Question

a. On 1/1/20, SD issued 3-year, 4% coupon, $30,000 face value bonds at par. b. On 1/1/20, SD sold all of its PPE for $25,000.

a. On 1/1/20, SD issued 3-year, 4% coupon, $30,000 face value bonds at par. b. On 1/1/20, SD sold all of its PPE for $25,000. c. On 1/4/20, a customer orders 1,200 cases of skinner dips at a price of $24 per case. You dont collect payment. You dont deliver the order because there are only 996 cases in your inventory (all at same cost). d. SDs supplier is charging $7 per case. SD uses LIFO, and on 1/5/20 you purchase and pay cash for enough cases to meet the order and keep your taxes as low as possible.

Please explain steps especially for part d!

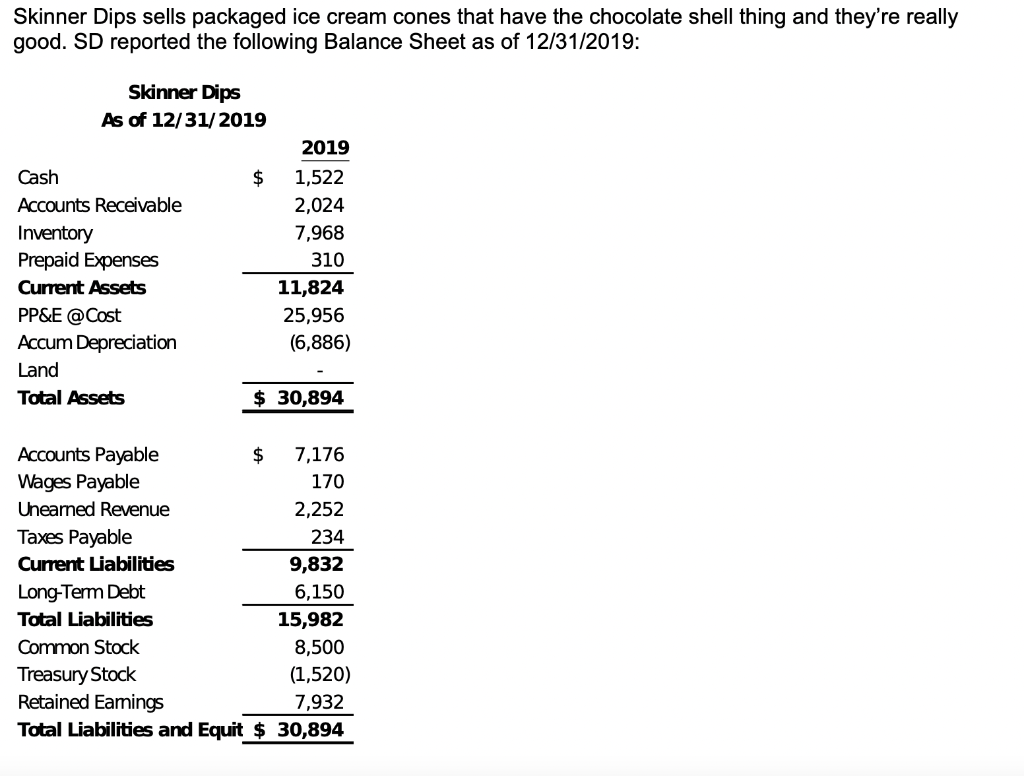

Skinner Dips sells packaged ice cream cones that have the chocolate shell thing and they're really good. SD reported the following Balance Sheet as of 12/31/2019: Skinner Dips As of 12/31/2019 $ Cash Accounts Receivable Inventory Prepaid Expenses Current Assets PP&E @ Cost Accum Depreciation Land Total Assets 2019 1,522 2,024 7,968 310 11,824 25,956 (6,886) $ 30,894 Accounts Payable $ 7,176 Wages Payable 170 Uneamed Revenue 2,252 Taxes Payable 234 Current Liabilities 9,832 Long-Term Debt 6,150 Total Liabilities 15,982 Common Stock 8,500 Treasury Stock (1,520) Retained Eamings 7,932 Total Liabilities and Equit $ 30,894 Skinner Dips sells packaged ice cream cones that have the chocolate shell thing and they're really good. SD reported the following Balance Sheet as of 12/31/2019: Skinner Dips As of 12/31/2019 $ Cash Accounts Receivable Inventory Prepaid Expenses Current Assets PP&E @ Cost Accum Depreciation Land Total Assets 2019 1,522 2,024 7,968 310 11,824 25,956 (6,886) $ 30,894 Accounts Payable $ 7,176 Wages Payable 170 Uneamed Revenue 2,252 Taxes Payable 234 Current Liabilities 9,832 Long-Term Debt 6,150 Total Liabilities 15,982 Common Stock 8,500 Treasury Stock (1,520) Retained Eamings 7,932 Total Liabilities and Equit $ 30,894Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started