Answered step by step

Verified Expert Solution

Question

1 Approved Answer

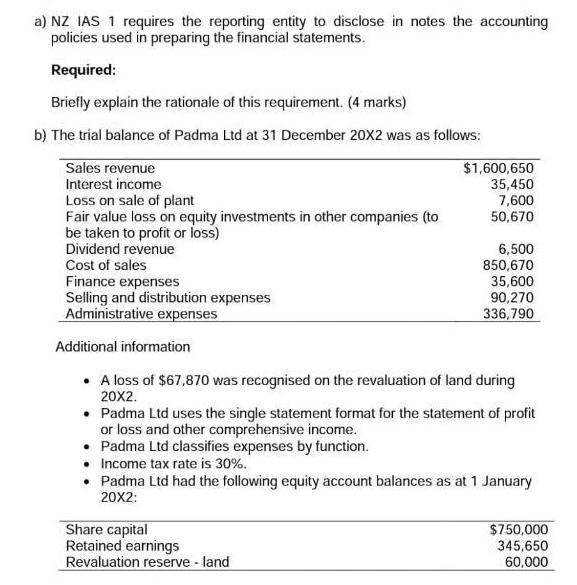

a) NZ IAS 1 requires the reporting entity to disclose in notes the accounting policies used in preparing the financial statements. Required: Briefly explain

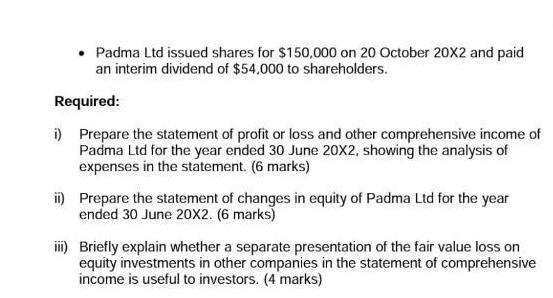

a) NZ IAS 1 requires the reporting entity to disclose in notes the accounting policies used in preparing the financial statements. Required: Briefly explain the rationale of this requirement. (4 marks) b) The trial balance of Padma Ltd at 31 December 20X2 was as follows: Sales revenue Interest income Loss on sale of plant Fair value loss on equity investments in other companies (to be taken to profit or loss) Dividend revenue Cost of sales $1,600,650 35,450 7,600 50,670 Finance expenses Selling and distribution expenses Administrative expenses 6,500 850,670 35,600 90,270 336,790 Additional information A loss of $67,870 was recognised on the revaluation of land during 20X2. Padma Ltd uses the single statement format for the statement of profit or loss and other comprehensive income. Padma Ltd classifies expenses by function. Income tax rate is 30%. Padma Ltd had the following equity account balances as at 1 January 20X2: Share capital Retained earnings Revaluation reserve - land $750,000 345,650 60,000 Padma Ltd issued shares for $150,000 on 20 October 20X2 and paid an interim dividend of $54,000 to shareholders. Required: i) Prepare the statement of profit or loss and other comprehensive income of Padma Ltd for the year ended 30 June 20X2, showing the analysis of expenses in the statement. (6 marks) i) Prepare the statement of changes in equity of Padma Ltd for the year ended 30 June 20X2. (6 marks) in) Briefly explain whether a separate presentation of the fair value loss on equity investments in other companies in the statement of comprehensive income is useful to investors. (4 marks)

Step by Step Solution

★★★★★

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started