Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new car costs you $16 000 to buy today. The cost of a new car is expected to rise by 7.5% per year

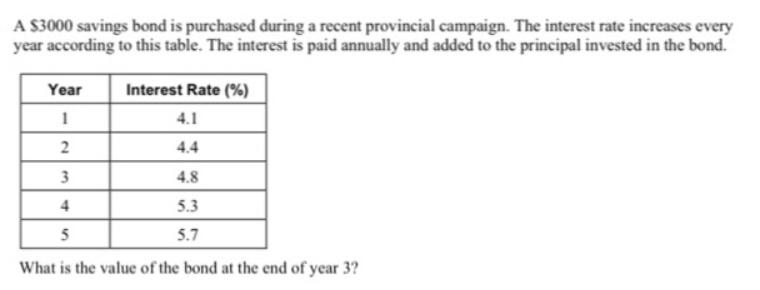

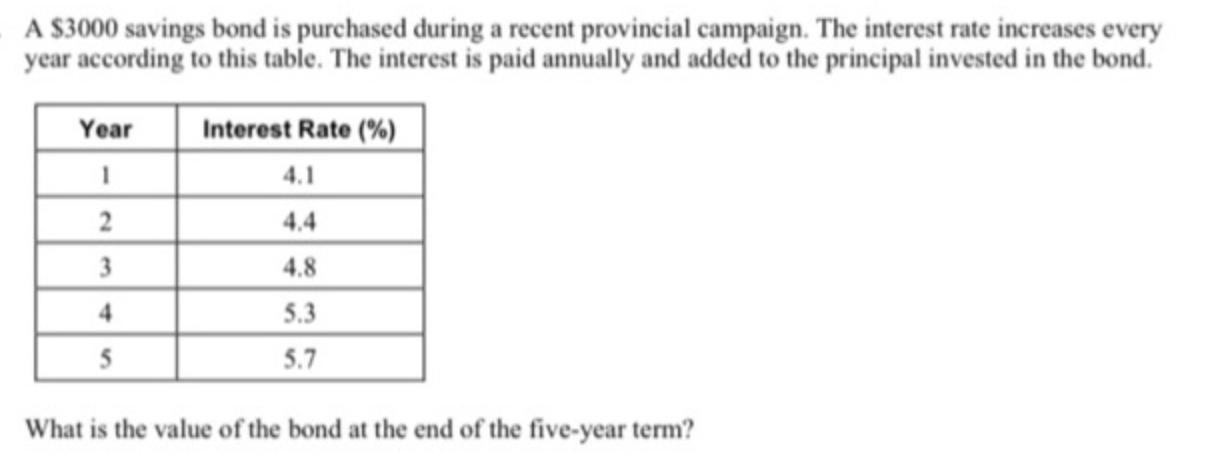

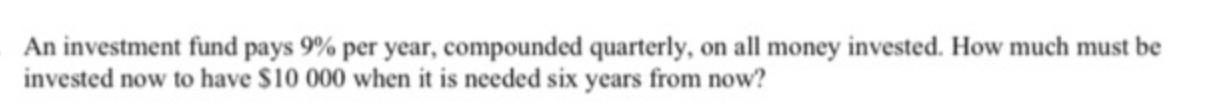

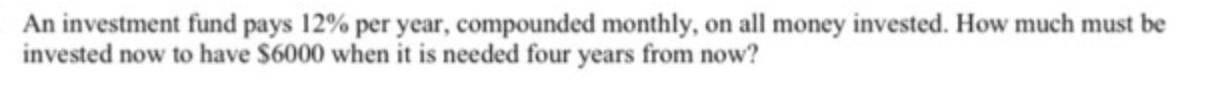

A new car costs you $16 000 to buy today. The cost of a new car is expected to rise by 7.5% per year over the next five years. At this rate, how much will the new car cost you in five years time? A $3000 savings bond is purchased during a recent provincial campaign. The interest rate increases every year according to this table. The interest is paid annually and added to the principal invested in the bond. Year Interest Rate (%) 1 4.1 2 4.4 3 4.8 4 5.3 5 5.7 What is the value of the bond at the end of year 3? A $3000 savings bond is purchased during a recent provincial campaign. The interest rate increases every year according to this table. The interest is paid annually and added to the principal invested in the bond. Year Interest Rate (%) 1 4.1 2 4.4 3 4.8 4 5.3 5 5.7 What is the value of the bond at the end of the five-year term? The newspaper reports that the annual inflation rate was 3.2%. If the inflation rate stays the same for the next five years, how much do you expect $1000.00 worth of goods to cost in five years? An investment fund pays 9% per year, compounded quarterly, on all money invested. How much must be invested now to have $10 000 when it is needed six years from now? An investment fund pays 12% per year, compounded monthly, on all money invested. How much must be invested now to have $6000 when it is needed four years from now?

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1The cost of new car is 16000 which is the same as buying price It will rise by 75 per year for 5 ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started