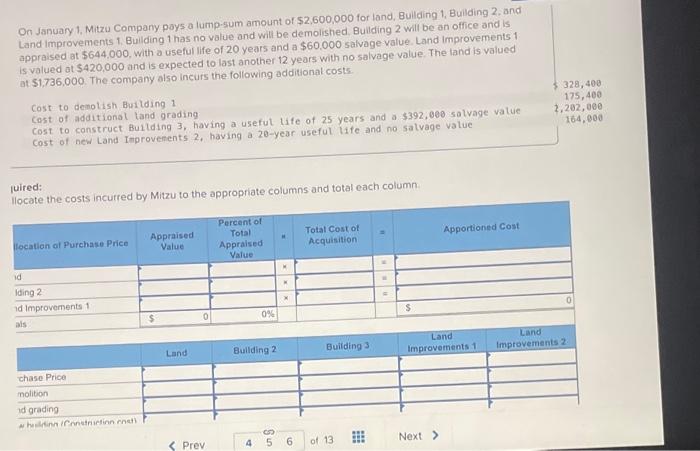

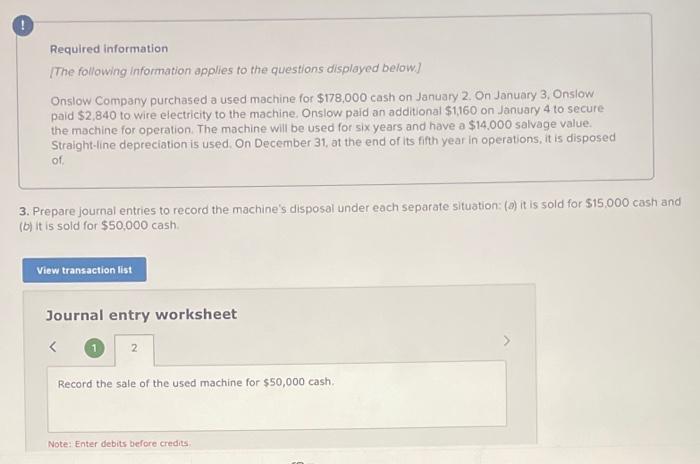

A mochine costing $257,500 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 475,000 units of product during its iffe. If actually produces the following units, 220,000 in Year 1, 124,600 in Year 2, 121,800 in Year 3, and 15,200 in Year 4, The total number of units produced by the end of Year 4 exceeds the original estimate - this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Campute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places.) Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line depreciation. method (Round your per unit depreciation to 2 decimal places.) Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Units of production. tequired: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation nethod. (Round your per unit depreciation to 2 decimal places.) Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Doubledeclining-balance. On January 1, Mitzu Company poys a lump-5um amount of $2,600,000 for land, Bullding 1, Buisding 2, and Land improvements 1. Building 1 has no value and will be demolished, Bulding 2 will be an office and is appraised at $644,000, with a useful life of 20 years and a $60,000 salvage value. Land improvements 1 is valued at $420,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,736,000. The company also incurs the following additional costs. Cost to denolish Buitding 1 cost of additional tand grading Cost to construct Bultding 3, having a useful tife of 25 years and a $392,000 salvage value Cost of new Land improvenents 2, having a 20-year useful iffe and no salvage value juired: Ilocate the costs incurred by Mitzu to the appropriate columns and total each column Required information [The following information applies to the questions displayed below] Onslow Company purchased a used machine for $178,000 cash on January 2. On January 3, Onslow paid \$2,840 to wire electricity to the machine, Onslow paid an additional $1,160 on January 4 to secure the machine for operation. The machine will be used for six years and have a $14,000 salvage value. Straight-line depreciation is used. On December 31, at the end of its fifth year in operations, it is disposed of Prepare joumal entries to record the machine's disposal under each separate situation: (a) it is sold for $15,000 cash and it is sold for $50,000 cash. Journal entry worksheet Record the sale of the used machine for $50,000 cash. Note: Enter debits before credits