Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new engineer at a sand and gravel operation is considering two mutually exclusive alternatives for a small dredging system. The first option from the

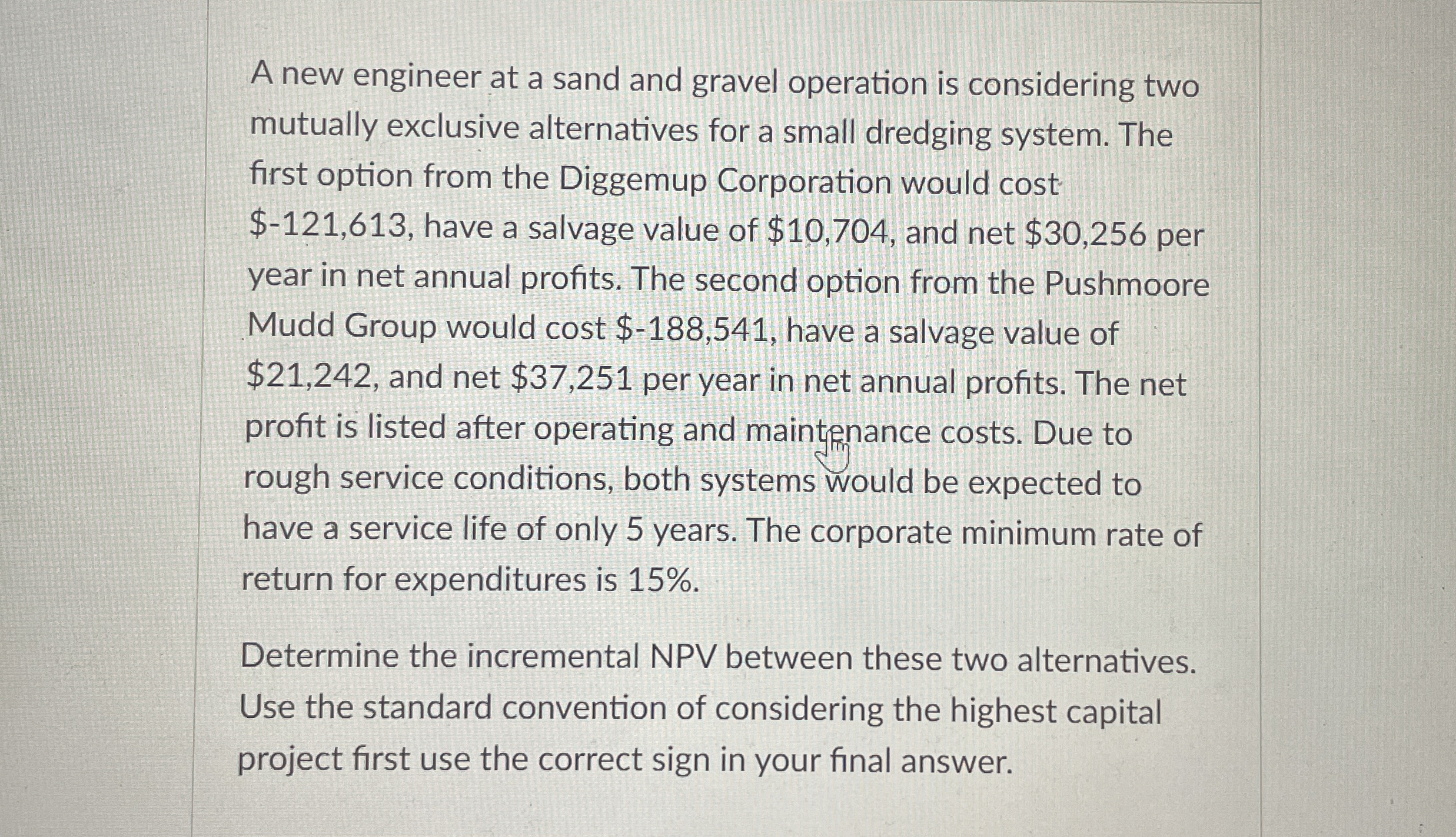

A new engineer at a sand and gravel operation is considering two

mutually exclusive alternatives for a small dredging system. The

first option from the Diggemup Corporation would cost

$ have a salvage value of $ and net $ per

year in net annual profits. The second option from the Pushmoore

Mudd Group would cost $ have a salvage value of

$ and net $ per year in net annual profits. The net

profit is listed after operating and maintenance costs. Due to

rough service conditions, both systems would be expected to

have a service life of only years. The corporate minimum rate of

return for expenditures is

Determine the incremental NPV between these two alternatives.

Use the standard convention of considering the highest capital

project first use the correct sign in your final answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started