Question

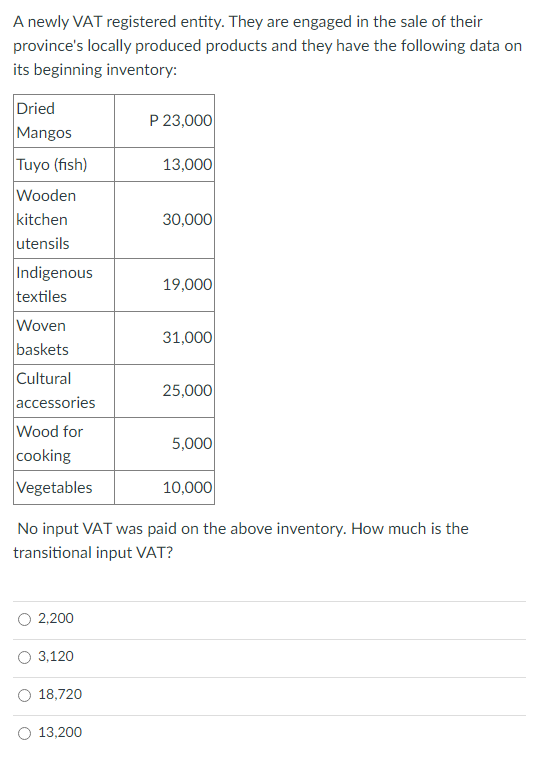

A newly VAT registered entity. They are engaged in the sale of their province's locally produced products and they have the following data on

A newly VAT registered entity. They are engaged in the sale of their province's locally produced products and they have the following data on its beginning inventory: Dried P 23,000 Mangos Tuyo (fish) 13,000 Wooden kitchen utensils 30,000 Indigenous 19,000 textiles Woven baskets 31,000 Cultural 25,000 accessories Wood for 5,000 cooking Vegetables 10,000 No input VAT was paid on the above inventory. How much is the transitional input VAT? 2,200 3,120 18,720 13,200

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer 3120 Explanation The transitional input VAT is the 2 of the beginning inventory It can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Law The Ethical Global and E-Commerce Environment

Authors: Arlen Langvardt, A. James Barnes, Jamie Darin Prenkert, Martin A. McCrory

17th edition

1259917118, 978-1259917110

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App