Answered step by step

Verified Expert Solution

Question

1 Approved Answer

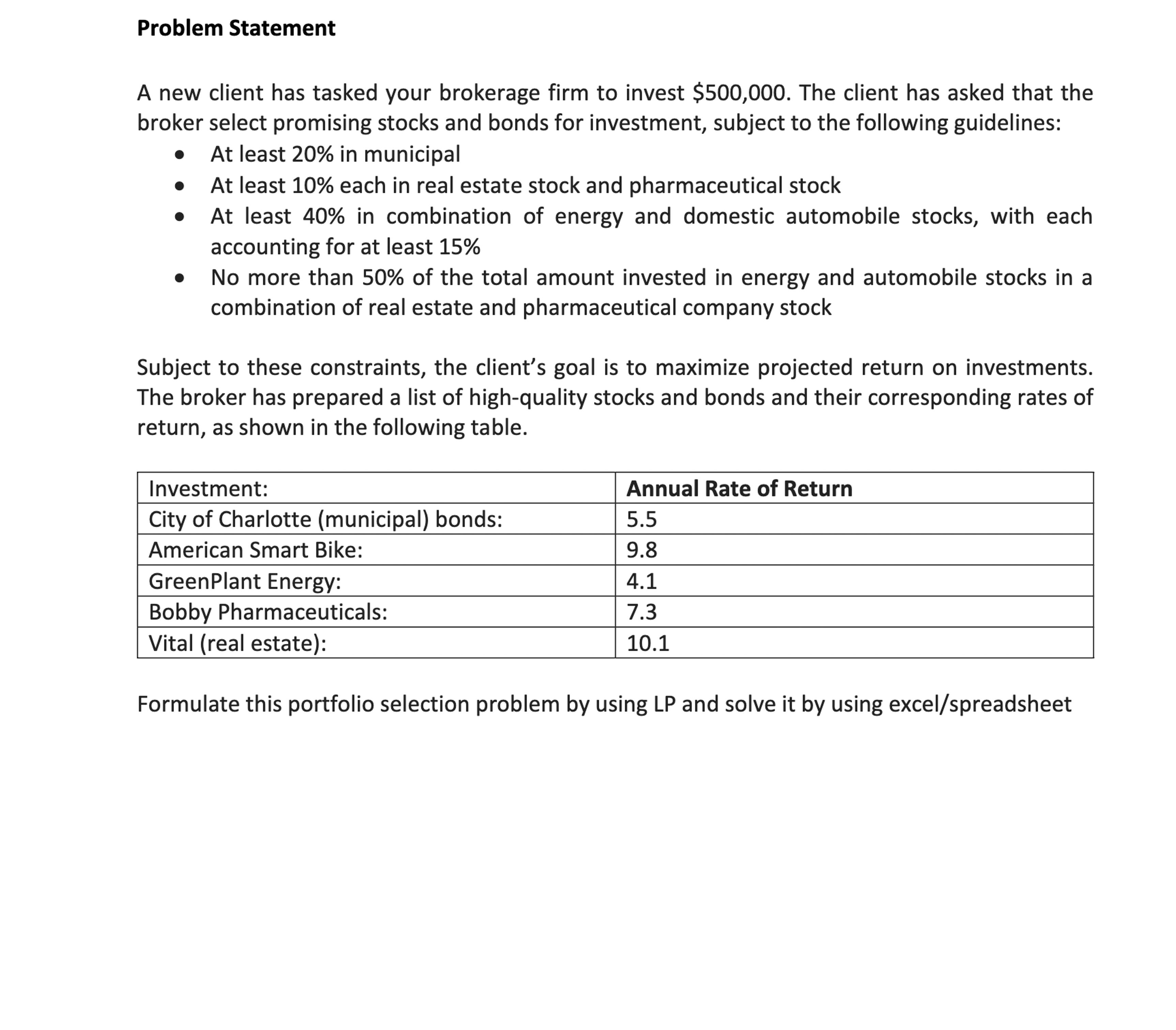

A new client has tasked your brokerage firm to invest $ 5 0 0 , 0 0 0 . The client has asked that the

A new client has tasked your brokerage firm to invest $ The client has asked that the

broker select promising stocks and bonds for investment, subject to the following guidelines:

At least in municipal

At least each in real estate stock and pharmaceutical stock

At least in combination of energy and domestic automobile stocks, with each

accounting for at least

No more than of the total amount invested in energy and automobile stocks in a

combination of real estate and pharmaceutical company stock

Subject to these constraints, the client's goal is to maximize projected return on investments.

The broker has prepared a list of highquality stocks and bonds and their corresponding rates of

return, as shown in the following table.

Formulate this portfolio selection problem by using LP and solve it by using excelspreadsheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started