Question

A not-for-profit hospital's fiscal year ends on December 31st. On January 1st, 2017, the hospital took out a bank loan for $200,000. The loan

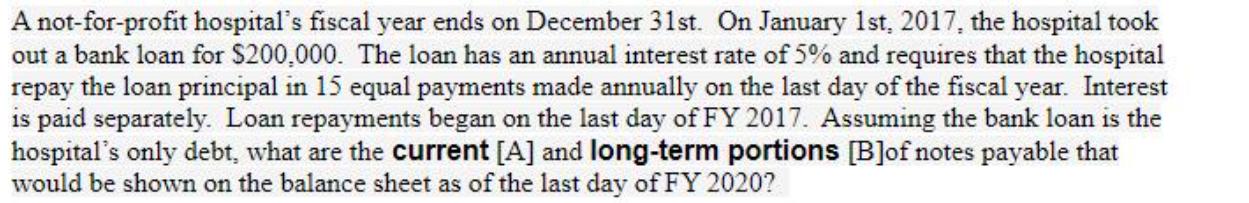

A not-for-profit hospital's fiscal year ends on December 31st. On January 1st, 2017, the hospital took out a bank loan for $200,000. The loan has an annual interest rate of 5% and requires that the hospital repay the loan principal in 15 equal payments made annually on the last day of the fiscal year. Interest is paid separately. Loan repayments began on the last day of FY 2017. Assuming the bank loan is the hospital's only debt, what are the current [A] and long-term portions [B]of notes payable that would be shown on the balance sheet as of the last day of FY 2020?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current and longterm portions of the notes payable as of the last day of FY 2020 we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael Granof, Saleha Khumawala, Thad Calabrese, Daniel Smith

7th edition

1118983270, 978-1119175025, 111917502X, 978-1119175001, 978-1118983270

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App