Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A mortgage lender called Buy-Home, originates 2 loans, X and Y. The loans have a term of 30 years, with a fixed interest rate

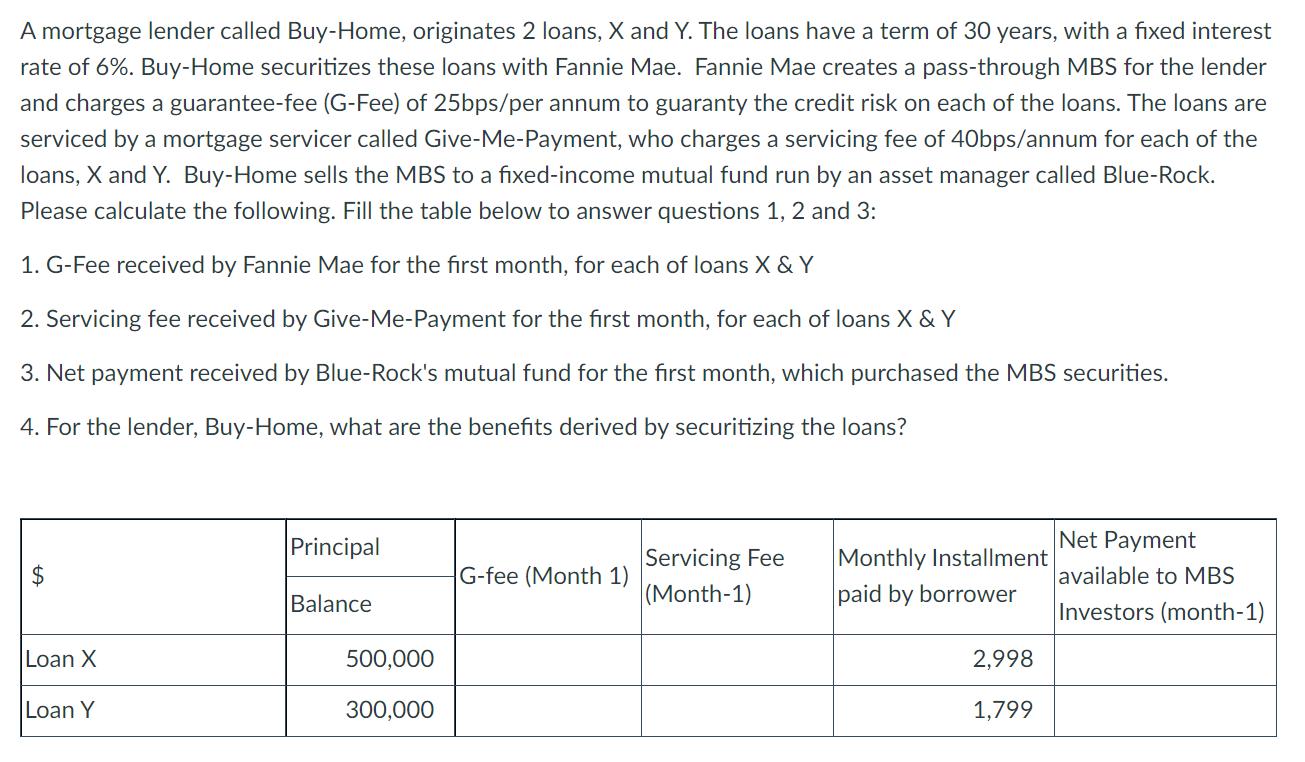

A mortgage lender called Buy-Home, originates 2 loans, X and Y. The loans have a term of 30 years, with a fixed interest rate of 6%. Buy-Home securitizes these loans with Fannie Mae. Fannie Mae creates a pass-through MBS for the lender and charges a guarantee-fee (G-Fee) of 25bps/per annum to guaranty the credit risk on each of the loans. The loans are serviced by a mortgage servicer called Give-Me-Payment, who charges a servicing fee of 40bps/annum for each of the loans, X and Y. Buy-Home sells the MBS to a fixed-income mutual fund run by an asset manager called Blue-Rock. Please calculate the following. Fill the table below to answer questions 1, 2 and 3: 1. G-Fee received by Fannie Mae for the first month, for each of loans X&Y 2. Servicing fee received by Give-Me-Payment for the first month, for each of loans X & Y 3. Net payment received by Blue-Rock's mutual fund for the first month, which purchased the MBS securities. 4. For the lender, Buy-Home, what are the benefits derived by securitizing the loans? Loan X Loan Y Principal Balance 500,000 300,000 G-fee (Month 1) Servicing Fee (Month-1) Monthly Installment paid by borrower 2,998 1,799 Net Payment available to MBS Investors (month-1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To address the questions given in the scenario lets go through the calculations one by one 1 GFee received by Fannie Mae for the first month for each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started