Answered step by step

Verified Expert Solution

Question

1 Approved Answer

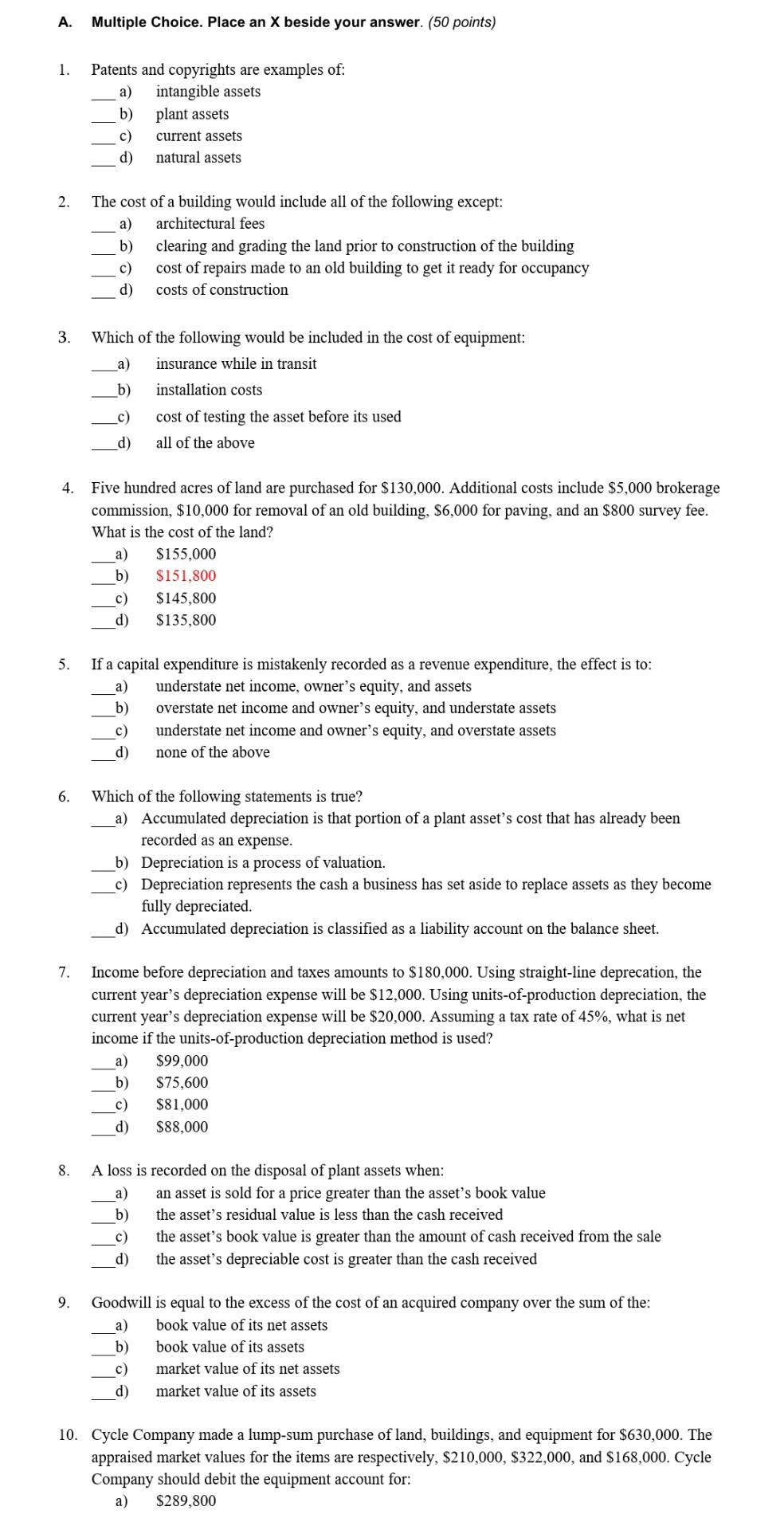

A. Multiple Choice. Place an X beside your answer. (50 points) 1. Patents and copyrights are examples of: a) intangible assets b) plant assets C)

A. Multiple Choice. Place an X beside your answer. (50 points) 1. Patents and copyrights are examples of: a) intangible assets b) plant assets C) current assets d) natural assets 2. The cost of a building would include all of the following except: a) architectural fees b) clearing and grading the land prior to construction of the building C) cost of repairs made to an old building to get it ready for occupancy d) costs of construction 3. Which of the following would be included in the cost of equipment: a) insurance while in transit b) installation costs C) cost of testing the asset before its used _d) all of the above 4. Five hundred acres of land are purchased for $130,000. Additional costs include $5,000 brokerage commission, $10,000 for removal of an old building, $6,000 for paving, and an $800 survey fee. What is the cost of the land? a) $155,000 b) $151,800 c) $145,800 d) $135,800 5. If a capital expenditure is mistakenly recorded as a revenue expenditure, the effect is to: a) understate net income, owner's equity, and assets b) overstate net income and owner's equity, and understate assets C) understate net income and owner's equity, and overstate assets d) none of the above 6. Which of the following statements is true? a) Accumulated depreciation is that portion of a plant asset's cost that has already been recorded as an expense. b) Depreciation is a process of valuation. C) Depreciation represents the cash a business has set aside to replace assets as they become fully depreciated. d) Accumulated depreciation is classified as a liability account on the balance sheet. 7. Income before depreciation and taxes amounts to $180,000. Using straight-line deprecation, the current year's depreciation expense will be $12,000. Using units-of-production depreciation, the current year's depreciation expense will be $20,000. Assuming a tax rate of 45%, what is net income if the units-of-production depreciation method is used? a $99,000 b) $75,600 C) $81,000 d) $88,000 8. A loss is recorded on the disposal of plant assets when: a) an asset is sold for a price greater than the asset's book value b) the asset's residual value is less than the cash received C) the asset's book value is greater than the amount of cash received from the sale d) the asset's depreciable cost is greater than the cash received 9. Goodwill is equal to the excess of the cost of an acquired company over the sum of the: a book value of its net assets b) book value of its assets c) market value of its net assets d) market value of its assets 10. Cycle Company made a lump-sum purchase of land, buildings, and equipment for $630,000. The appraised market values for the items are respectively, $210,000, $322,000, and $168,000. Cycle Company should debit the equipment account for: a) $289,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started