Question

A multinational retail company currently has excess funds in the amount 10,000,000. Why might this company choose to invest these funds in the Money Market

A multinational retail company currently has excess funds in the amount £10,000,000. Why might this company choose to invest these funds in the Money Market instead of depositing them into a savings account at a bank? Provide an example in your discussion.

B. You purchase a 91-day U.S. Treasury bill for $987.50 with a face value of $1,000.

(1) What is the annualised discount rate for this Treasury bill?

(2) What is the annualised investment rate for this Treasury bill if it was a leap year?

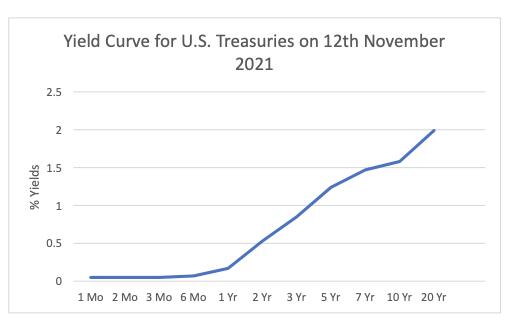

C. Based on the yield curve of U.S. Treasuries on 12th November, 2021, answer the questions below.

(1) What is the market predicting about the movement of future short-term interest rates?

(2) What might the yield curve indicate about the market’s predictions concerning the inflation rate in the future?

(3) Explain, according to the liquidity premium theory, why longer-term U.S. Treasury Securities tend to have higher yields.

D. Standard and Poor’s has issued Orchid Plc with a credit rating of AA and Petunia Plc with a credit rating of BB. The corporate bond issued by Orchid Plc currently has a yield of 3% and the corporate bond issued by Petunia Plc currently has a yield of 4.5%. Based on this information, from which company would an investor buy a bond? Explain your answer.

% Yields Yield Curve for U.S. Treasuries on 12th November 2021 2.5 2 1.5 1 0.5 0 1 Mo 2 Mo 3 Mo 6 Mo 1 Yr 2 Yr 3 Yr 5 Yr 7 Yr 10 Yr 20 Yr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The multinational retail company might choose to invest excess funds in the Money Market instead of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started