Question

A new study from UIU Quant Research has found that annual revenues from commercial drones sales are expected to reach $525 million this year. This

A new study from UIU Quant Research has found that annual revenues from commercial drones sales are expected to reach $525 million this year. This is a significant increase from the prior year. UIU Quant research further indicated that a low price point had significantly reduced the barrier to entry in many sectors, with high-performance models now available for less than $3,000. It claimed that the reduction in drone price points had in turn resulted in their commercial application within an array of new fields including mapping, inspection and monitoring.

"Quant Compete" will allow you to purchase Ag Air 1 for $2,100 per unit for the first quarter of 2019; pricing could fluctuate monthly thereafter. If you agree to purchase more, they are willing to offer a quantity discount of 2% discount for a 100-unit block and 5% discount for a 250

-unit block.

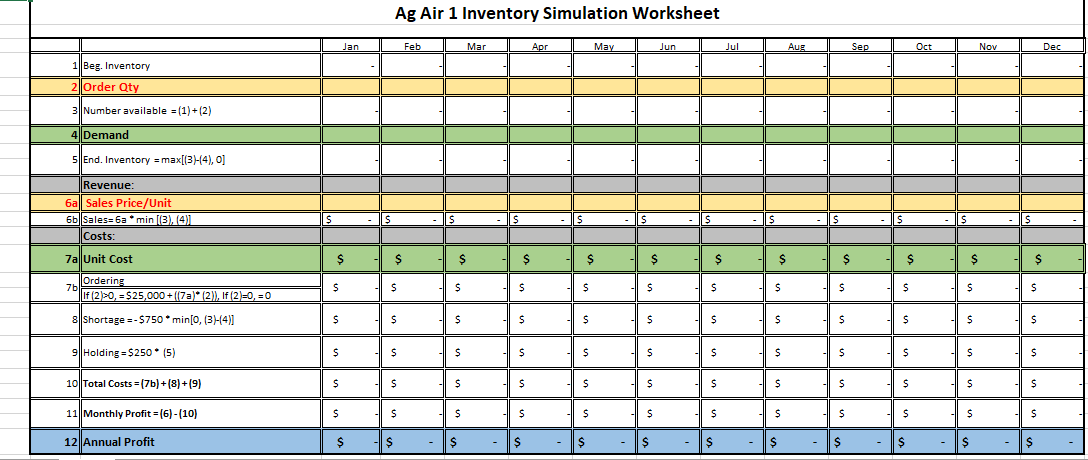

Market research results given at the recent trade show indicated that potential customers would be willing to pay $2,650 to $3,400 for Ag Air 1 (your retail operations believes these are appropriate price points and will stay within these ranges). Demand and pricing for these products these products fluctuates monthly. Note that the amount you sell in a given month is always the lowest of either monthly demand, or beginning inventory + quantity ordered.

Placing an order costs $25,000 (note that the manufacturer allows a single replenishment per month). The high ordering costs also covers fixed monthly charges allocated to the drone product(s). Any unsatisfied demand (a stockout) costs $750 per unit short in addition to the foregone profit on this lost sale. Backorders are not allowed (since customers will most likely purchase from a competitor if you don't have enough on-hand). Inventory remaining at the end of a month costs you $250 per unit.

Your task is to determine the sales price by which you plan to market the drones, and replenishments amounts (when to order, how much to order) on a month-by-month basis for the next 12 months. You may adjust your sales price at the beginning of each month. Assume that the first month in the planning horizon is January, and that there is no inventory on-hand. After you make your replenishment decision, the instructor will announce the demand for that month. Then, you may make the decision for next month. Use the attached table to indicate your monthly sales price and replenishments, and to tabulate the results of your respective strategy. If a stockout occurs, write "0" for the ending inventory, and put a "0" for the beginning inventory of the subsequent month.

Criteria

Simulation Modeling is about defining the problem, assessing tools needed to determine optimal results and running the data through the model to project future outcomes. For this exercise, I want you to assess each of the methods we have covered in this class and document the pro?s and con?s of each method as it relates to this situation (25 points). I want you then to pick one method and run the data you have through the model to determine your initial order quantity (5 points). Then come see me with your quantity, I will provide you will the actual demand. We will repeat the process for the subsequent months. Documentation of your estimate for each subsequent month is worth (5 points for each estimate; lack of documentation showing how you determined your estimate will result in an automatic forfeiture of 3 points per estimate).

Finally, I want a couple paragraph synopsis of this exercise. What went well, what did not? In order to better project forward demand, what additional tools, factors should be considered? What are some advantages and limitations of simulation modeling in this scenario? How did gut instinct influence your decision? Since demand fluctuates in this situation, how did that impact your results? (15 points)

Market Influences

Your initial estimates indicate that you should be able to capture one percent of the United States Ag market from day one. The film industry demand for drones is still very uncertain, however you feel that if your pricing is competitive you will be able to sell enough units to meet Quant Competes minimum order requirements.

Unit cost for the Air Ag 1 is expected to fluctuate as much as 20% over the next year. Market pricing for sales is expected to be equally volatile as industry data shows a 50 percent increase in new retailers over the next 24-36 months. Key components for the Air Ag 1 model are imported from both Japan and Canada. Availability for these specialty parts are expected to be largely available in Q1, but could become less available throughout the remainder of the year.

Air Ag 1 sales are very price sensitive. As price goes up, the demand for the product is expected to diminish as much as 50% between Low, Medium and High price ranges. Quant Compete does not vary is cost per unit based upon retail sales price.

Parameters for Normal Distribution: Normal( (D2+D1*3) / 4, absvalue(D1-D2)) where: D1 is demand last year D2 is demand 2 years ago Thus, demand for July is calculated from: Normal ((20+24*3)/4, absvalue(24-20)) Normal (23,4)

Step by Step Solution

3.57 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Simulation Modeling Methods There are various simulation modeling methods that can be used to determine optimal results in this scenario Some of the methods that can be used are 1 Deterministic Modeli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started