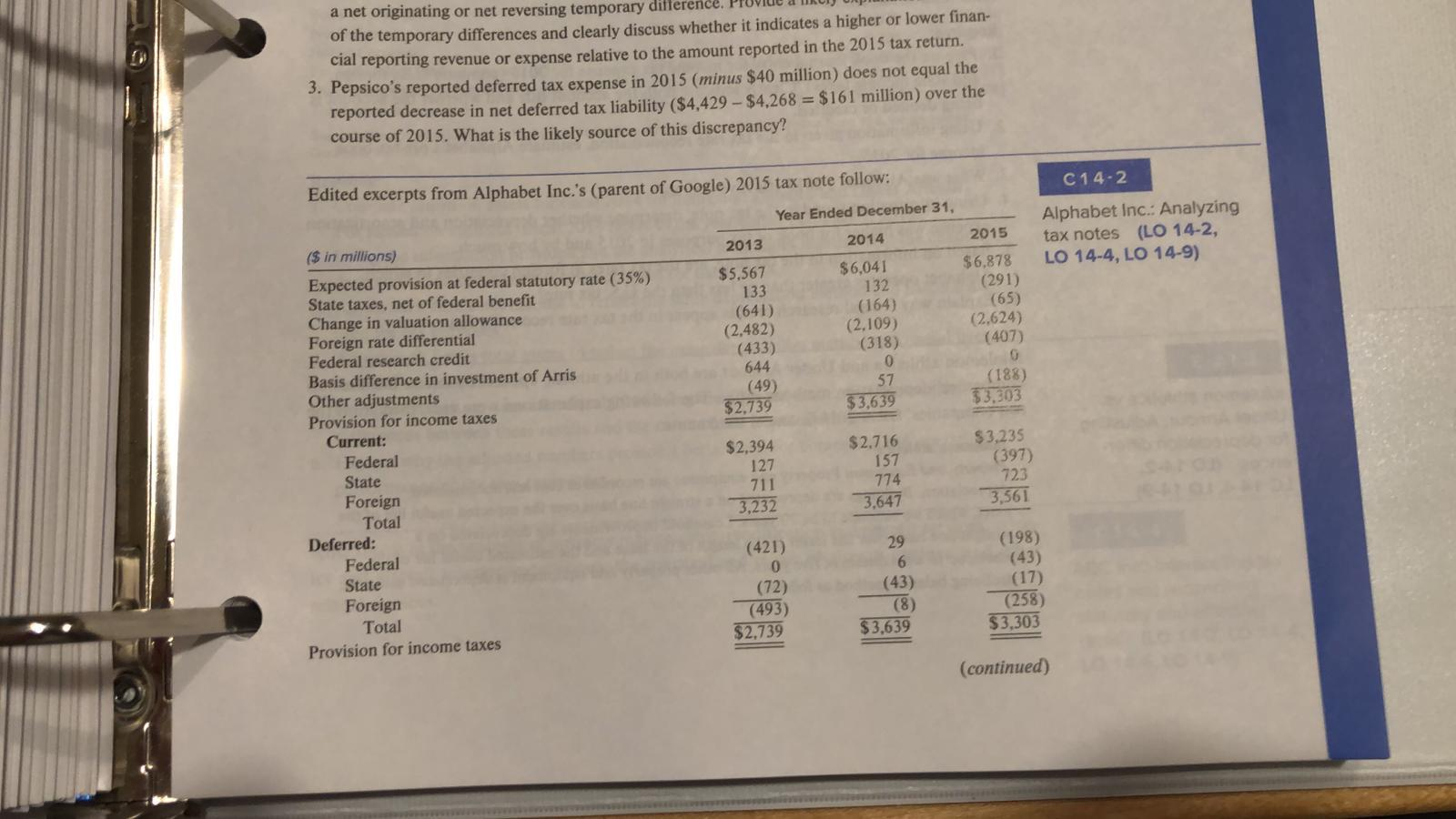

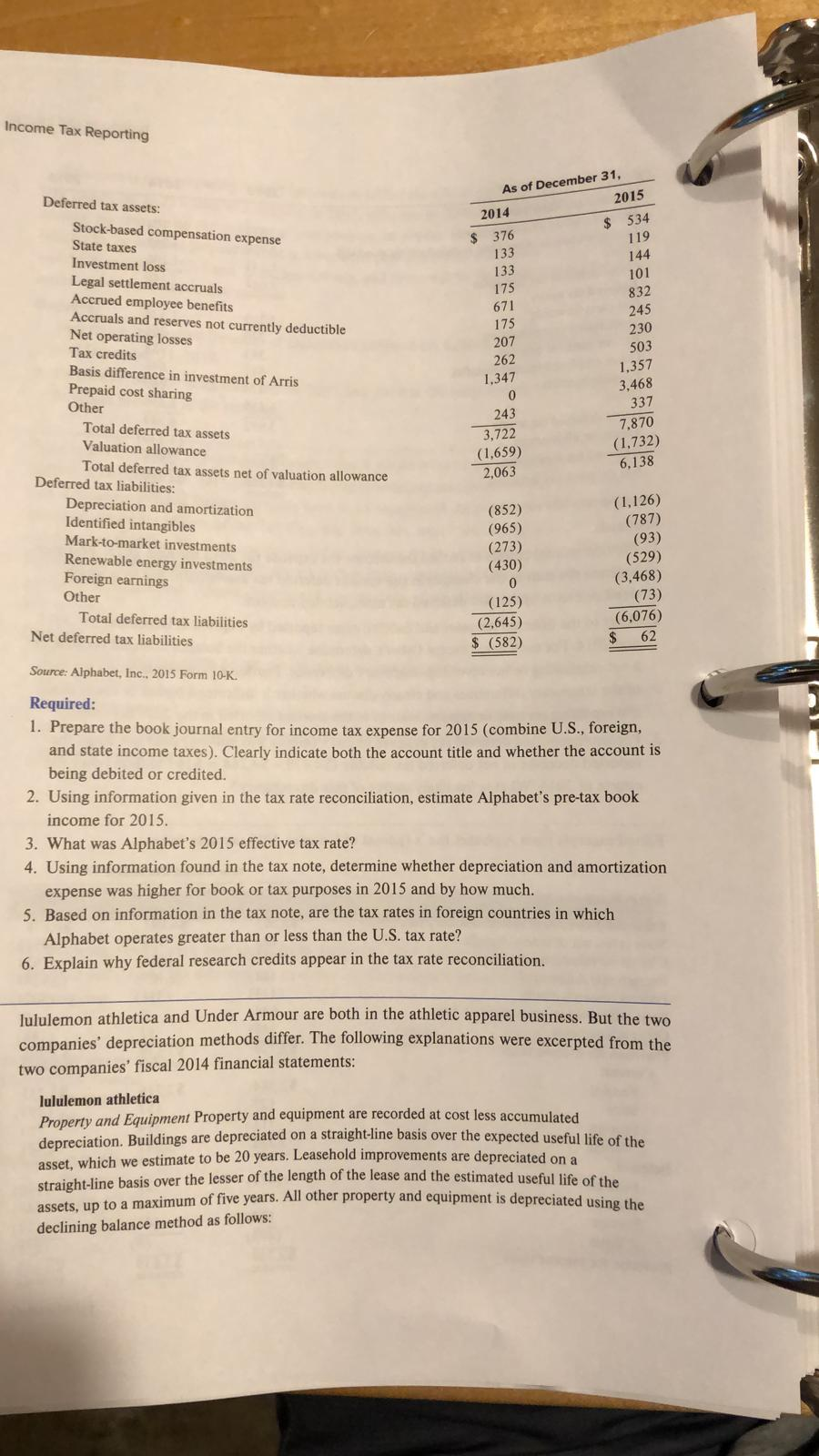

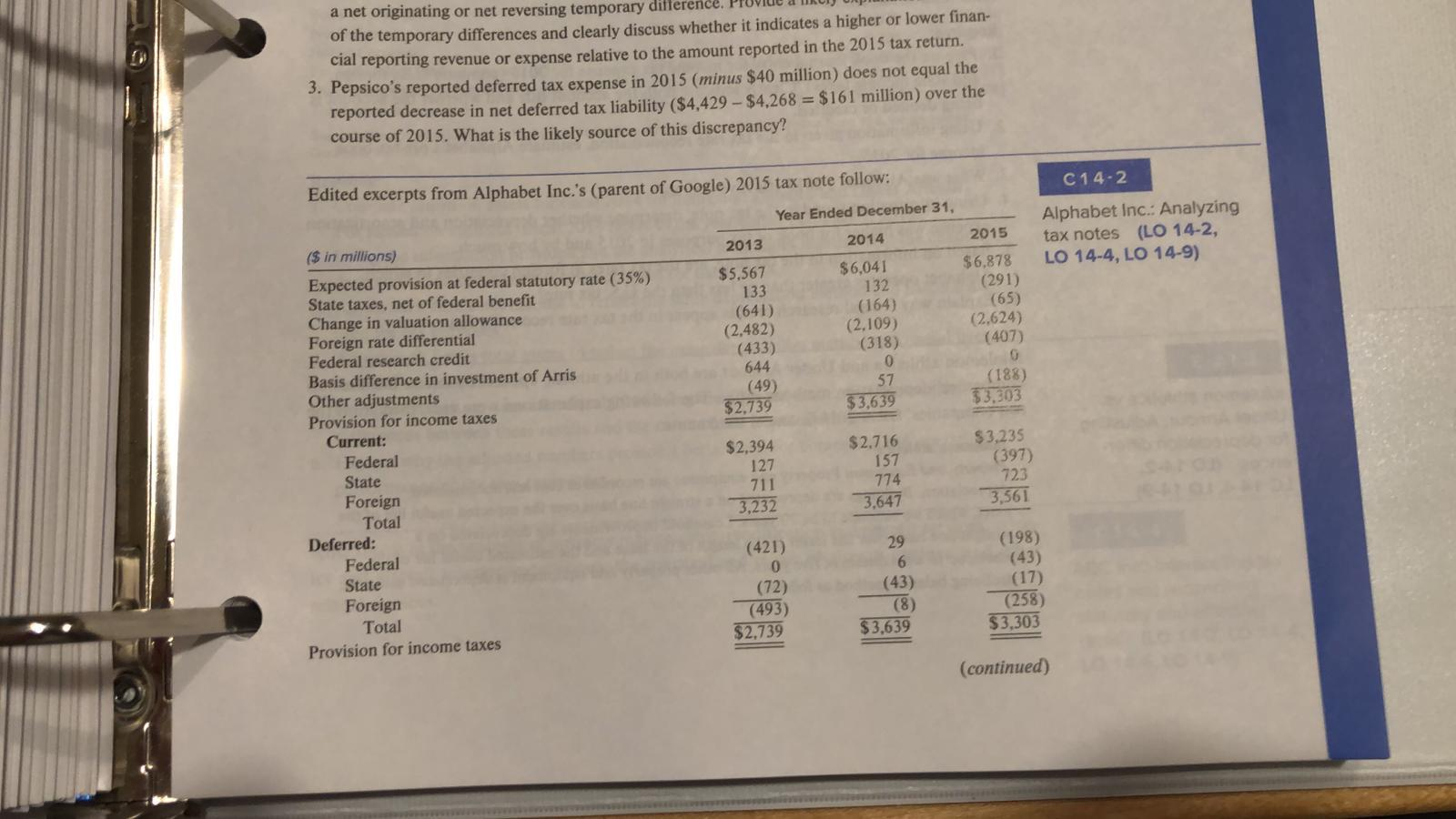

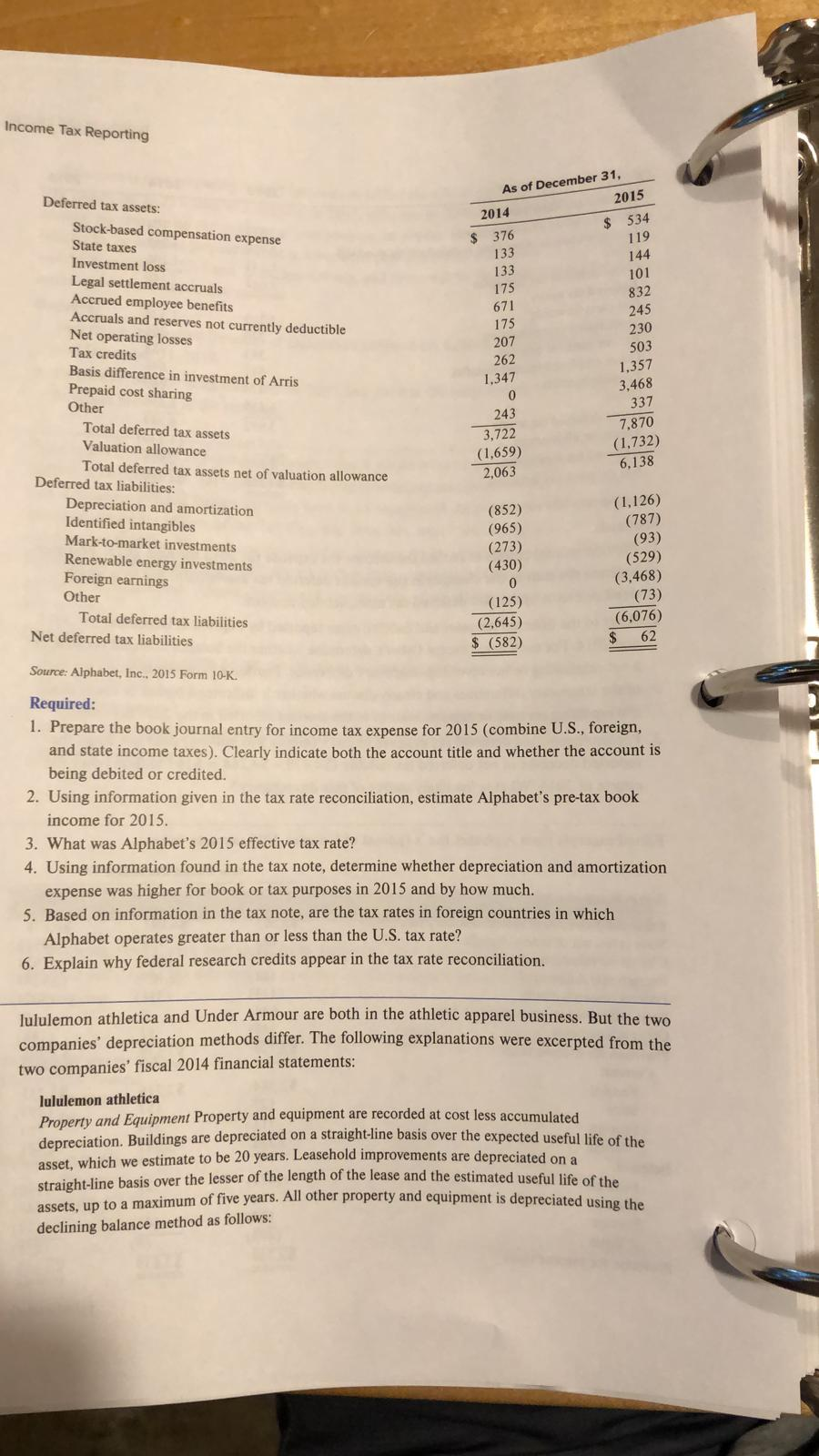

a net originating or net reversing temporary difference. of the temporary differences and clearly discuss whether it indicates a higher or lower finan- cial reporting revenue or expense relative to the amount reported in the 2015 tax return. 3. Pepsico's reported deferred tax expense in 2015 (minus $40 million) does not equal the reported decrease in net deferred tax liability ($4,429 - $4.268 = $161 million) over the course of 2015. What is the likely source of this discrepancy? C14-2 Alphabet Inc.: Analyzing tax notes (LO 14-2, LO 14-4, LO 14-9) Edited excerpts from Alphabet Inc.'s (parent of Google) 2015 tax note follow: Year Ended December 31, ($ in millions) 2013 2014 2015 Expected provision at federal statutory rate (35%) $5.567 $6,041 $6,878 State taxes, net of federal benefit 133 132 (291) Change in valuation allowance (641) (164) (65) Foreign rate differential (2,482) (2.109) (2,624) Federal research credit (433) (318) (407) Basis difference in investment of Arris 644 0 Other adjustments (49) 57 (188) Provision for income taxes $2,739 $3,639 $3,303 Current: Federal $2,394 $2.716 $3,235 State 127 157 (397) 711 Foreign 723 774 Total 3,232 3,647 3,561 Deferred: Federal (421) 29 (198) 0 6 State (43) Foreign (72) (43) (17) Total (493) (8) (258) Provision for income taxes $2,739 $3,639 $3,303 (continued) Income Tax Reporting Deferred tax assets: Stock-based compensation expense State taxes Investment loss Legal settlement accruals Accrued employee benefits Accruals and reserves not currently deductible Net operating losses Tax credits Basis difference in investment of Arris Prepaid cost sharing Other Total deferred tax assets Valuation allowance Total deferred tax assets net of valuation allowance Deferred tax liabilities: Depreciation and amortization Identified intangibles Mark-to-market investments Renewable energy investments Foreign earnings Other Total deferred tax liabilities Net deferred tax liabilities As of December 31, 2014 2015 $ 376 $ 534 133 119 133 144 175 101 671 832 175 245 207 230 262 503 1.347 1,357 0 3,468 243 337 3,722 7.870 (1,659) (1.732) 2,063 6.138 (852) (965) (273) (430) 0 (125) (2,645) $ (582 (1,126) (787) (93) (529) (3,468) (73) (6,076) 62 Source: Alphabet, Inc., 2015 Form 10-K. Required: 1. Prepare the book journal entry for income tax expense for 2015 (combine U.S., foreign, and state income taxes). Clearly indicate both the account title and whether the account is being debited or credited. 2. Using information given in the tax rate reconciliation, estimate Alphabet's pre-tax book income for 2015. 3. What was Alphabet's 2015 effective tax rate? 4. Using information found in the tax note, determine whether depreciation and amortization expense was higher for book or tax purposes in 2015 and by how much. 5. Based on information in the tax note, are the tax rates in foreign countries in which Alphabet operates greater than or less than the U.S. tax rate? 6. Explain why federal research credits appear in the tax rate reconciliation. lululemon athletica and Under Armour are both in the athletic apparel business. But the two companies' depreciation methods differ. The following explanations were excerpted from the two companies' fiscal 2014 financial statements: lululemon athletica Property and Equipment Property and equipment are recorded at cost less accumulated depreciation. Buildings are depreciated on a straight-line basis over the expected useful life of the asset, which we estimate to be 20 years. Leasehold improvements are depreciated on a straight-line basis over the lesser of the length of the lease and the estimated useful life of the assets, up to a maximum of five years. All other property and equipment is depreciated using the declining balance method as follows