Answered step by step

Verified Expert Solution

Question

1 Approved Answer

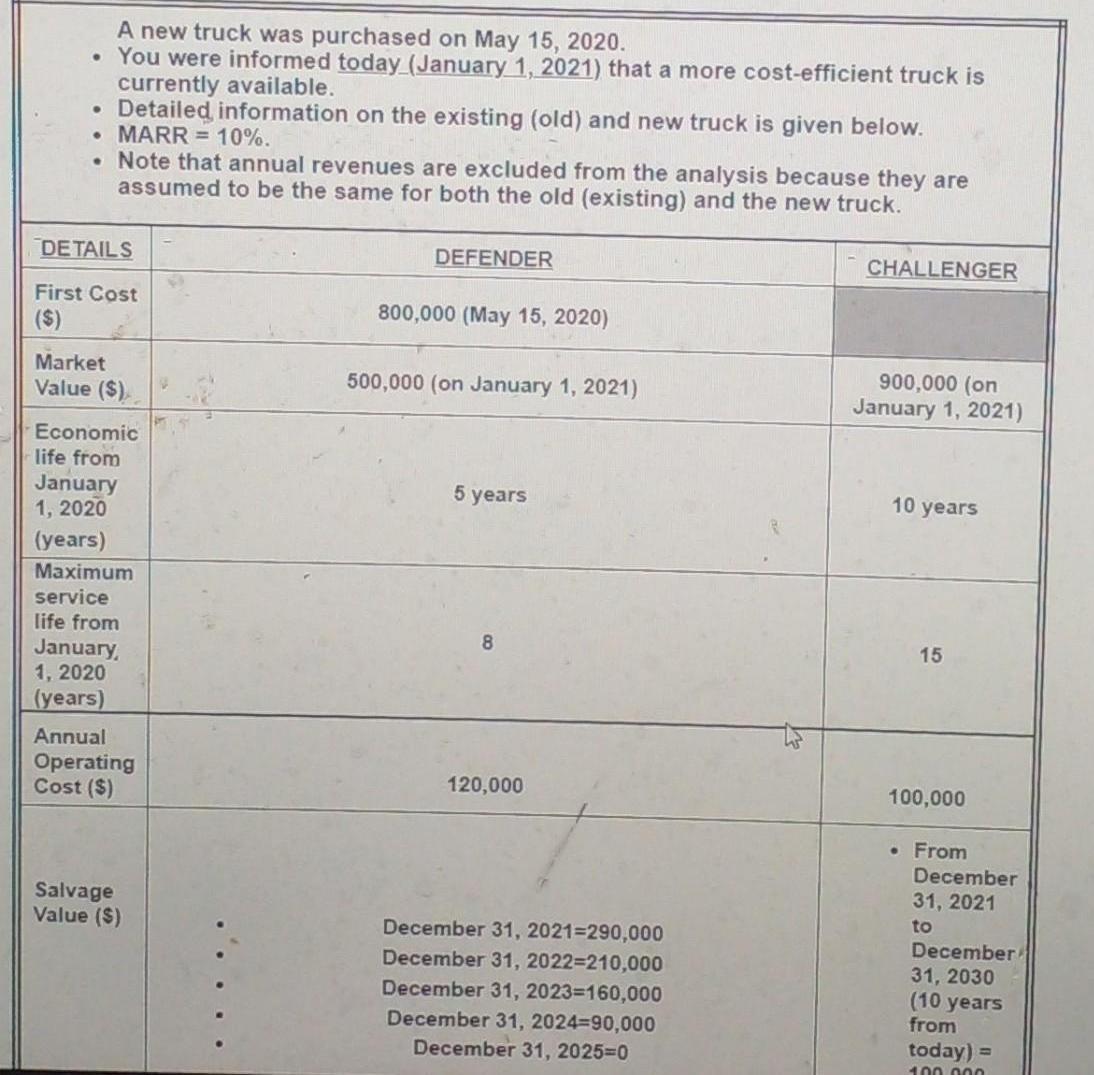

A new truck was purchased on May 15, 2020. You were informed today (January 1, 2021) that a more cost-efficient truck is currently available.

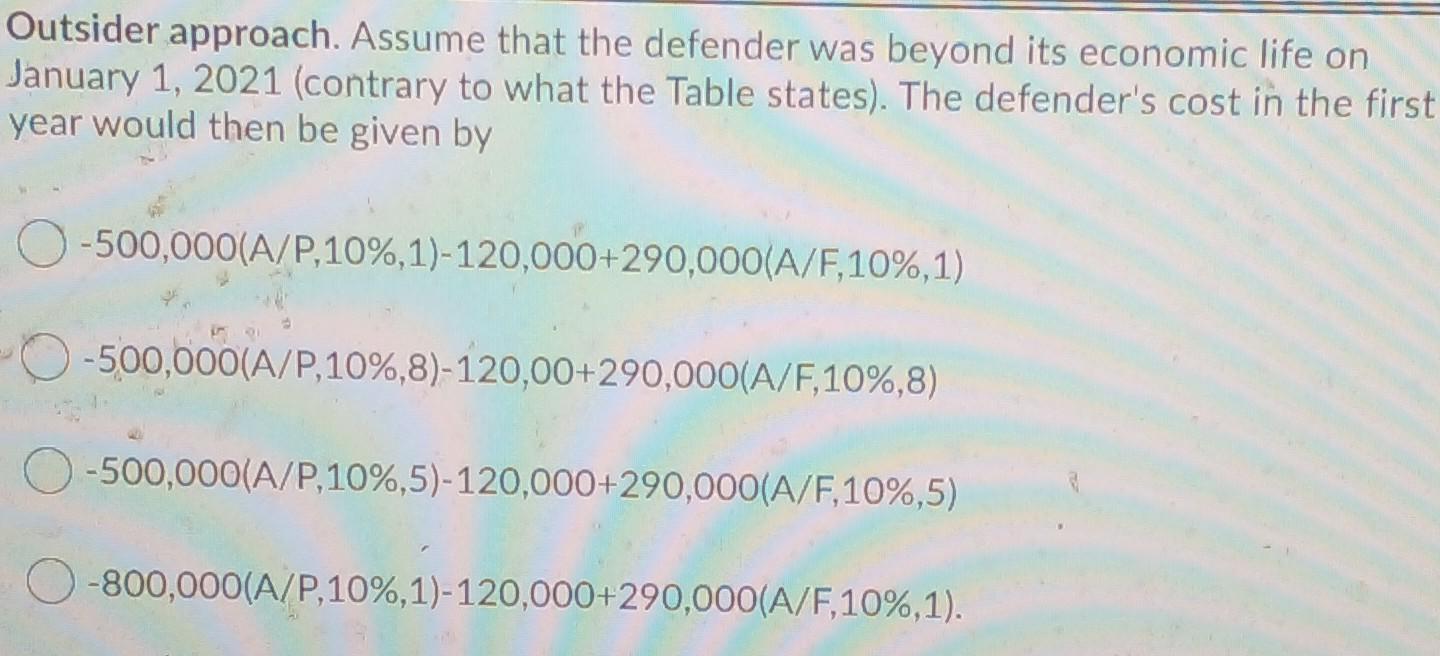

A new truck was purchased on May 15, 2020. You were informed today (January 1, 2021) that a more cost-efficient truck is currently available. Detailed information on the existing (old) and new truck is given below. MARR = 10%. Note that annual revenues are excluded from the analysis because they are assumed to be the same for both the old (existing) and the new truck. DETAILS First Cost ($) Market Value ($) Economic life from January 1, 2020 (years) Maximum service life from January, 1, 2020 (years) Annual Operating Cost ($) Salvage Value ($) DEFENDER 800,000 (May 15, 2020) 500,000 (on January 1, 2021) 5 years 8 120,000 December 31, 2021-290,000 December 31, 2022=210,000 December 31, 2023=160,000 December 31, 2024-90,000 December 31, 2025-0 CHALLENGER 900,000 (on January 1, 2021) 10 years 15 100,000 From December 31, 2021 to December 31, 2030 (10 years from today) = 100.000 Outsider approach. Assume that the defender was beyond its economic life on January 1, 2021 (contrary to what the Table states). The defender's cost in the first year would then be given by -500,000(A/P,10%, 1)-120,000+290,000(A/F, 10%,1) -500,000(A/P,10 %, 8) -120,00 +290,000(A/F, 10%,8) -500,000(A/P,10%, 5)-120,000+290,000(A/F, 10%,5) -800,000(A/P,10%, 1) - 120,000+290,000(A/F, 10%, 1).

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question 500000AP105120000290000AF105 we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started