Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new restaurant is ready to open for business. It is estimated that the food costs (variable cost) will be 30% of sales, while

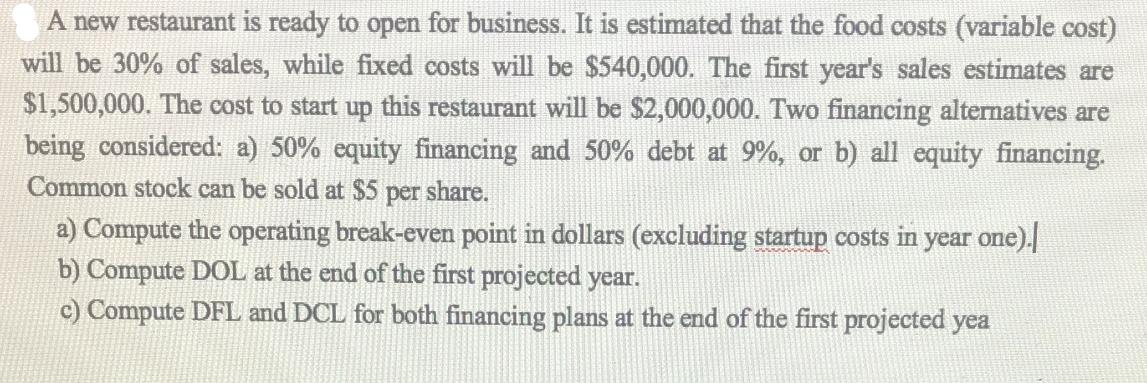

A new restaurant is ready to open for business. It is estimated that the food costs (variable cost) will be 30% of sales, while fixed costs will be $540,000. The first year's sales estimates are $1,500,000. The cost to start up this restaurant will be $2,000,000. Two financing alternatives are being considered: a) 50% equity financing and 50% debt at 9%, or b) all equity financing. Common stock can be sold at $5 per share. a) Compute the operating break-even point in dollars (excluding startup costs in year one).| b) Compute DOL at the end of the first projected year. c) Compute DFL and DCL for both financing plans at the end of the first projected yea

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets break down the information provided Variable Cost 30 of Sales Fixed Costs 540000 First Years Sales Estimates 1500000 Sta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started