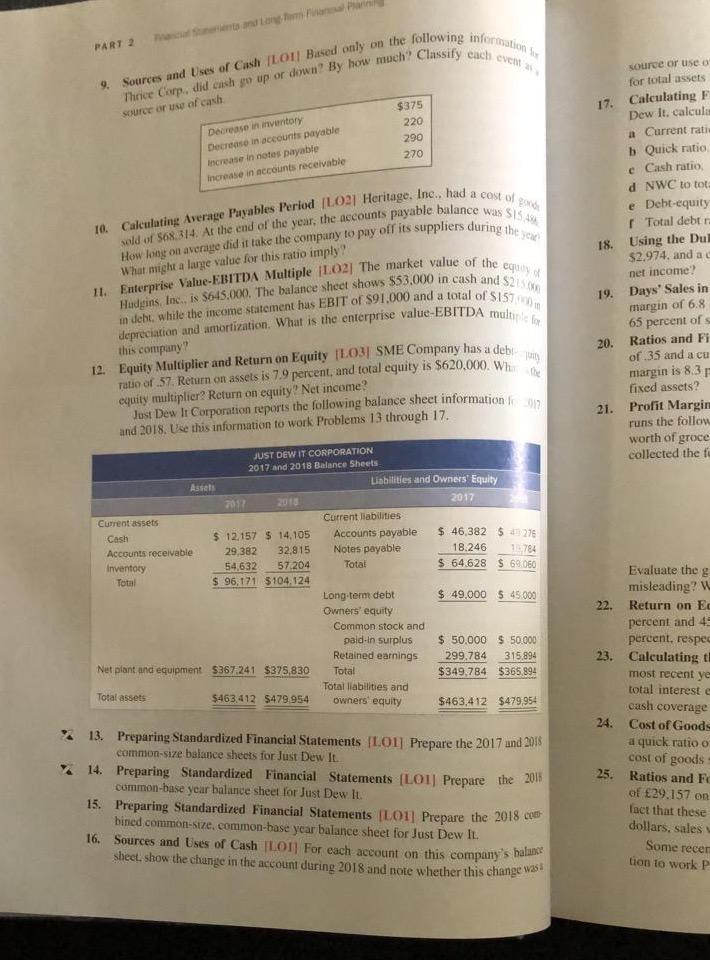

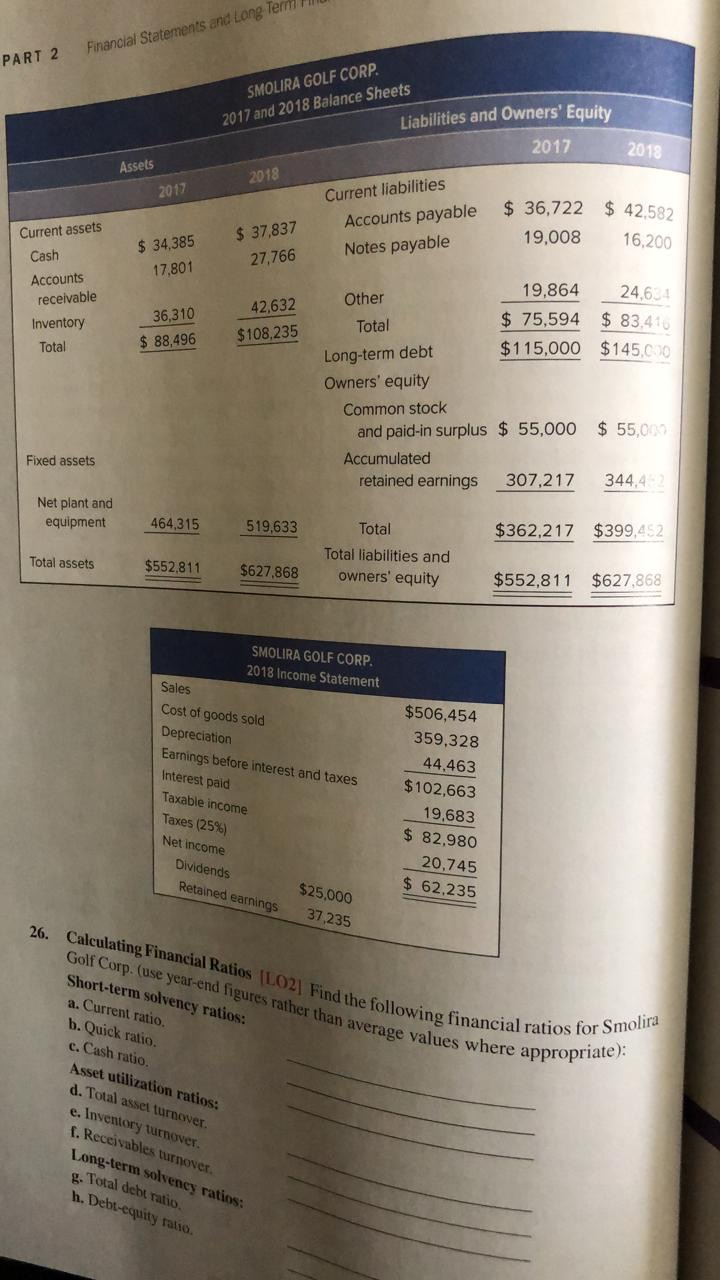

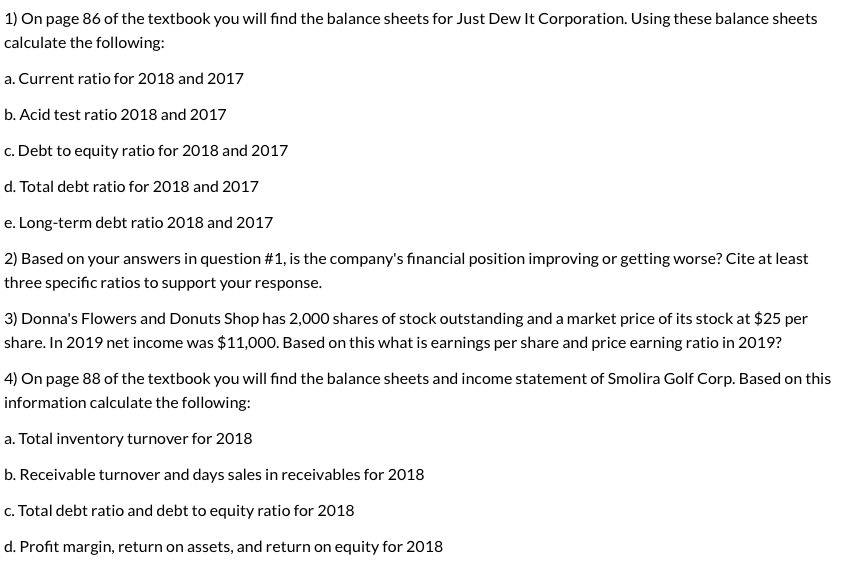

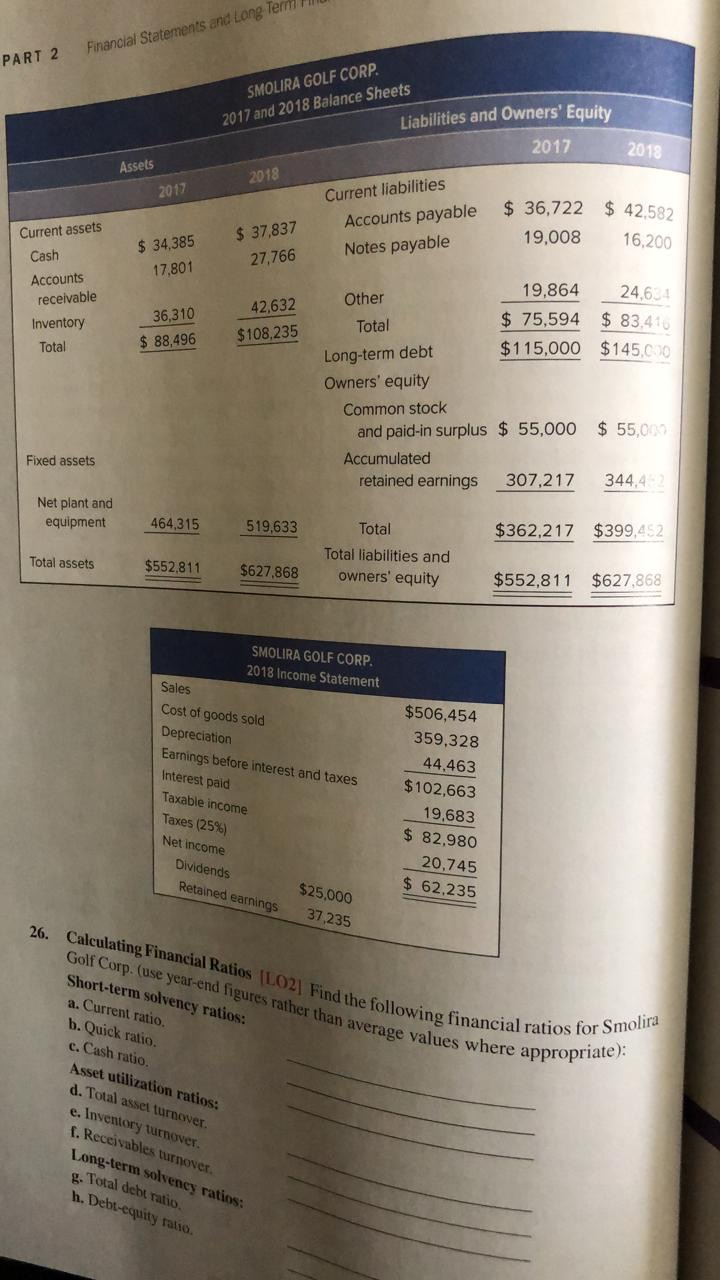

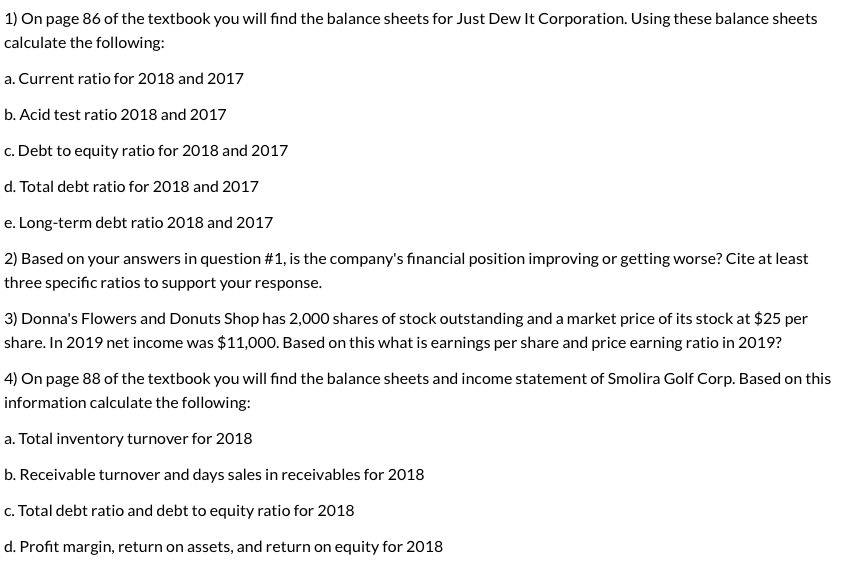

a ndton form S collowing information PART 2 sify each event 9. Sources and Uses of Cash LOI Based only on the followin Thuice Corp. did cash go up or down? By how much? Classify source or use of cash Decrease in inventory Decrease in accounts payable Increase in notes payable Increase in mccounts receivable $375 220 290 270 had a cost of wance was SIA pliers during they e of the equity cash and $25.00 source or use o for total assets Calculating F Dew It, calculs a Current ratie b Quick ratio e Cash ratio d NWC to tot: e Debt-equity f Total debut 18. Using the Dul $2.974. and ad net income? 19. Days' Sales in margin of 6.8 65 percent of 20. Ratios and Fi of.35 and a cu margin is 8.30 fixed assets? 21. Profit Margin runs the follow worth of groce collected the of $157 10. Calculating Average Payables Period (LO2Heritage. Inc., had sold of $68.314. At the end of the year, the accounts payable balance How long on average did it take the company to pay off its suppliers du What might a large value for this ratio imply? 11. Enterprise Value-EBITDA Multiple (L02] The market value of th Hudgins, Inc. is $645.000. The balance sheet shows $53.000 in cash ar in debt, while the income statement has EBIT of S91.000 and a total of 5157 depreciation and amortization. What is the enterprise value-EBITDA mul this company? 12. Equity Multiplier and Return on Equity LO3J SME Company has a deh ratio of 57. Return on assets is 7.9 percent, and total equity is $620,000. W equity multiplier? Return on equity? Net income? Just Dew It Corporation reports the following balance sheet information and 2018. Use this information to work Problems 13 through 17. ITDA multiple for su debljin 20.000. Whether JUST DEW IT CORPORATION 2017 and 2018 Balance Sheets Liabilities and Owners' Equity Assets 2017 2018 2017 Current assets Current liabilities Cash $ 12,157 $ 14.105 Accounts payable $ 46,382 $ 43776 Accounts receivable 29,382 32,815 Notes payable 18.246 1.784 Inventory 54,632 57.204 Total $ 64,628 $ 69.060 Total $ 96,171 $104.124 Long-term debt $ 49.000 $ 45.000 Owners' equity Common stock and paid-in surplus $ 50.000 $ 50.000 Retained earnings 299.784 315.894 Net plant and equipment $367 241 $375,830 Total $349.784 $365.894 Total liabilities and Total assets $463.412 $479.954 owners' equity $463.412 $479,954 23 Calen Evaluate the g misleading? W 22. Return on Ed percent and 49 percent. respec Calculating to most recent ye total interest cash coverage 24. Cost of Goods a quick ratio o cost of goods 25. Ratios and F of 29.157 on fact that these dollars, sales Some recer tion to work P 13. Preparing Standardized Financial Statements (LO1] Prepare the 2017 and 2015 common-size balance sheets for Just Dew It 14. Preparing Standardized Financial Statements (LOI Prepare the 2015 common-base year balance sheet for Just Dew it 15. Preparing Standardized Financial Statements (L01 Prepare the 2018 com bined common-size, common-base year balance sheet for Just Dew It. 16. Sources and Uses of Cash LOI For each account on this company sheel show the change in the account during 2018 and note whether this change was Financial Statements and Long Term PART 2 SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2017 2018 2018 2017 $ 36,722 $425 Current liabilities Accounts payable Notes payable Current assets $ 37,837 27,766 19,008 $ 34,385 17,801 16,200 Cash Accounts receivable Inventory Total 36,310 $ 88,496 42,632 $ 108,235 Other 19,864 24,61 Total $ 75,594 $ 83,410 Long-term debt $115,000 $145.000 Owners' equity Common stock and paid-in surplus $ 55,000 $ 55,000 Accumulated retained earnings 307,217 344,42 Fixed assets Net plant and equipment 464,315 519,633 $362,217 $399,452 Total Total liabilities and owners' equity Total assets $552.811 $627,868 $552,811 $627,868 SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income $506,454 359,328 44,463 $102,663 19,683 $ 82,980 20,745 $ 62,235 Taxes (25%) Net income Dividends Retained earnings $25.000 37,235 26. Calculating Financial Ratios ILO2) Find the following financia Golf Corp. (use year-end figures rather than average values where a Short-term solvency ratios: a. Current ratio. b. Quick ratio. c. Cash ratio. Asset utilization ratios: d. Total asset turnover. e. Inventory turnover. f. Receivables turnover. Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio nancial ratios for Smolira where appropriate): 1) On page 86 of the textbook you will find the balance sheets for Just Dew It Corporation. Using these balance sheets calculate the following: a. Current ratio for 2018 and 2017 b. Acid test ratio 2018 and 2017 c. Debt to equity ratio for 2018 and 2017 d. Total debt ratio for 2018 and 2017 e. Long-term debt ratio 2018 and 2017 2) Based on your answers in question #1, is the company's financial position improving or getting worse? Cite at least three specific ratios to support your response. 3) Donna's Flowers and Donuts Shop has 2,000 shares of stock outstanding and a market price of its stock at $25 per share. In 2019 net income was $11,000. Based on this what is earnings per share and price earning ratio in 2019? 4) On page 88 of the textbook you will find the balance sheets and income statement of Smolira Golf Corp. Based on this information calculate the following: a. Total inventory turnover for 2018 b. Receivable turnover and days sales in receivables for 2018 c. Total debt ratio and debt to equity ratio for 2018 d. Profit margin, return on assets, and return on equity for 2018