A new client has come to you for tax preparation services for 2020. Brady LLC wants to file as an S Corporation. They provided you

a) This assignment is less about putting the values into a tax return software and more about testing your critical thinking skills. Clients often bring you incomplete accounting records. Often, you must determine what they've failed to record or tell you about. This generally results in requesting additional information. Answer the following questions:

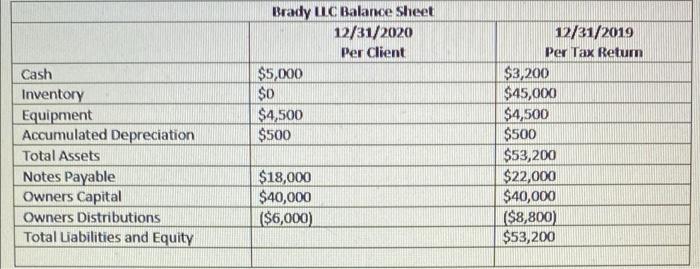

b) There are two expenses not recorded on the Income Statement at this time. Name those two expenses and which two Balance Sheet accounts will need to be updated when these expenses are recorded.

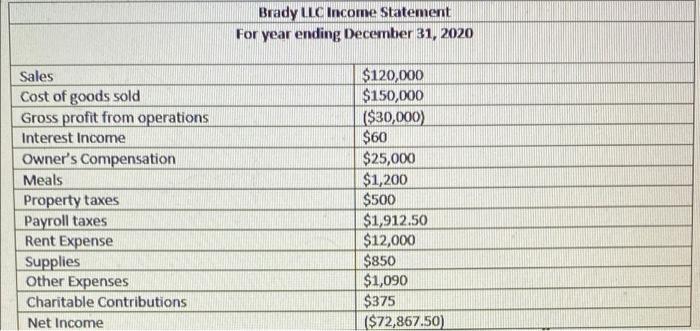

Brady LLC Income Statement For year ending December 31, 2020 $120,000 $150,000 ($30,000) $60 $25,000 Sales Cost of goods sold Gross profit from operations Interest Income Owner's Compensation $1,200 $500 $1,912.50 $12,000 $850 $1,090 $375 ($72,867.50) Meals Property taxes Payroll taxes Rent Expense Supplies Other Expenses Charitable Contributions Net Income

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Depreciation has not been charged to income statement which should be charged for the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started