Question

A money demand function is defined as follows: Where M1 is the narrow money supply, GDP is real GDP, RS is the interest rate and

A money demand function is defined as follows:

Where M1 is the narrow money supply, GDP is real GDP, RS is the interest rate and PR is the rate of inflation

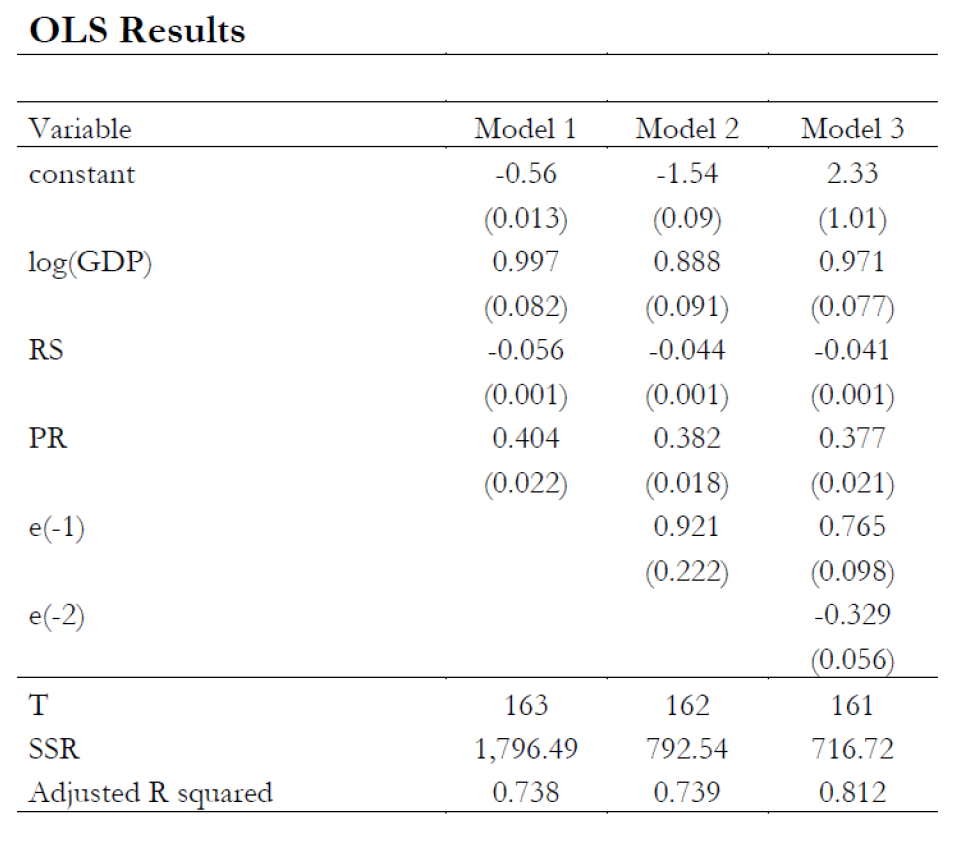

The model was estimated using quarterly data for the United States over the period

1952:1-1992:4 (T=163 observations) and using two different specifications: Specification 1

assumes the model suers autocorrelation AR(1) and Specification 2 assumes the structure

in the error terms following AR(2) process. The following table shows estimation results:

Note that the dependent variable in Model 1 is log(M1) and the dependent variable in

Models 2 and 3 are the estimation residuals of Model 1.

(a) (6 points) Test for autocorrelation using Model 2 at 1% significance level.

(b) (6 points) Test for autocorrelation using Model 3 at 1% significance level.

(c) (6 points) Explain the conclusion you arrive at with regard to the serial correlation

in our money demand function.

OLS Results Variable constant log(GDP) Model 1 -0.56 (0.013) 0.997 (0.082) -0.056 (0.001) 0.404 (0.022) RS Model 2 -1.54 (0.09) 0.888 (0.091) -0.044 (0.001) 0.382 (0.018) 0.921 (0.222) Model 3 2.33 (1.01) 0.971 (0.077) -0.041 (0.001) 0.377 (0.021) 0.765 (0.098) -0.329 (0.056 161 PR e(-1) e(-2) T SSR Adjusted R squared 163 1,796.49 0.738 162 792.54 0.739 716.72 0.812 OLS Results Variable constant log(GDP) Model 1 -0.56 (0.013) 0.997 (0.082) -0.056 (0.001) 0.404 (0.022) RS Model 2 -1.54 (0.09) 0.888 (0.091) -0.044 (0.001) 0.382 (0.018) 0.921 (0.222) Model 3 2.33 (1.01) 0.971 (0.077) -0.041 (0.001) 0.377 (0.021) 0.765 (0.098) -0.329 (0.056 161 PR e(-1) e(-2) T SSR Adjusted R squared 163 1,796.49 0.738 162 792.54 0.739 716.72 0.812Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started