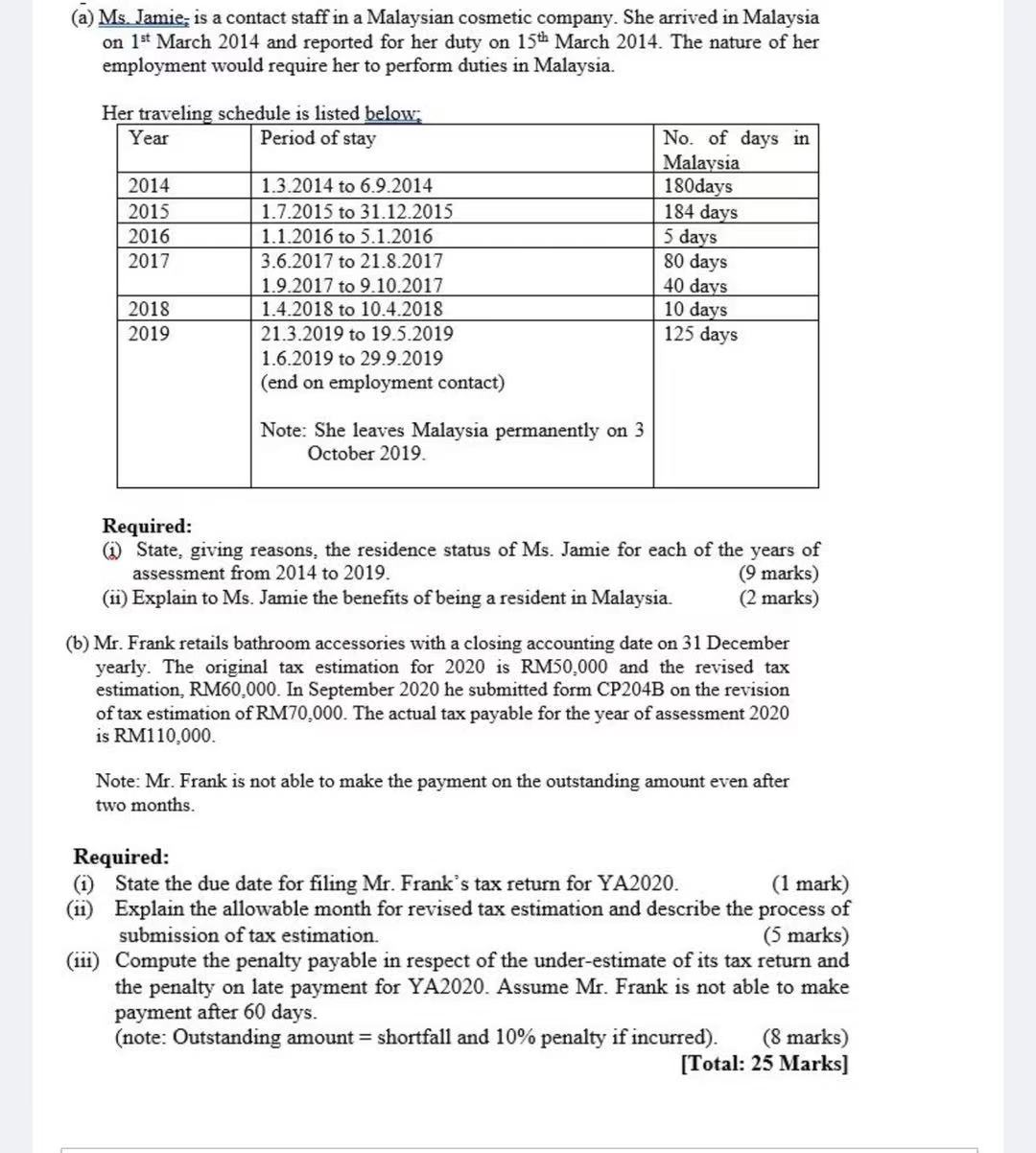

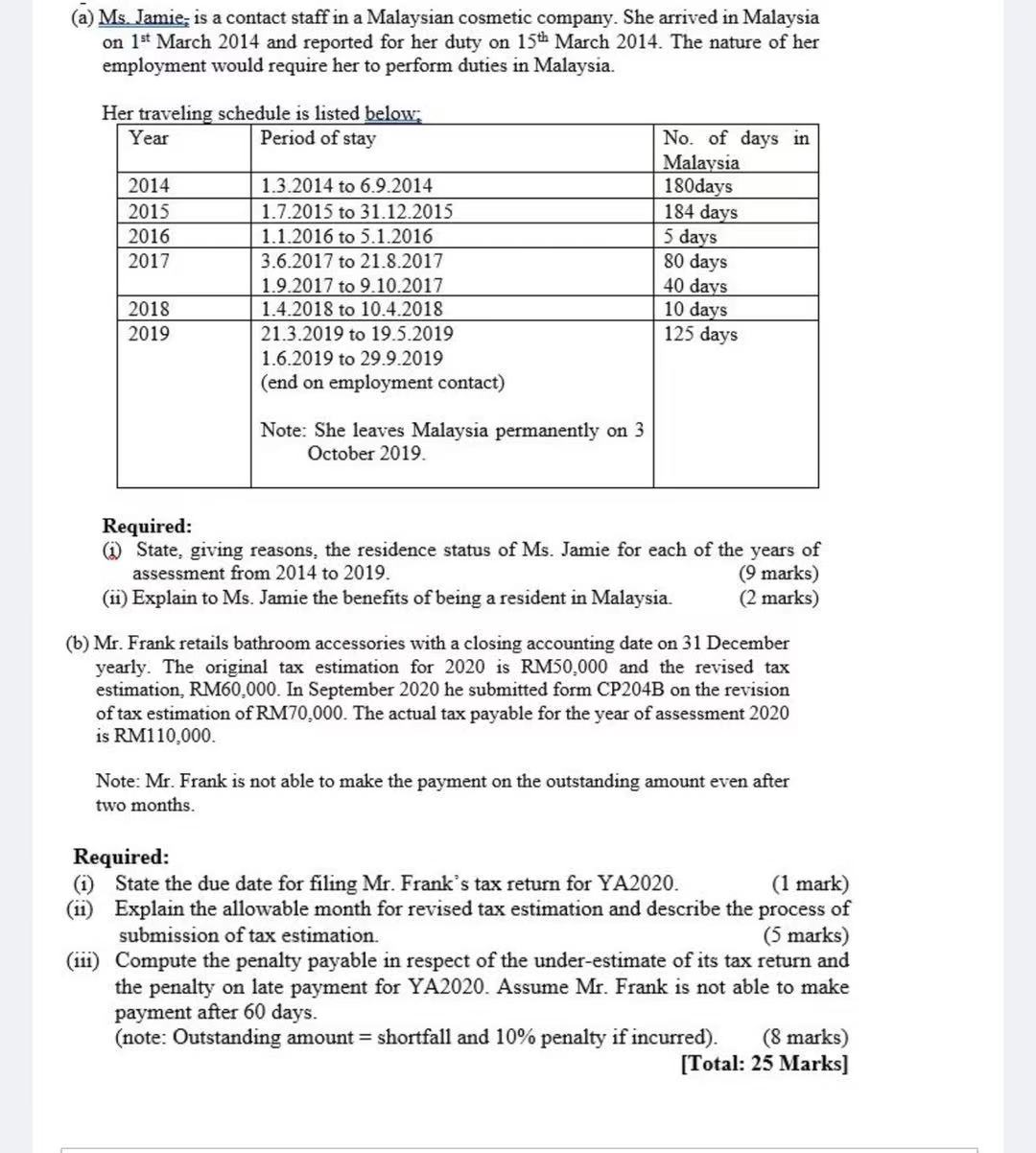

(a) Ms. Jamie, is a contact staff in a Malaysian cosmetic company. She arrived in Malaysia on 1st March 2014 and reported for her duty on 15th March 2014. The nature of her employment would require her to perform duties in Malaysia. Her traveling schedule is listed below: Year Period of stay 2014 2015 2016 2017 1.3.2014 to 6.9.2014 1.7.2015 to 31.12.2015 1.1.2016 to 5.1.2016 3.6.2017 to 21.8.2017 1.9.2017 to 9.10.2017 1.4.2018 to 10.4.2018 21.3.2019 to 19.5.2019 1.6.2019 to 29.9.2019 (end on employment contact) No. of days in Malaysia 180days 184 days 5 days 80 days 40 days 10 days 125 days 2018 2019 Note: She leaves Malaysia permanently on 3 October 2019. Required: (DState, giving reasons, the residence status of Ms. Jamie for each of the years of assessment from 2014 to 2019. (9 marks) (11) Explain to Ms. Jamie the benefits of being a resident in Malaysia. (2 marks) (b) Mr. Frank retails bathroom accessories with a closing accounting date on 31 December yearly. The original tax estimation for 2020 is RM50,000 and the revised tax estimation, RM60,000. In September 2020 he submitted form CP204B on the revision of tax estimation of RM70,000. The actual tax payable for the year of assessment 2020 is RM110,000 Note: Mr. Frank is not able to make the payment on the outstanding amount even after two months. Required: (1) State the due date for filing Mr. Frank's tax return for YA2020. (1 mark) Explain the allowable month for revised tax estimation and describe the process of submission of tax estimation. (5 marks) (111) Compute the penalty payable in respect of the under-estimate of its tax return and the penalty on late payment for YA2020. Assume Mr. Frank is not able to make payment after 60 days. (note: Outstanding amount = shortfall and 10% penalty if incurred). (8 marks) [Total: 25 Marks) (a) Ms. Jamie, is a contact staff in a Malaysian cosmetic company. She arrived in Malaysia on 1st March 2014 and reported for her duty on 15th March 2014. The nature of her employment would require her to perform duties in Malaysia. Her traveling schedule is listed below: Year Period of stay 2014 2015 2016 2017 1.3.2014 to 6.9.2014 1.7.2015 to 31.12.2015 1.1.2016 to 5.1.2016 3.6.2017 to 21.8.2017 1.9.2017 to 9.10.2017 1.4.2018 to 10.4.2018 21.3.2019 to 19.5.2019 1.6.2019 to 29.9.2019 (end on employment contact) No. of days in Malaysia 180days 184 days 5 days 80 days 40 days 10 days 125 days 2018 2019 Note: She leaves Malaysia permanently on 3 October 2019. Required: (DState, giving reasons, the residence status of Ms. Jamie for each of the years of assessment from 2014 to 2019. (9 marks) (11) Explain to Ms. Jamie the benefits of being a resident in Malaysia. (2 marks) (b) Mr. Frank retails bathroom accessories with a closing accounting date on 31 December yearly. The original tax estimation for 2020 is RM50,000 and the revised tax estimation, RM60,000. In September 2020 he submitted form CP204B on the revision of tax estimation of RM70,000. The actual tax payable for the year of assessment 2020 is RM110,000 Note: Mr. Frank is not able to make the payment on the outstanding amount even after two months. Required: (1) State the due date for filing Mr. Frank's tax return for YA2020. (1 mark) Explain the allowable month for revised tax estimation and describe the process of submission of tax estimation. (5 marks) (111) Compute the penalty payable in respect of the under-estimate of its tax return and the penalty on late payment for YA2020. Assume Mr. Frank is not able to make payment after 60 days. (note: Outstanding amount = shortfall and 10% penalty if incurred). (8 marks) [Total: 25 Marks)