Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new machine will cost a company 140,000 and will increase profits by 21,000 per year for the first five years and by 20,000

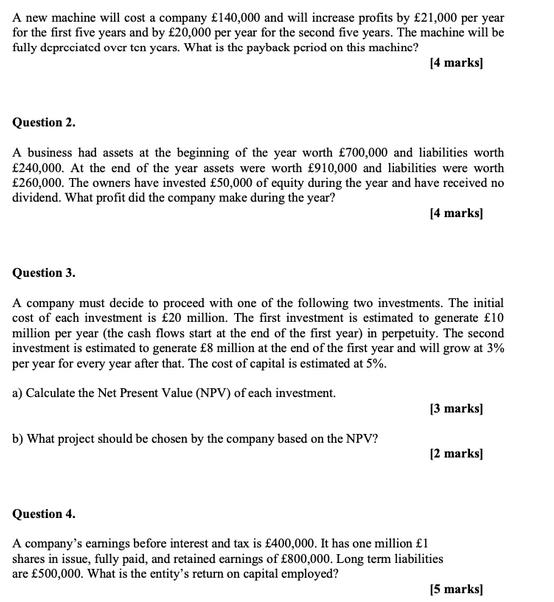

A new machine will cost a company 140,000 and will increase profits by 21,000 per year for the first five years and by 20,000 per year for the second five years. The machine will be fully depreciated over ten years. What is the payback period on this machine? [4 marks] Question 2. A business had assets at the beginning of the year worth 700,000 and liabilities worth 240,000. At the end of the year assets were worth 910,000 and liabilities were worth 260,000. The owners have invested 50,000 of equity during the year and have received no dividend. What profit did the company make during the year? [4 marks] Question 3. A company must decide to proceed with one of the following two investments. The initial cost of each investment is 20 million. The first investment is estimated to generate 10 million per year (the cash flows start at the end of the first year) in perpetuity. The second investment is estimated to generate 8 million at the end of the first year and will grow at 3% per year for every year after that. The cost of capital is estimated at 5%. a) Calculate the Net Present Value (NPV) of each investment. [3 marks] b) What project should be chosen by the company based on the NPV? [2 marks] Question 4. A company's eamings before interest and tax is 400,000. It has one million 1 shares in issue, fully paid, and retained earnings of 800,000. Long term liabilities are 500,000. What is the entity's return on capital employed? [5 marks]

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To calculate the payback period for the new machine you need to determine how long it wil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started